The Ministry of Power notified on May 25th that it is working on a scheme to liquidate the past dues of power distribution companies (discoms) to provide relief to the entire value chain in the power sector which has been reeling under the pressure of non-payment.

But the notification has left power sector officials with many questions, and some skepticism over its success. This is after all the second such scheme in two years.

The ministry is hopeful that the new scheme would provide the much-needed liquidity to the power generating companies, and the measures being planned will ensure that discoms pay their dues regularly.

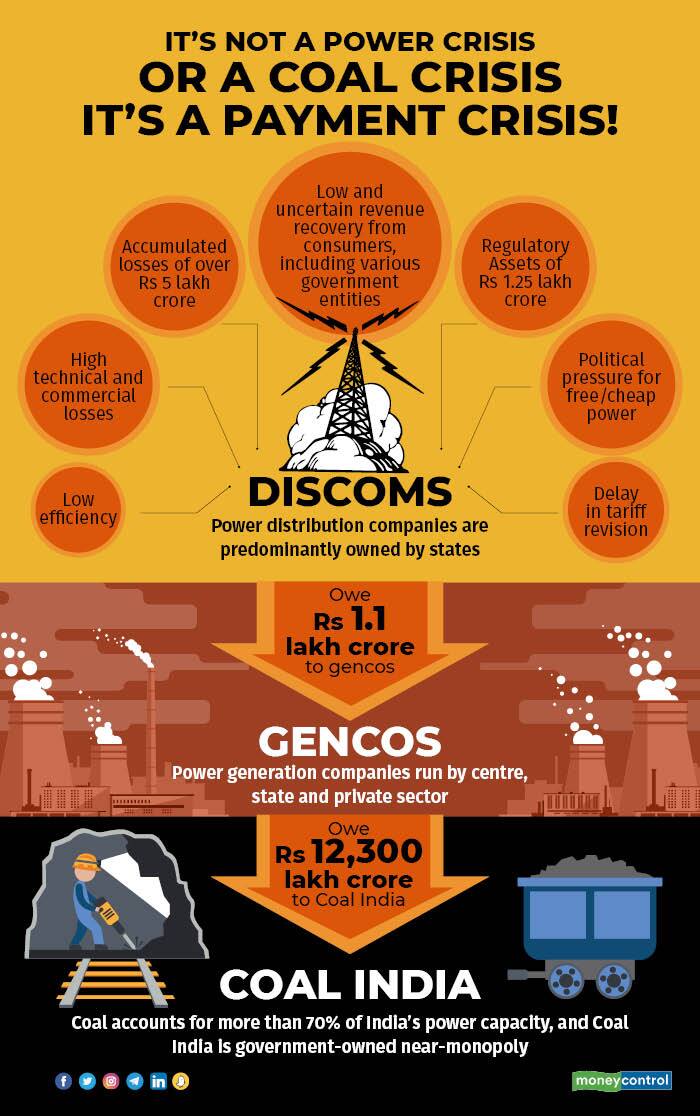

Power discoms have accumulated losses of over Rs 5 lakh crore and regulatory assets, which represent costs that are deferred for recovery through future tariff revisions, worth Rs 1.25 lakh crore. They owe power generators over Rs 1.1 lakh crore, who in turn owe Coal India Rs 12,300 crore. The payment crisis hurts the entire power sector ecosystem.

“These concessions should be only given if the generators can be insulated from future defaults. Along with the concession, a mechanism needs to be put in place like a tri-partied agreement, which insulates the generators from any future defaults. Otherwise it becomes a never ending cycle of default,” Ashok Khurana, director general, Association of Power Producers, told Moneycontrol .

The New Scheme

The Ministry of Power said that the proposed scheme will enable discoms to pay off financial dues in easy installments. There would be a one-time relaxation which would freeze the outstanding amount of discoms, including principal and late payment surcharge (LPSC), on the date of notification of the scheme and no further LPSC will be imposed on this amount. The discoms will have the flexibility to pay the outstanding amount in up to 48 installments. In case they falter and there are delays, the discoms will have to pay the late payment surcharge for the entire amount, which was otherwise exempted.

The late payment surcharge is levied on the payment outstanding by a discom to a power generating company at the base rate, pegged to the State Bank of India’s marginal cost of lending rate. The surcharge is applicable for the period of default at base rate for the first month of default and increased by 0.5 percent for every successive month of delay, subject to a maximum of 3 percent over the base rate at any time.

“The liquidation of outstanding dues in deferred manner without imposition of LPSC will give discoms time to shore up their finances,” the ministry said.

The ministry said that the plan will potentially lead to a saving of Rs 19,833 crore on late payment surcharge over the next 12 to 48 months. States like Tamil Nadu and Maharashtra who have large outstanding dues will save over Rs 4,500 crore each, while Uttar Pradesh will save around Rs 2,500 crore and others like Andhra Pradesh, Jammu & Kashmir, Rajasthan and Telangana could save in the range of Rs 1,100 crore to Rs 1,700 crore.

But how?

Power sector executives that Moneycontrol spoke to asked, “Where will the finances come from?” One skeptical executive asked, “If they could not manage to pay earlier, how will they pay installment for past dues and the regular payments on top of that?”

Rahul Prithiani, Senior Director, Energy, Commodities and Sustainability, CRISIL, said, “Although the scheme will help provide greater visibility of cashflow in the near term, the fundamental issues of lack of timely pass through costs to end users and delay subsidy payment will continue to hurt the state discoms over the medium to longer term.”

The concerns of the power sector executives stem from past experience with such schemes. Many committees and experts have in the past highlighted the need for a more stringent payment security mechanism as the crisis has led to almost a full-fledged banking crisis due to escalating non-performing assets in the power sector.

There have been many schemes in the past but the sector continues to face recurring issues. The last such scheme was announced in June 2020 when the dues of discoms touched a record high of Rs 1.3 trillion. Finance Minister Nirmala Sitharaman announced a special liquidity infusion scheme to help discoms clear their dues to generation and transmission companies.

“The basic challenge in the Indian power sector is the endemic problem of revenue not covering cost in many distribution utilities. Given the reluctance and restrictions put on financial institutions, it has become difficult for discoms to avail working capital loans to bridge such gaps. This results in accumulating dues for fuel, transmission and generating companies. Periodically special dispensations will have to be provided to ensure that the system doesn’t collapse,” said Debasish Mishra, Partner & Leader (Energy), Deloitte India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.