RBI MPC Meet Highlights: Shaktikanta Das announces key rates unchanged; GDP growth forecast retained, CPI inflation revised for Q1 and Q2 for FY25

RBI Monetary Policy Committee Meeting Highlights: MPC has decided to be resolute in its commitment to align CPI to its target, says RBI Guv Das. RBI kept policy rates, stance unchanged.

-330

April 05, 2024· 13:46 IST

The live blog session has concluded. For more news, views and updates, stay tuned with Moneycontrol.com.

-330

April 05, 2024· 13:42 IST

RBI MPC Meet Live: Rajani Sinha, Chief Economist, CareEdge Ratings on RBI Policy

“The RBI’s MPC decision to leave policy rate unchanged was very much on expected lines. The RBI governor highlighted that healthy economic growth gives room to the Central Bank to continue its focus on containing inflation to the 4% target on a durable basis. Core inflation, including services inflation has been moderating in the last few months. However, the main concern of the Central Bank is the persistent high food inflation and the adverse impact of that on household inflationary expectations. Expectations of normal monsoon in the current year bodes well for food inflation. However, the continuation of geo-political rifts and supply side risks of the same on commodity prices requires monitoring. Increased climate risks in the domestic and global economy have emerged as another big risks for food inflation in the last few years.

Going forward, the Central Bank can look at a real rate of interest of around 1-1.5%. Hence as inflation moderates to around 4.5% and as US Fed starts cutting rates, we can expect RBI to go for a shallow rate cut of around 50 bps in two tranches starting Q3 FY25.”

-330

April 05, 2024· 13:29 IST

RBI MPC Meet Live: Siddhartha Sanyal, Chief Economist and Head of Research, Bandhan Bank on RBI policy

Today’s status quo on the repo rate was on expected lines. The central bank recognized India’s resilient macro backdrop leading to greater policy space for the RBI. However, the central bank does not seem to be in any rush to start cutting the repo rate.

While the RBI kept the FY25 CPI forecast unchanged at 4.5%, interestingly, for the first two-quarters CPI was further lowered, potentially to a sub-4% zone. That will push the real repo rate (ie., the difference between the repo rate and inflation) beyond 2% for a while, strengthening the case for repo rate cuts later this year.

However, the timing of RBI rate easing will involve several other factors. Most of the major global central banks appear to be cautious to start easing policy rates. While the US Fed is expected to start easing rates in June, such expectations altered several times in recent months and are far from certain. Against that backdrop and given that the RBI’s legroom for the repo rate from the current 6.50% is likely limited to only 50-100 basis points, one maintains that a rate cut by RBI is unlikely before August.

While the MPC decided to keep the stance of the policy unchanged today, one sees merit in considering changing the stance of monetary policy to “neutral” sooner than later. The MPC adopted “withdrawal of accommodation” as the stance of monetary policy since April 2022. Since then, policy rates were pushed higher till February 2023. For the next one year, the RBI absorbed a large quantum of excess liquidity from the banking system. However, now the RBI will likely move sideways for a few months both on the rates and liquidity front. Accordingly, one feels that the case for a change in policy stance to “neutral” in the coming MPC meetings is stronger now.

-330

April 05, 2024· 13:18 IST

RBI MPC Meet Live: George Alexander Muthoot, MD, Muthoot Finance on RBI policy

On expected lines the RBI kept the policy repo rate unchanged while maintaining the stance on ‘withdrawal of accommodation’. While the RBI does remain cautious on the inflation front, we believe moderating inflationary pressures, coupled with the realization of normal monsoon may open up the possibility of rate cuts by the RBI in first half of fiscal 2024-25. We are encouraged by the resilience of the global economy, continued economic growth momentum in India, coupled with relative rupee stability. Steady pick up in investment activity and strengthening of rural demand conditions bode well for the economy and further fuels our optimism towards steady demand for gold loans, vehicle loans and home loans during the year.

We appreciate RBI’s initiative of regularly engaging with multiple stakeholders to simplify regulations and reduce compliance burden. The implementation of recommendations of the Regulations Review Authority (RRA 2.0) is a testament of the RBI’s commitment. At Muthoot Finance, we remain committed to maintaining the highest standards of corporate governance and compliance. We are in alignment with RBI’s view point that regulated entities should prioritise compliance and corporate governance and we believe this is paramount for ensuring sustainable growth for India while also safeguarding customers' interests.

-330

April 05, 2024· 13:10 IST

RBI MPC Meet Live: Vijay Kuppa, CEO, InCred Money on RBI policy

RBI has expectedly kept the repo rates constant at 6.50%. With India GDP growth strong, there is little incentive for the MPC to cut rates, especially when inflationary pressures have not completely eased off. Food price uncertainties are expected to continue and food inflation would need close monitoring. Till inflation is around 4.0% on a durable basis, MPC is unlikely to cut rates. So we can expect rate revisions mostly in Q3FY25.

-330

April 05, 2024· 13:04 IST

RBI MPC Meet Live: Vikram Chhabra, Senior Economist at 360 ONE Asset on RBI policy

“We maintain our view of a shallow rate-cut cycle of 75-100 bps in FY25. Private consumption growth has slowed considerably, and this weakness is also reflected in the series-low core CPI. Hence, RBI could consider changing the policy stance to neutral in the June or August meeting. However, RBI will likely continue to be cautious regarding rate cuts, given the uncertainty around food inflation. Much now relies on how the monsoon season pans out.”

-330

April 05, 2024· 13:02 IST

RBI MPC Meet Live: Shishir Baijal, Chairman and Managing Director, Knight Frank India on RBI policy

“The RBI's decision to keep the REPO rate unchanged at 6.5%, aligns with expectations and is greatly welcomed. This move towards maintaining stability in lending rates bodes well for the real estate sector, which has been consistently growing.

It also provides added support to consumers, ensuring economic growth remains robust. Furthermore, the Governor's optimism is bolstered by the resilience in domestic macro fundamentals. With the government’s revised GDP growth projection for FY 24 at 7.6%, Manufacturing PMI hitting a 14-year high, strong Services PMI, and high FOREX reserves, sentiment is further uplifted, promising sustained long-term growth for the domestic economy”

-330

April 05, 2024· 12:56 IST

RBI MPC Meet Live: Space for rate cut likely opened up though RBI seems in no hurry, says Mahendra Kumar Jajoo, CIO, Fixed Income, Mirae Asset Investment Managers (India)

Possible spill overs from ongoing geopolitics developments, reversion in commodity prices from recent lows and lingering impact of global food price volatility creates caution amongst the members.

Space for rate cut likely has opened up though RBI seems in no hurry to cut rates presently but use its pole position to align inflation structurally to its long term target of 4%.

As such, markets may find confidence in projecting rate cuts in later part of the year and interest rates may remain stable with a downward bias.”

-330

April 05, 2024· 12:52 IST

RBI MPC Meet Live: Can see significant movement towards term deposits, says DG Swaminathan

Banks are quite active in their purpose of mobilsising deposits and customers are becoming price sensitive and we can see significant movement towards term deposits.

-330

April 05, 2024· 12:45 IST

RBI MPC Meet Live: We regularly supervise banks and NBFCs, says Das

We regularly supervise banks and NBFCs and whenever we see deviations we first try to sensitise them bilaterally and when we see after that steps are not upto mark then only we put restrictions if any.

I am not commenting on cases where we have taken actions

-330

April 05, 2024· 12:43 IST

RBI MPC Meet Live: RBI Deputy Governor Sankar on CBDC

Volumes increased after making it interoperable with UPI

There are around 46 lakh users, 4 lakh merchants and total transaction is Rs 2.2 crore so far

-330

April 05, 2024· 12:39 IST

RBI MPC Meet Live: RBI Deputy Governor Sankar on fintechs

Examining comments received on Self-Regulatory Organisations (SRO) for FinTech Sector. We will come out with a framework, wait for it.

Guv Das says: Expect to release framework on Self-Regulatory Organisations (SRO) for FinTech Sector before April.

-330

April 05, 2024· 12:33 IST

RBI MPC Meet Live: RBI Guv on urban and rural consumption

Urban consumption remains strong and rural consumption has recovered and gaining

-330

April 05, 2024· 12:32 IST

RBI MPC Meet Live: RBI Guv on gold reserves

RBI MPC Meeting 2024 Live: We are building gold reserves. That is a part of our reserve deployment. And we assess all aspects while building reserves.

-330

April 05, 2024· 12:31 IST

RBI MPC Meet Live: RBI Guv Das on inflation

RBI MPC Meeting 2024 Live: I said clearly we would like the elephant to return to the forest and stay there on a durable basis so we want inflation to align with the target on a durable basis

-330

April 05, 2024· 12:29 IST

RBI MPC Meet Live: Our monetary policy is primarily guided by domestic situation, says RBI Guv Das

RBI MPC Meeting 2024 Live: Rate action is linked to evolving path of inflation.

Our monetary policy is primarily guided by domestic situation and we do not follow the footsteps of US Fed

-330

April 05, 2024· 12:28 IST

RBI MPC Meet Live: RBI Governor on GDP growth rate

RBI MPC Meeting 2024 Live: The average growth rate for three years FY22-FY24 works out tobe 8 percent, so potential growth rate has gone up.

We will undertake a study after final GDP is out for FY24 in May to assess potential growth and real rates. And then can give additional information

Cant give forward guidance on rate action this year

-330

April 05, 2024· 12:27 IST

RBI MPC Meet Live: RBI Governor says no comments on Supreme Court judgement and electoral bonds

RBI MPC Meeting 2024 Live: SBI acted according to SC judgment, have no comments on poll bonds, says Das

-330

April 05, 2024· 12:24 IST

RBI MPC Meet Live: RBI Deputy Governor Patra on inflation

RBI MPC Meeting 2024 Live: The distance of inflation from the target, even going 12 months forward inflation is not at target so that is our primary aim to align inflation with target. And, till then real rates are not so high as you say

Real rates matter, but we need to see inflation aligning to the target that is the primary objective of monetary policy

-330

April 05, 2024· 12:23 IST

RBI MPC Meet Live: RBI Deputy Governor Patra on food inflation

RBI MPC Meeting 2024 Live: Food inflation has been highly volatile. And indications are that in view of adverse climate events it will remain high

We are worried about spillovers of firm prices on proteins to the rest of CPI basket

-330

April 05, 2024· 12:19 IST

RBI MPC Meet Live: RBI Governor Das FX derivatives decision

RBI MPC Meeting 2024 Live: There is no change in the policy. This is something that is every market participants knew about the underlying. It is not correct to say it is new. That is the purpose we issued the circular yesterday.

This has been the requirement all along. Market players knew about it, it is part of FEMA regulations

We received requests from market participations that they need more time

-330

April 05, 2024· 12:18 IST

RBI MPC Meet Live: RBI Deputy Governor Patra on FX derivatives decision

RBI MPC Meeting 2024 Live: The point is it is only for hedging and underline exposure is a mandatory requirement

Some market participants has been misusing the relaxation by assuming that it is tantamount to no underlying and that is a violation of the law

-330

April 05, 2024· 12:15 IST

RBI MPC Meet Live: RBI Deputy Governor Patra on FX derivatives decision

RBI MPC Meeting 2024 Live: The RBI policy on foreign exchange risk management has remained consistent over the last few years and there is no change in policy approach

-330

April 05, 2024· 12:13 IST

RBI MPC Meet Live: Guv Das on food inflation

RBI MPC Meeting 2024 Live: Have to watch impact of above normal temperatures in April-June especially on food crops.

So far as wheat crops is concerned, as per our information by and large the harvesting is over, therefore wheat availability will not be affected as much

Impact of heat wave on vegetable prices has to be watched

-330

April 05, 2024· 12:12 IST

RBI MPC Meet Live: Guv Das on FX Reserves

RBI MPC Meeting 2024 Live: Endeavor to build up FX reserves continues since it acts as a buffer against future risks, especially when the cycle turns and if there are significant outflow of dollars.

This whole approach adds to the strength of the national balance sheet

-330

April 05, 2024· 12:10 IST

RBI MPC Meet Live: Shaktikanta Das on Indian Rupee

RBI MPC Meeting 2024 Live: To ensure stability of the Indian rupee has always been a priority for RBI.

-330

April 05, 2024· 12:09 IST

RBI MPC Meet Live: Shaktikanta Das on last mile of inflation

RBI MPC Meeting 2024 Live: Elephant moves at a slow pace, therefore last mile of disinflation is always challenging and sticky

-330

April 05, 2024· 12:07 IST

RBI MPC Meet Live: RBI’s decision to hold repo rates will keep housing boom on course, says experts

RBI MPC Meeting 2024 Live: Real estate developers and experts have said that the housing demand will remain buoyant and the home loan EMIs will remain unchanged for now as the Reserve Bank of India (RBI) has decided to hold the repo rate at 6.5 percent.

Real estate experts say the move will ensure that the housing boom stays on course and aspiring homebuyers can proceed with confidence.

-330

April 05, 2024· 12:00 IST

RBI MPC Meet Live: Dharmakirti Joshi, Chief Economist, CRISIL on RBI monetary policy

RBI MPC Meeting 2024 Live: Easing food inflation and benign non-food inflation should bring headline inflation closer to the RBI’s target of 4%. That said, any weather disruptions and sustained uptick in crude oil prices will remain monitorable.

The transmission impact of rate hikes since May 2022 and regulatory measures on risky lending are still playing out.

We expect growth and inflation in fiscal 2025 at 6.8% and 4.5%, respectively.Overall, the macro environment is likely to turn favourable for a rate cut by mid-2024 in our base case, lest oil prices and monsoons play a spoilsport.

-330

April 05, 2024· 11:57 IST

RBI MPC Meet Live: Negatives for the market from the RBI policy statement

RBI MPC Meeting 2024 Live: Food price uncertainties to weigh on inflation outlook.

Rising incidence of climate shocks may aggravate food inflation.

Low reservoir levels, hotter-than-usual summer, concerning

Tight demand supply conditions in certain pulses, high prices of key vegetables a worry.

After sustained decline, cost-driven price increases by firms rising.

Crude prices rising.

Geo-political tensions, volatility in financial markets, rising Red Sea disruptions, may fuel inflation.

-330

April 05, 2024· 11:53 IST

RBI MPC Meet Live: Positives for the market from the RBI policy statement

RBI MPC Meeting 2024 Live: Normal monsoon to support agricultural activity.

Expected record rabi wheat production to contain cereal prices.

Domestic economic activity resilient

.Investment demand strong, business and consumer sentiment upbeat.

Manufacturing to maintain momentum on sustained profitability.

Services activity likely to grow above the pre-pandemic trend.

Pick up seen in rural activity, discretionary spending by urban households.

Capex outlook bright on business optimism, healthy corporate, bank balance sheets, robust government capex, signs of upturn in private capex cycle.

-330

April 05, 2024· 11:43 IST

RBI MPC Meet Live: Here are the top highlights

- RBI's top announcements

-330

April 05, 2024· 11:33 IST

RBI MPC Meet Live: Suman Chowdhury, Chief Economist and Head – Research, Acuité Ratings & Research on RBI Policy

RBI MPC Meeting 2024 Live: The central bank would continue to be watchful about the increased crude oil prices and any upward risks in food inflation in the near term, given the forecast of an intense upcoming summer season. The governor highlighted the significance of keeping the “elephant in the forest” (metaphor for high inflation) for a durable period. Given the tone of the MPC statement and the expectation of strong domestic growth, we believe that there is a low likelihood of any rate cut by RBI before October 2025.

-330

April 05, 2024· 11:23 IST

RBI MPC Meet Live: RBI to widen door for foreign investment in sovereign green bonds

RBI MPC Meeting 2024 Live: RBI Governor Shaktikanta Das on April 5 said the regulator will permit eligible foreign investors in the International Financial Services Centre (IFSC) to invest in sovereign green bonds.

-330

April 05, 2024· 11:15 IST

RBI MPC Meet Live: Guv Das on LCR review for banks

RBI MPC Meeting 2024 Live: RBI will soon issue a draft circular to review the liquidity coverage ratio (LCR) for banks, Governor Shaktikanta Das said in his April 5 monetary policy speech.

“A need has arisen to undertake a comprehensive LCR review for banks. A draft circular will be issued for stakeholder consultation,” he said.

-330

April 05, 2024· 11:11 IST

RBI MPC Meet Live: Small finance banks can use rupee interest derivative product, says Das

RBI MPC Meeting 2024 Live: The Reserve Bank of India (RBI) Governor Shaktikanta Das on April 5 said the central bank allowed small finance banks to use rupee derivative product to hedge interest risks.

Full Coverage here.

-330

April 05, 2024· 11:08 IST

RBI MPC Meet Live: Banks, NBFCs must give priority to regulatory guidelines, says RBI Governor

RBI MPC Meeting 2024 Live: Guv Das has asked banks, non-banking finance companies (NBFCs) and other financial institutions to prioritise regulatory guidelines.

“Banks, NBFCs and other FI must give high priority to regulatory guidelines,” Das said on April 5 while sharing the outcome of the monetary policy committee (MPC).

Full report here.

-330

April 05, 2024· 11:03 IST

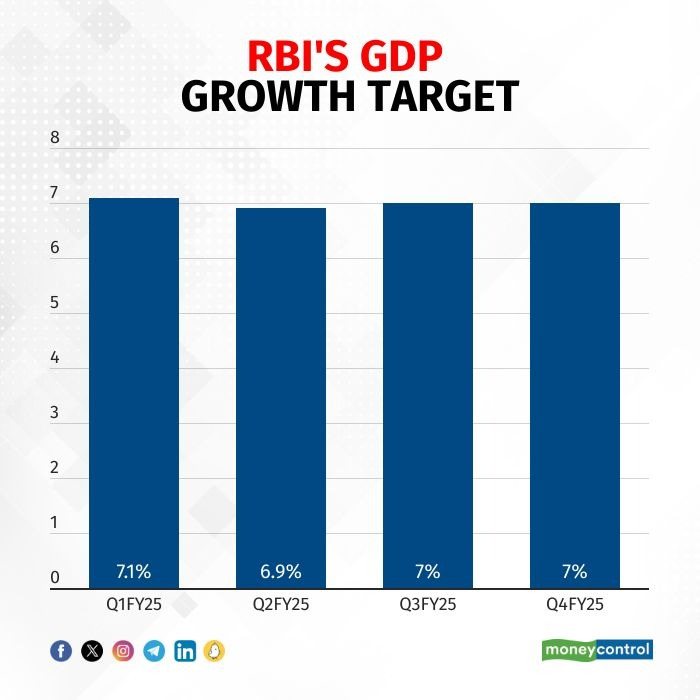

RBI MPC Meet Live: GDP forecast

RBI MPC Meeting 2024 Live: GDP growth forecast retained at 7%

-330

April 05, 2024· 10:59 IST

RBI MPC Meet Live: Rate-sensitive stocks trade mixed after RBI Monetary Policy

RBI MPC Meeting 2024 Live: Auto stocks such as Bajaj Auto, TVS Motors, Maruti Suzuki and Ashok Leyland traded marginally lower.

Banking stocks traded mixed. While HDFC Bank gained 1 percent, Kotak Mahindra Bank was up 0.66 percent and State Bank of India 0.3 percent, other lenders such as Axis Bank fell 1 percent and Indusind Bank and ICICI Bank lost 0.6 percent each.

-330

April 05, 2024· 10:52 IST

RBI MPC Meet Live: Here's how the MPC members voted on stance

RBI MPC Meeting 2024 Live: Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Prof.

Jayanth R. Varma voted for a change in stance to neutral.

-330

April 05, 2024· 10:47 IST

RBI MPC Meet Live: From rates, stance being unchanged to GDP and inflation forecasts - here are the top highlights

RBI MPC Meeting 2024 Live: RBI decides to keep the ranges unchanged by a 5:1 majority

RBI maintains the stance of 'withdrawal of accommodation'

Core inflation has declined steadily, notes RBI; MPC must be actively disinflationary

Food inflation continues to show considerable volatility

‘Inflation, the elephant in the room has now gone for a walk in the forest’

FY25 CPI inflation seen at 4.5%

FY25 real GDP growth projection at 7%

Liquidity conditions have turned surplus since March; will remain nimble, flexible in liquidity management

Engaging with regulated entities to reduce compliance burden

FY25 CAD seen at a level that is manageable

RBI to soon notify trading of sovereign green bonds at IFSC

Mobile app planned for access to RBI’s Retail Direct Scheme to Participate in the G-sec market

Propose to facilitate cash deposits at CDMs using UPI, move to make cash handling at banks easier

Permit use of third-party apps to make PPI prepaid payment instrument for UPI

Distribution of CBDC to be allowed via non-bank payment system operators

-330

April 05, 2024· 10:41 IST

RBI MPC Meet Live: Inflation is on a declining trajectory and GDP growth is buoyant, says Das

RBI MPC Meeting 2024 Live: Shaktikanta Das said, "Inflation is on a declining trajectory and GDP growth is buoyant. At this juncture we should not lower our guard but continue to work towards ensuring that inflation aligns durably to the target. Our goal is in sight and we must remain vigilant."

-330

April 05, 2024· 10:38 IST

RBI Monetary Policy Live: Shaktikanta Das on Rupee, Forex and UPI

RBI MPC Meeting 2024 Live: Exchange rate of rupee is market determined, there are inflows and outflows of dollars happening. But It is our prime focus to build a strong buffer in terms of substantial quantum of forex reserves which will help us when the cycle turns or when it rains heavily.

UPI for cash deposits: Now proposed to facilitate cash dedposits at CDMs using UPI, to make cash handling at banks easier

RBI Governor Das: Investment and trading of sovereign green bonds in IFSC to be notified shortly

-330

April 05, 2024· 10:36 IST

RBI Monetary Policy Live: Mobile app for G-secs

- Mobile app planned for access to RBI’s Retail Direct Scheme to participate in the G-sec market

-330

April 05, 2024· 10:34 IST

RBI Monetary Policy Live: Emkay Global's Madhavi Arora on RBI policy

RBI MPC Meeting 2024 Live: We maintain the RBI’s tone will slowly tiptoe to ‘Gracklish’ from the usual ‘Hawk-Dove’ signaling, implying a non-committal stance and limited definite forward guidance ahead. While bull-steepening of India bonds looks to be a popular trade, consistent repricing of Fed cuts could spill over into the RBI’s reaction function and will be cyclically noisy for bonds/FX.

-330

April 05, 2024· 10:31 IST

RBI Monetary Policy Live: Guv Shaktikanta Das on CAD

RBI MPC Meeting 2024 Live: Current Account Deficit (CAD) for FY25 is expected to remain at a level that is both viable and eminently manageable.

-330

April 05, 2024· 10:28 IST

RBI Monetary Policy Live: Guv Shaktikanta Das on NBFCs

RBI MPC Meeting 2024 Live: ey indicators of capital and asset quality of scheduled commercial banks continue to be healthy. Financial indicators of NBFCs are also in line with the banking system as per the latest available data.

Banks, NBFCs and other FI must give high priority to regulatory guidelines.

-330

April 05, 2024· 10:27 IST

RBI Monetary Policy Live: Guv Shaktikanta Das on Rupee's performance

RBI MPC Meeting 2024 Live:Indian Rupee showed lowest stability in FY24 Vs Last 3 years

-330

April 05, 2024· 10:25 IST

RBI Monetary Policy Live: Guv Shaktikanta Das on CPI inflation

RBI MPC Meeting 2024 Live: Monetary transmission continues to be work in progress.

It is essential for the best interest of the economy that CPI inflation continues to moderate and aligns to the target on a durable basis. Till this is achieved our task remains unfinished. The success in the disinflation process so far should not distract us from vulnerability of the inflation trajectory to the frequent incidents of supply side shocks

-330

April 05, 2024· 10:24 IST

RBI Monetary Policy Live: Shaktikanta Das on food inflation

RBI MPC Meeting 2024 Live: Food inflation continues to considerably exhibit volatility which is impeding the ongoing disinflation process

The strong growth momentum together with GDP forecast for FY25 give us policy space to unwaveringly focus on price stability.

-330

April 05, 2024· 10:23 IST

RBI Monetary Policy Live: Shaktikanta Das says elephant of inflation gone back to forest

RBI MPC Meeting 2024 Live: Earlier, the elephant in the room was inflation and now the elephant has gone out for a walk, says Das

-330

April 05, 2024· 10:22 IST

RBI Monetary Policy Live: CPI inflation projected at 4.5 percent for FY25

RBI MPC Meeting 2024 Live: Guv Shaktikanta Das revises CPI inflation for Q1 and Q2 for FY25

Q1 4.9 percent

Q2 3.8 percent

Q3 4.6 percent

Q4 4.5 percent

-330

April 05, 2024· 10:20 IST

RBI Monetary Policy Live: RBI MPC - Highlights so Far

RBI MPC Meeting 2024 Live: RBI has also maintained the stance of 'withdrawal of accommodation'

RBI decides to keep the ranges unchanged by a 5:1 majority, stance

MPC has decided to be resolute in its commitment to align CPI to its target

FY25 real GDP growth projection at 7%

Prospects of investment activity have remained bright

Outlook for agricultural activity remain bright; indicators show that urban consumption has remained buoyant

As rural demand catches up, consumption expected to support economic growth

Global economy looking resilient with a stable outlook

-330

April 05, 2024· 10:18 IST

RBI Monetary Policy Live: Real GDP growth forecast

RBI MPC Meeting 2024 Live: Real GDP growth for FY25 projected at 7 percent. Q1 at 7.1 percent, Q2 at 6.9 percent and Q3 and Q4 each at 7 percent

-330

April 05, 2024· 10:15 IST

RBI Monetary Policy Live: Das sticks to the script!

RBI MPC Meeting 2024 Live: As expected, there are no surprises. The RBI Governor Shaktikanta Das reiterated the rate panel’s commitment on inflation fight saying the MPC remains resolute in its decision to fight inflation, particularly in view of the uncertainty surrounding food prices. MPC remains vigilant about upside risks of inflation, Das said, adding the MPC must continue to be actively disinflationary. The message here is very clear—the central bank isn’t willing to lower the guard on inflation fight. Any chances of rate cut in the immediate future looks are unlikely till inflation eases to 4% levels.- - Dinesh Unnikrishnan, Editor-Banking & Finance.

-330

April 05, 2024· 10:14 IST

RBI Monetary Policy Live: Flow of resources to commercial sector banks high, says Das

RBI MPC Meeting 2024 Live: Total flow of resources to the commercial sector from banks 31.2 lakh crore during 2023-24 is significantly higher than 26.4 lakh crore previous year.

-330

April 05, 2024· 10:13 IST

RBI Monetary Policy Live: Guv Das on inflation

- RBI Monetary Policy Live: Looking ahead, robust growth prospects provide policy space to remain focused on inflation and ensure its descent to the target of 4 percent. As uncertainties in food prices continue to pose challenges, the MPC remains vigilant to the upside risks to inflation that may derail the path to disinflation.

- Das also added, "Under these circumstances, monetary policy must continue to be actively disinflationary to ensure anchoring of inflation expectations and fuller transmission of past monetary policy actions."

-330

April 05, 2024· 10:12 IST

RBI Monetary Policy Live: Guv Das on CPI

- RBI Monetary Policy Live: MPC has decided to be resolute in its commitment to align CPI to its target, says Guv Das

-330

April 05, 2024· 10:07 IST

RBI Monetary Policy Live: Guv Das on inflation

- RBI Monetary Policy Live: Core inflation has declined steadily, notes RBI; MPC must be 'actively disinflationary'

-330

April 05, 2024· 10:06 IST

RBI Monetary Policy Live: RBI decides to keep key rates unchanged by a 5:1 majority

- RBI MPC Meeting 2024 Live: RBI decides to keep key rates unchanged by a 5:1 majority at 6.5%

- RBI has also maintained the stance of 'withdrawal of accommodation'

-330

April 05, 2024· 10:03 IST

RBI Monetary Policy Live: Follow MC's livestream

- RBI MPC Meeting 2024 Live: Repo Rate To Remain Steady For Seventh Time? | Governor Shaktikanta Das Speech

- Watch here.

-330

April 05, 2024· 09:59 IST

RBI Monetary Policy Live: RBI likely to keep stance unchanged - withdrawal of accommodation

- RBI MPC Meeting 2024 Live: The RBI's policy stance indicates the thinking within the MPC, the rate-setting panel. Currently, its stance is of withdrawal of accommodation.

- The majority of the participants in the Moneycontrol poll said the central bank may keep its stance unchanged, i.e. withdrawal of accommodation.

-330

April 05, 2024· 09:55 IST

RBI Monetary Policy Live: What Bandhan Bank’s Sanyal thinks about the MPC outcome

- The Reserve Bank of India's (RBI) monetary policy committee (MPC) may keep the repo rate unchanged, said Siddhartha Sanyal, Chief Economist and Head-Research, Bandhan Bank.

- Speaking exclusively to Moneycontrol, Sanyal said that though the repo rate may remain unchanged, the central bank could shift to a neutral stance.

-330

April 05, 2024· 09:51 IST

RBI Monetary Policy Live: Interest Rates keenly watched

- Interest rate policy will also be watched keenly by another segment viz. bank depositors. The year saw banks scrambling for deposits due to tight liquidity and also slowing CASA deposits.

-330

April 05, 2024· 09:45 IST

RBI Monetary Policy Live: Neither rate nor stance changes are likely

- With this being the first meeting of a new financial year and with elections around the corner, neither rate nor stance changes are likely.

-330

April 05, 2024· 09:40 IST

RBI Monetary Policy Live: RBI unlikely to reduce policy rates anytime soon, here's why

- With adverse heat conditions predicted, agriculture output and food prices can be problematic and therefore it is unlikely the RBI is going to reduce policy rates any time soon, especially if it feels the growth concern is out of the way.

-330

April 05, 2024· 09:35 IST

RBI Monetary Policy Live: Currently, SDF rate is at 6.25 percent.

- SDF rate is a rate at which the RBI accepts uncollateralised deposits, on an overnight basis, from banks.

- Currently, SDF rate is at 6.25 percent.

-330

April 05, 2024· 09:30 IST

RBI Monetary Policy Live: RBI likely to keep repo rate unchanged at 6.50%. But what is repo rate?

- Repo rate is an interest rate at which the RBI provides liquidity under the liquidity adjustment facility (LAF) to banks against the collateral of government and other approved securities.

-330

April 05, 2024· 09:25 IST

RBI Monetary Policy Live: Will there be a message to NBFCs?

- In the last six months, the RBI has intensified scrutiny and has clamped down on several NBFCs citing rule violations. These include actions against IIFL, JMFPL and Bajaj Finance.

- According to banking industry sources, the central bank is worried about the rising bank lending to NBFCs which, in turn, is finding way to unsecured loan pockets. In some other cases, there are multiple rule violations on credit practices. The central bank has cautioned NBFCs saying they need to take ownership of the lending activity and make sure underwriting standards are kept high. Will the Governor repeat his caution to banks on NBFC lending today? Let’s wait and watch! - Dinesh Unnikrishnan, Editor-Banking & Finance.

-330

April 05, 2024· 09:20 IST

RBI Monetary Policy Live: CPI inflation to soften to 4.6% owing to favourable monsoon?

- Experts said presuming a favourable monsoon, we project the average CPI inflation to soften to 4.6% in FY2025 from 5.3% in FY2024.

-330

April 05, 2024· 09:17 IST

RBI Monetary Policy Live: RBI likely to keep repo rate unchanged thanks to country's robust economy

- The RBI is likely to keep the policy rate unchanged, considering that growth is robust, and it may continue to cite challenges in managing the last mile of inflation, as stated by governor Shaktikanta Das in the previous policy.

-330

April 05, 2024· 09:10 IST

RBI Monetary Policy Live: Crude oil prices to affect headline inflation?

- Crude oil prices have hardened to about $85 per barrel. However, recently announced cuts in LPG and petrol/diesel prices may have a marginal positive impact on headline inflation.

-330

April 05, 2024· 09:05 IST

RBI Monetary Policy Live: Will Das up GDP growth target?

- Everyone is optimistic about the growth numbers. Recently, the RBI Governor said the growth number for the current fiscal year will be ‘very close’ to 8 per cent in the current fiscal year based on improving fundamentals of the economy and pick up in investment activities. The government’s growth projection for FY24 is 7.6% while the RBI forecast is 7 per cent. There is quite a strong possibility for the RBI to revisit the growth forecast this time to around 7.5%.- Dinesh Unnikrishnan, Editor-Banking & Finance.

-330

April 05, 2024· 09:00 IST

RBI MPC Meet live: Indian economy in Q3FY24

- India’s economy grew a robust 8.4 percent in Q3 of FY24, the fastest among major economies.

- GDP growth was fuelled by a strong performance in the manufacturing and construction sectors.

-330

April 05, 2024· 08:55 IST

RBI MPC Meet live: Banking Liquidity Stance

- In the February 8 meeting, RBI said that after remaining in surplus during April-August 2023, system-level liquidity turned into a deficit from September after a gap of four and a half years but adjusted for government cash balances, potential liquidity in the banking system was still in surplus.

-330

April 05, 2024· 08:50 IST

RBI MPC Meet live: RBI's growth projections to give some sense of confidence to the markets

- The central bank's projections will give some sense of confidence to the market in terms of the overall environment for growth which will have a bearing on corporate earnings.

-330

April 05, 2024· 08:45 IST

RBI MPC Meet live: No rate action, but watch out for Das’ policy language

- None of the economists expect any rate action from the RBI Governor today. That prediction is based on the assessment that the MPC is still far away from achieving the medium-term target of four per cent. But what is more important to watch out will be the signal on future rate cuts. The first sign of a rate reversal will happen when the MPC changes its stance to ‘neutral’ from ‘withdrawal of accommodation’. Chances of this happening today is unlikely since inflation is yet to ease to the 4 per cent level. But, if Das chooses to surprise with a stance change to guide markets, that will be the big news of the day! –Dinesh Unnikrishnan, Editor-Banking & Finance.

-330

April 05, 2024· 08:40 IST

RBI MPC Meet live: Headline CPI inflation print to decline to a 10-month low of 4.7% in March 2024, says ICRA

- ICRA expects the headline CPI inflation print to decline to a 10-month low of 4.7% in March 2024, amid a cut in domestic LPG cylinder and retail prices of petrol and diesel.

- While food inflation is expected to moderate, it is likely to persist above the 7.0% mark in the month. This would imply an average CPI inflation print of 5.0% for Q4 FY2024, in line with the MPC’s projections for that quarter.

-330

April 05, 2024· 08:35 IST

RBI MPC Meet live: CPI inflation to soften to 4.6% owing to favourable monsoon?

- Experts said presuming a favourable monsoon, we project the average CPI inflation to soften to 4.6% in FY2025 from 5.3% in FY2024.

- While the IMD’s expectations of the development of La Nina conditions during the monsoon season are likely to augur well for food prices, any unpleasant surprises on the agro-climatic front could push up the food inflation trajectory and also pose the risk of food price pressures transmitting to the core segment.

-330

April 05, 2024· 08:30 IST

RBI MPC Meet live: RBI likely to cut rates in second half of FY25

- CareEdge ratings agency said that the central bank will look at cutting the key rates in the second half of financial year (FY) 2024-25.

- “Going ahead, we anticipate that the MPC will contemplate rate cuts in the second half of FY25 as headline inflation approaches the 4 percent threshold. By that time, the RBI will likely have gained further clarity on the risks associated with food inflation and the policy outlook of the US Fed,” the ratings agency said.

-330

April 05, 2024· 08:25 IST

RBI MPC Meet live: CPI inflation seen at 5.4% for 2023-24 with Q4 at 5%

- Consumer Price Index (CPI) based Inflation is a measure of changes in the price levels of goods and services purchased by households.

- In February, India's headline retail inflation rate was almost unchanged at 5.09 percent, from 5.10 percent in January.

- According to the RBI's latest forecast, CPI inflation is seen at 5.4 percent for 2023-24 with Q4 at 5 percent.

-330

April 05, 2024· 08:22 IST

RBI MPC Meet live: Food and core inflation in focus

- Analysts estimate food inflation to remain elevated above 7.5 percent in 1H CY24 on the back of high cereals and pulses (legumes) inflation from an ongoing heatwave in the country.

- On core inflation, they expect core services inflation to bottom out in Q1 and increase towards 4.0 percent by mid-2024 driven by an up-turn in housing (rental) inflation, and expect core goods inflation to increase on the back of a rise in manufacturing input costs with higher copper prices by the end of 2024.

-330

April 05, 2024· 08:17 IST

RBI MPC Meet live: Experts said the RBI may finetune overnight rates with their liquidity operations

- Experts are of the view that the central bank may continue to maintain the finetuning of liquidity through repo and reverse repo auctions.

- Experts said the RBI may finetune overnight rates with their liquidity operations.

- They added that the RBI would prefer to micromanage daily liquidity positions and act accordingly. Hence, it is not expected that the RBI will announce anything in advance to manage liquidity.

-330

April 05, 2024· 08:14 IST

RBI MPC Meet live: RBI projected GDP growth of 7% for FY25.

- In the February policy review, the RBI projected GDP growth of 7 percent for FY25.

- Experts said the central bank may revise its projection after a surprise increase in the third quarter of FY24.

-330

April 05, 2024· 08:12 IST

RBI MPC Meet live: RBI likely to keep stance unchanged - withdrawal of accommodation.

- The RBI's policy stance indicates the thinking within the MPC, the rate-setting panel. Currently, its stance is of withdrawal of accommodation.

- The majority of the participants in the Moneycontrol poll said the central bank may keep its stance unchanged, i.e. withdrawal of accommodation.

-330

April 05, 2024· 08:07 IST

RBI MPC Meet live: How are Markets gearing up today? Tune in to the podcast to know

- Markets to remain volatile on account of the RBI policy meeting outcome. Investors will eye interest rate cut commentary and inflation, GDP forecast.

- Listen to the podcast here.

-330

April 05, 2024· 07:59 IST

RBI MPC Meet live: RBI MPC to be cautious about risk from food inflation, says Goldman Sachs

- According to a Goldman Sachs report, while the core inflation has softened, the central bank will remain cautious about an upside risk to food inflation.

- Goldman's analysts expect the Reserve Bank of India's Monetary Policy Committee (MPC) to keep the policy repo rate unchanged at the April 5 meeting at 6.50 percent, retain the monetary policy stance of ‘withdrawal of accommodation’, sound optimistic on growth, and continue to reiterate the commitment to the 4 percent headline inflation target.

-330

April 05, 2024· 07:49 IST

RBI MPC Meet live: GDP grew 8.4 percent in the December quarter

- India's gross domestic product (GDP) grew 8.4 percent in the December quarter, data released by the Ministry of Statistics and Programme Implementation on February 29 showed.

- The statistics ministry now expects the full-year GDP growth to be even higher than its unexpectedly high first advance estimate of 7.3 percent.

-330

April 05, 2024· 07:39 IST

RBI MPC Meet live: Here's what happened in the past MPC meetings

- In its February monetary policy, the central bank kept the repo rate unchanged at 6.50 percent for the sixth consecutive time.

- The RBI has kept the repo rate unchanged since the April 2023 monetary policy. This was after inflation showed signs of moderating.

- Earlier, the MPC had steadily raised the repo rate by 250 basis points (bps) starting from May 2022.

-330

April 05, 2024· 07:29 IST

RBI MPC Meet live: A look at the GDP numbers

- The Reserve Bank of India will revise its projection of India's GDP after a surprise increase in the third quarter of the current financial year, say experts.

- “GDP numbers have pleasantly surprised everyone. India is the fastest-growing economy among all the large economies, and it is quite likely that we will continue to be so in 2024-25 as well,” said Kishore Lodha, Chief Financial Officer, U GRO Capital Ltd.

-330

April 05, 2024· 07:19 IST

RBI MPC Meet live: Economists and bankers said that the central bank is likely to make minor changes in the inflation forecast due to easing fuel and cooking gas prices.

- “Minor changes in the quarterly profile for inflation are likely. Average inflation for FY25 is likely to be maintained at around 4.5 percent,” said Gaura Sengupta, Chief economist, IDFC First Bank.

- Dipti Deshpande, Principal Economist at CRISIL, expects headline CPI inflation to continue to soften next fiscal year to 4.5 percent from an estimated 5.5 percent this fiscal, supported by the assumption of a normal monsoon, softer domestic demand, and benign global oil prices.

-330

April 05, 2024· 07:09 IST

RBI MPC Meet live: The Inflation Fineprint

- The inflation print in February was far above the central bank’s medium term target of 4 percent.

- According to the RBI's latest forecast, CPI inflation is seen at 5.4 percent for 2023-24 with Q4 at 5 percent.

- Assuming a normal monsoon next year, CPI inflation for 2024-25 is projected at 4.5 percent with Q1 at 5.0 percent; Q2 at 4 percent; Q3 at 4.6 percent; and Q4 at 4.7 percent, the RBI said in its February monetary policy.

-330

April 05, 2024· 06:59 IST

RBI MPC Meet live: What Bandhan Bank’s Sanyal thinks about the MPC outcome

- The Reserve Bank of India's (RBI) monetary policy committee (MPC) may keep the repo rate unchanged, said Siddhartha Sanyal, Chief Economist and Head-Research, Bandhan Bank.

- Speaking exclusively to Moneycontrol, Sanyal said that though the repo rate may remain unchanged, the central bank could shift to a neutral stance.

-330

April 05, 2024· 06:50 IST

RBI MPC Meet live: Here are the five things equity investors should look out for in the upcoming MPC

- Repo Rate and Stance - Analysts mostly expect the status quo to continue on the repo rate from the current 6.5 percent.

- Inflation expectations - Although it is under the RBI's tolerable band of 4-6 percent, India's inflation is still at the higher end of the band.

- Read more here.

-330

April 05, 2024· 06:45 IST

RBI MPC Meeting 2024: CareEdge report says repo rate to be unchanged in April meeting

- The Reserve Bank-led Monetary Policy Committee (MPC) may keep the repo rate unchanged on April 5, said ratings agency CareEdge on April 2.

- “Given that the RBI Governor has been highlighting the aim of getting inflation to 4 percent on a durable basis, the policy rates are likely to be kept on hold in the upcoming policy meeting, with no change in stance,” the ratings agency said.

-330

April 05, 2024· 06:38 IST

RBI MPC Meeting 2024: Expert thinks RBI might lower inflation forecast for FY24

Abhishek Bisen, Head of Fixed Income at Kotak Mutual Fund, suggested in an interview with Moneycontrol that the Reserve Bank of India (RBI) is poised to revise down its inflation projection for FY25 by 10-15 basis points (bps) to 4.3-4.4 percent from the previous 4.5 percent. This adjustment is anticipated due to the potential transition from El Nino to La Nina, which could bolster food prices in the latter part of 2024. Read more

-330

April 05, 2024· 06:24 IST

RBI MPC Meeting 2024: RBI might tweak inflation forecast for FY24

Regarding inflation, the RBI is expected to adjust the FY24 forecast, buoyed by the decline in fuel prices. In the previous policy review, the RBI forecasted 5.4 percent for FY24. Similarly, on the growth front, the RBI is anticipated to express optimism. Governor Das recently suggested that India's GDP growth for the current fiscal year ending in March might approach "very close" to 8 percent.

The RBI-led policy panel is likely to maintain vigilance regarding inflation and may echo the sentiments of the previous monetary policy, potentially hinting at future rate cuts later in the year, contingent upon inflation comfortably reaching the 4 percent target.

-330

April 05, 2024· 06:14 IST

RBI MPC Meeting 2024: Robust growth might prompt RBI to keep interest rate steady

With the growth outlook brightening, the MPC may opt to maintain interest rates. India's economy sustained robust growth in Q3, supported by strong momentum, robust indirect taxes, and reduced subsidies, as per RBI's State of the Economy article on March 19. Q4 saw a remarkable 8.4% expansion.

-330

April 05, 2024· 06:00 IST

RBI MPC Meeting 2024: Challenges and objectives

The central bank has consistently highlighted the issue of insufficient monetary policy transmission within the banking system. Despite the Monetary Policy Committee (MPC) raising key rates by 250 basis points to 6.5 percent in efforts to curb inflation, the effective transmission of these rates to end-borrowers has been limited. The Reserve Bank of India (RBI) is keen to observe the extent to which previous rate cuts have been transmitted throughout the banking system.

-330

April 05, 2024· 05:28 IST

RBI MPC Meeting 2024: Unlikely for RBI to precede the Federal Reserve in rate reversal, say economists at Emkay Global

The Monetary Policy Committee (MPC) is closely monitoring global interest rates, particularly the approach of the US Federal Reserve, for indications regarding potential rate adjustments. Recently, the US central bank opted to maintain its key rates unchanged while reiterating caution regarding inflation. Federal Reserve Chairman Jerome Powell emphasized that despite some fluctuations, inflation remained elevated in the US, asserting that the broader narrative remained consistent. "Inflation is gradually moderating, albeit with occasional bumps, toward 2 percent," Powell remarked. Economists at Emkay Global suggest it is improbable for the Indian central bank to precede the Federal Reserve in implementing rate reversals.