The Central Board of Indirect Taxes and Customs on Sunday said single packages of food items like cereals, pulses and flour weighing up to 25 kg will be considered as 'prepackaged and labelled', and liable to five per cent GST from July 18.

It also clarified that if a retail shopkeeper supplies in loose quantity the item bought from a manufacturer or a distributor in a 25-kg pack, such sale to consumers will not attract GST.

The CBIC on Sunday night issued a set of frequently asked questions (FAQs) on GST applicability on 'pre-packaged and labelled' goods, just a day before the five per cent GST on such items becomes applicable.

In the context of food items (such as pulses, cereals like rice, wheat, flour etc), the supply of specified pre-packaged food articles would fall within the purview of the definition of 'pre-packaged commodity' under the Legal Metrology Act, 2009, if such pre-packaged and labelled packages contained a quantity up to 25 kilogram (or 25 litres).

"It is clarified that a single package of these items (cereals, pulses, flour etc.) containing a quantity of more than 25 Kg/25 litre would not fall in the category of pre-packaged and labelled commodity for the purposes of GST and would therefore not attract GST," it said.

The CBIC said the supply of pre-packed atta meant for retail sale to ultimate consumer of 25 Kg shall be liable to GST. However, supply of such a 30-kg pack thereof shall be exempt from levy of GST.

The board also said that GST would apply on a package that contains multiple retail packages, for example a package containing 10 retail packs of flour of 10 kg each, the CBIC said.

It said for the purpose of GST, pre-packaged commodity would mean a commodity which, without the purchaser being present, is placed in a package of whatever nature, whether sealed or not, so that the product contained therein has a pre- determined quantity.

Any such supply which requires declaration under the Legal Metrology act would attract GST, it said.

What else gets expensive?

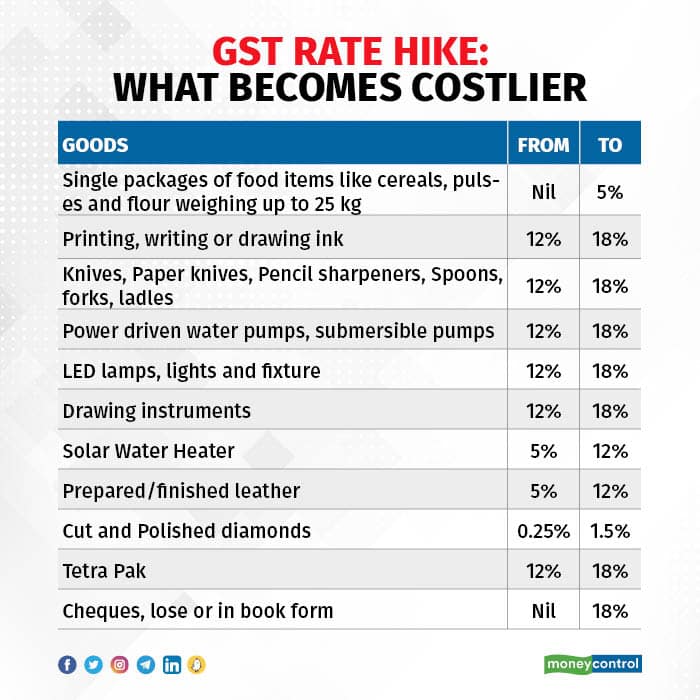

The other consumer items that get expensive from today include LED lamps, lights and fixtures that will attract a GST of 18 percent against the 12 percent levy earlier.

Knives, pencil sharpeners, spoons, forks and ladles as well as drawing instruments will attract a tax of 18 percent against 12 percent earlier.

Bank cheques will also be charged a GST of 18 percent against no tax earlier.

GST on Tetra Pak packaging is being raised to 18 percent from 12 percent, while finished leather will be taxed 12 percent against 5 percent earlier.

The tax on cut and polished diamonds is being raised to 1.5 percent from 0.25 percent.

Among services, services provided job works related to processing of leather, leather goods and footwear and clay bricks will not attract 12 percent GST from 5 percent earlier.

Works contract for roads, bridges, railways, metro, effluent treatment plant will be charged 18 percent GST against 12 percent earlier.

Works contracts supplied to central and state governments, local authorities for canals, dams, pipelines, educational institutions, hospitals will attract a GST of 18 percent from 12 percent earlier.

Rate on earthwork contracts for government has also been raised to 12 percent from five percent earlier.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.