Hot stocks added by top smallcap funds in September

Fund managers of smallcap funds seem to never shy away from deploying into new opportunities in the smallcap and microcap universes irrespective of market peaks and rich valuations. They spread the risk by adding more stocks to the portfolio

1/14

The Smallcap fund category has been the most preferred mutual fund category among investors over the last one year. Data compiled from the Association of Mutual Funds in India (AMFI) shows that a massive one-third of the MF industry equity net flows (Rs 33,336 crore) flocked into smallcap funds over the last one year.

While few smallcap funds with larger asset sizes stopped accepting lumpsum subscriptions, the category still continues to get flows from SIP subscriptions. Large inflows have been a cause of concern for smallcap funds given the current scenario of most of the stocks trading at their peak valuations. Poor liquidity is the problem while taking larger positions in small caps — getting in is easy but getting out is tricky.

While few smallcap funds with larger asset sizes stopped accepting lumpsum subscriptions, the category still continues to get flows from SIP subscriptions. Large inflows have been a cause of concern for smallcap funds given the current scenario of most of the stocks trading at their peak valuations. Poor liquidity is the problem while taking larger positions in small caps — getting in is easy but getting out is tricky.

2/14

However, fund managers of most smallcap funds seem to never abstain from deploying into new opportunities in the smallcap and microcap universes. Instead of holding into cash assets, most of them add new stocks in their portfolios to spread the risk. This has increased the number of holdings in their portfolios. For instance, the average number of equity holdings of the category increased to 86 in September 2023 from 60 stocks seen three years before.

In unusual circumstances, smallcap funds raise their cash holdings. However, the category is now maintaining the cash level relatively low. The latest data shows that more than half of the smallcap funds maintain cash levels at 6 percent and below.

Below are the lists of newly added stocks by the top-performing smallcap funds in September. Source: ACEMF.

In unusual circumstances, smallcap funds raise their cash holdings. However, the category is now maintaining the cash level relatively low. The latest data shows that more than half of the smallcap funds maintain cash levels at 6 percent and below.

Below are the lists of newly added stocks by the top-performing smallcap funds in September. Source: ACEMF.

3/14

Quant Small Cap Fund

Fund managers: Ankit A Pande, Vasav Sahgal and Sanjeev Sharma

Also see: Enhanced Value index funds topped the return chart past year. Here are their top stocks bet

Fund managers: Ankit A Pande, Vasav Sahgal and Sanjeev Sharma

Also see: Enhanced Value index funds topped the return chart past year. Here are their top stocks bet

4/14

Nippon India Small Cap Fund

Fund managers: Samir Rachh and Tejas Sheth

Fund managers: Samir Rachh and Tejas Sheth

5/14

Axis Small Cap Fund

Fund managers: Mayank Hyanki and Shreyash Devalkar

Fund managers: Mayank Hyanki and Shreyash Devalkar

6/14

ICICI Pru Smallcap Fund

Fund managers: Anish Tawakley and Sri Sharma

Also see: Time to rebalance your portfolio? Check out these aggressive hybrid funds that provide stability and high growth

Fund managers: Anish Tawakley and Sri Sharma

Also see: Time to rebalance your portfolio? Check out these aggressive hybrid funds that provide stability and high growth

7/14

Kotak Small Cap Fund

Fund managers: Pankaj Tibrewal

Fund managers: Pankaj Tibrewal

8/14

Union Small Cap Fund

Fund managers: Hardick Bora and Sanjay Bembalkar

Fund managers: Hardick Bora and Sanjay Bembalkar

9/14

DSP Small Cap Fund

Fund managers: Abhishek Ghosh, Resham Jain and Vinit Sambre

Also see: Nifty @20K: Can these low volatile stocks cushion your portfolio volatility?

Fund managers: Abhishek Ghosh, Resham Jain and Vinit Sambre

Also see: Nifty @20K: Can these low volatile stocks cushion your portfolio volatility?

10/14

SBI Small Cap Fund

Fund manager: R. Srinivasan

Fund manager: R. Srinivasan

11/14

HSBC Small Cap Fund

Fund managers: Venugopal Manghat and Cheenu Gupta

Fund managers: Venugopal Manghat and Cheenu Gupta

12/14

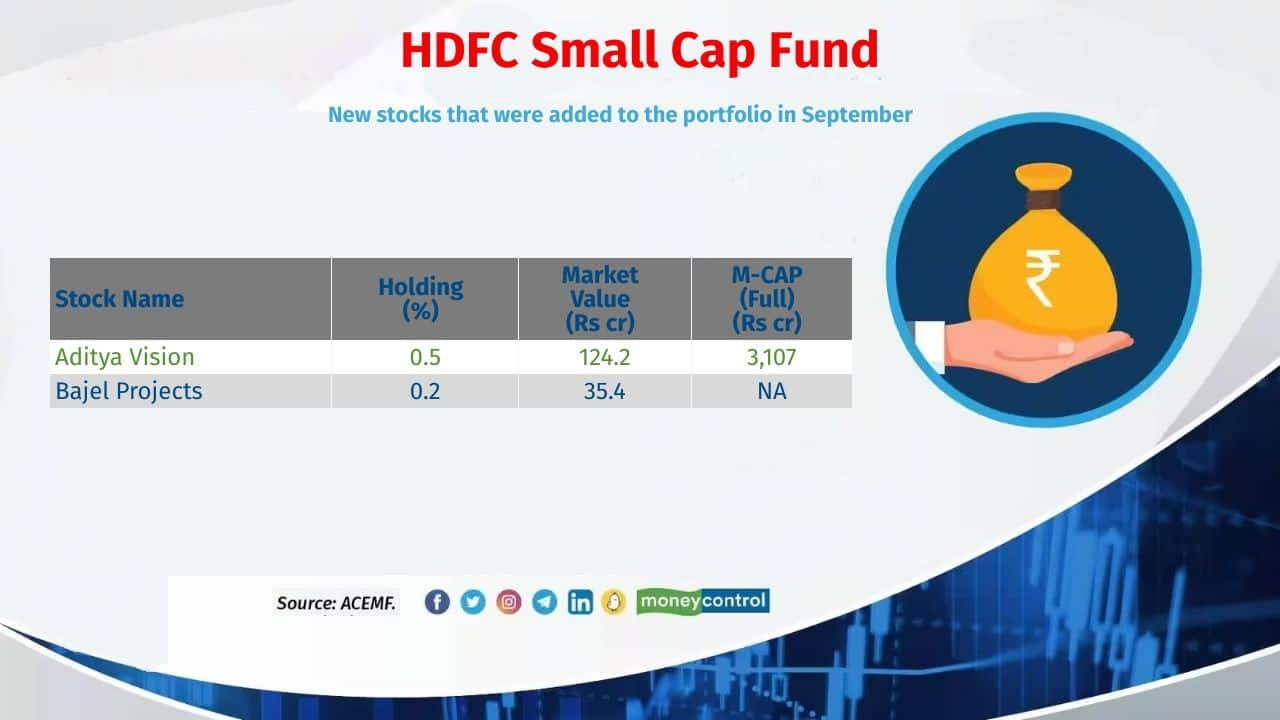

HDFC Small Cap Fund

Fund manager: Chirag Setalvad

Also see: PMS managers exited from these midcap stocks: Check your portfolio

Fund manager: Chirag Setalvad

Also see: PMS managers exited from these midcap stocks: Check your portfolio

13/14

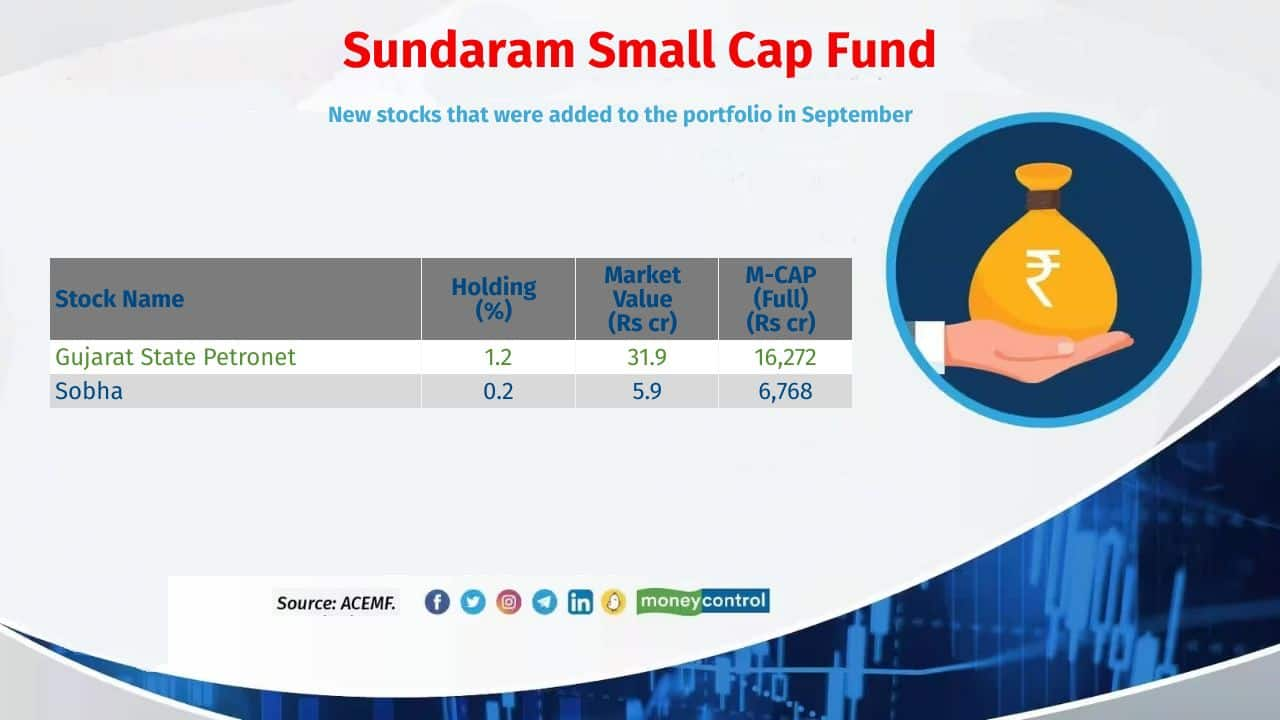

Sundaram Small Cap Fund

Fund managers: Ravi Gopalakrishnan and Rohit Seksaria

Fund managers: Ravi Gopalakrishnan and Rohit Seksaria

14/14

Franklin India Smaller Cos Fund

Fund managers: Akhil Kalluri and R Janakiraman

Also see: How have India’s oldest MF schemes rewarded investors?

Fund managers: Akhil Kalluri and R Janakiraman

Also see: How have India’s oldest MF schemes rewarded investors?

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!