The International Monetary Fund's (IMF) top economist has warned that while the multilateral agency's forecasts are indicative of a "soft landing scenario", the global economy is "limping along, not sprinting".

Commenting in a blog accompanying the IMF's World Economic Outlook report, released on October 10, Pierre-Olivier Gourinchas said the world economy had shown "remarkable" resilience in the face of energy and food market disruptions and "unprecedented" monetary tightening, with growth only slowing down and not stalling.

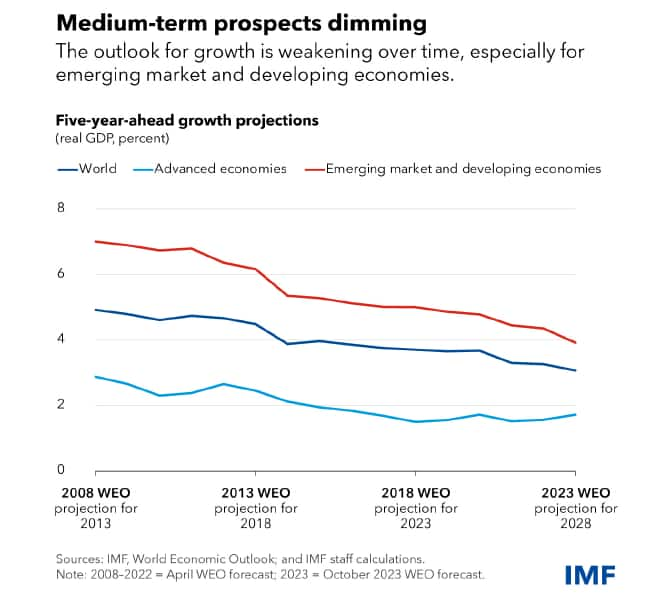

"Even so, growth remains slow and uneven, with widening divergences," he said, adding the world's focus should return to the "dimming" medium-term outlook.

"Global growth prospects are weak, especially for emerging market and developing economies. The implications are profound: a much slower convergence toward the living standards of advanced economies, reduced fiscal space, increased debt vulnerabilities and exposure to shocks, and diminished opportunities to overcome the scarring from the pandemic and the war," Gourinchas said.

Also Read: IMF hikes India FY24 GDP growth forecast by 20 bps to 6.3% on strong Q1 data

In the latest World Economic Outlook report, the IMF retained its global growth forecast for 2023 at 3 percent but lowered it marginally by 10 basis points for 2024 to 2.9 percent. But crucially, while the 2023 and 2024 growth forecasts for advanced economies were unchanged from July, emerging market and developing economies are now seen growing at a slightly slower pace of 4 percent in 2024, down from 4.1 percent projected earlier.

According to Gourinchas, the services sector has nearly recovered fully, with demand now softening. Tighter financial conditions are now exerting pressure on housing markets, investment, and activity in general.

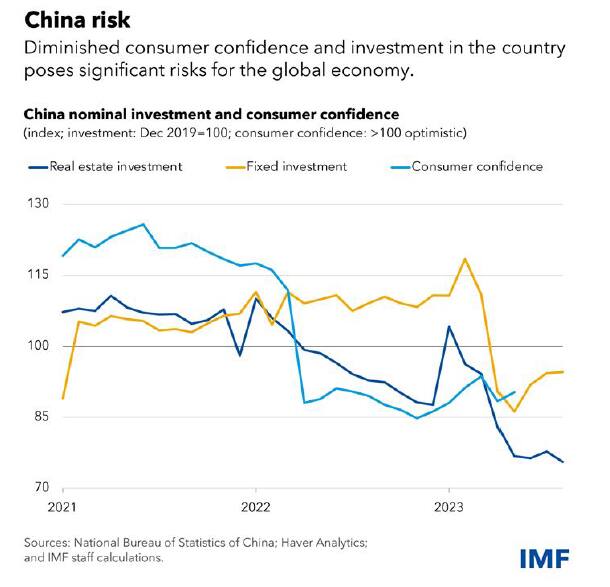

The weakness in the Chinese economy can present a "complex policy challenge".

"If China's real estate prices decline too rapidly, the balance sheets of banks and households will worsen, with the potential for serious financial amplification," Gourinchas warned. Artificially supporting real estate prices may temporarily protect balance sheets but this will crowd out other investment opportunities, reduce new construction, and hurt local government revenues through reduced land sales, he said.

Also Read: Lehman to Evergrande - The long shadow of real estate-led economic crises

"Either way, China's economy must pivot away from growth that relies on credit for the real estate sector."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.