The debt piled on by the private sector during the coronavirus pandemic could lower growth for emerging markets by 1.3 percent over three years, the International Monetary Fund (IMF) has warned.

For developed nations, the hit to growth is seen marginally lower at 0.9 percent over the same period, the IMF said in a chapter of its World Economic Outlook report released on April 18.

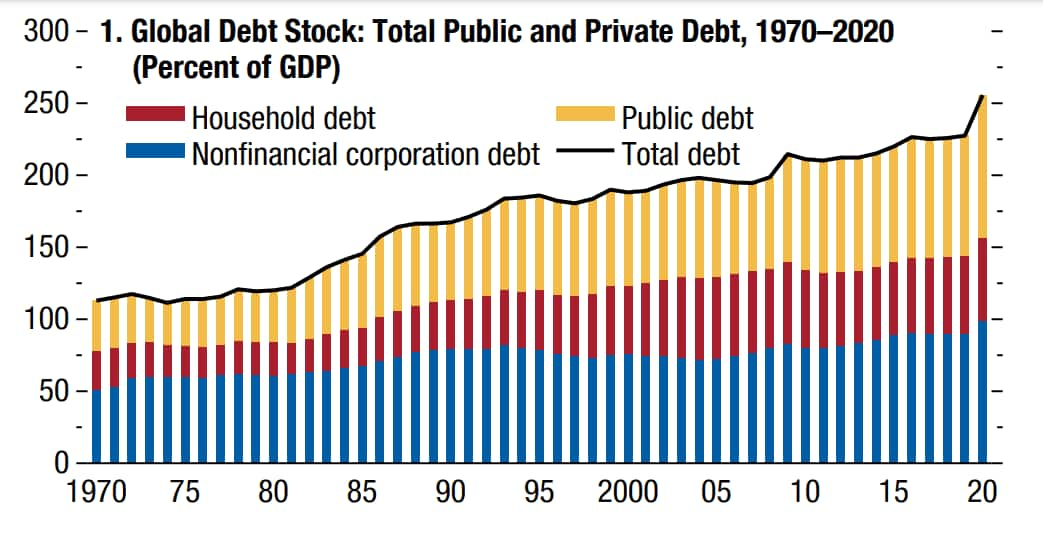

"The surge in global private debt in 2020–13 percent of GDP–was widespread, faster than during the global financial crisis and almost as large as the rise in public debt," the IMF said in the report.

The Fund forecasts in January said advanced economies were seen growing 3.9 percent in 2022 and 2.6 percent in 2023. GDP growth for emerging market and developing economies was pegged at 4.8 percent for the current calendar year and 4.7 percent for 2023.

These numbers are expected to be revised lower, with IMF Managing Director Kristalina Georgieva saying on April 14 that the Fund would be downgrading its growth forecasts for 2022 and 2023 because of the war between Russia and Ukraine.

The IMF will release its revised growth forecasts and the complete World Economic Outlook report on April 19.

In the chapter released on April 18, the IMF said the estimates of the hit to growth from the rise in private sector debt were prepared before Russia's invasion of Ukraine. They do not account for consequences the war may have for private sector balance sheets.

Source: IMF World Economic Outlook report

According to the IMF, a rapid rise in debt may be unsustainable and lead to deleveraging along with below-average growth.

"In a nutshell, loose financial conditions encourage debt buildup, which boosts spending, growth, and asset prices and further incentivises credit as collateral values increase. This eventually unwinds when returns disappoint or are too poor to justify further debt-financed investment, lenders become wary of rolling over credit and extending new loans, or financial conditions tighten and rising debt-service costs crowd out other spending," the IMF said.

The cross-country study conducted by the IMF showed the current level of private sector leverage could exert larger-than-estimated drag on growth in countries where: indebtedness is more concentrated among financially constrained households and at-risk firms, insolvency processes are inefficient, fiscal space is limited, and monetary policy needs to be tightened quickly.

Inflation considerations

With global inflation elevated for some time now, the IMF said fiscal and monetary authorities should consider how the tightening of financial conditions would impact those consumers and businesses which are "most financially stretched".

The IMF's calculations show a "surprise tightening" of 100 basis points could weaken investment among highly leveraged firms by 650 basis points over two years. This would be 400 basis points more than for firms with "little leverage".

"Where the recovery is well underway and balance sheets are in good shape, fiscal support could be reduced faster, facilitating the work of central banks. Elsewhere, governments should target fiscal support to the most vulnerable in the transition to recovery while keeping within credible medium-term fiscal frameworks," the IMF said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.