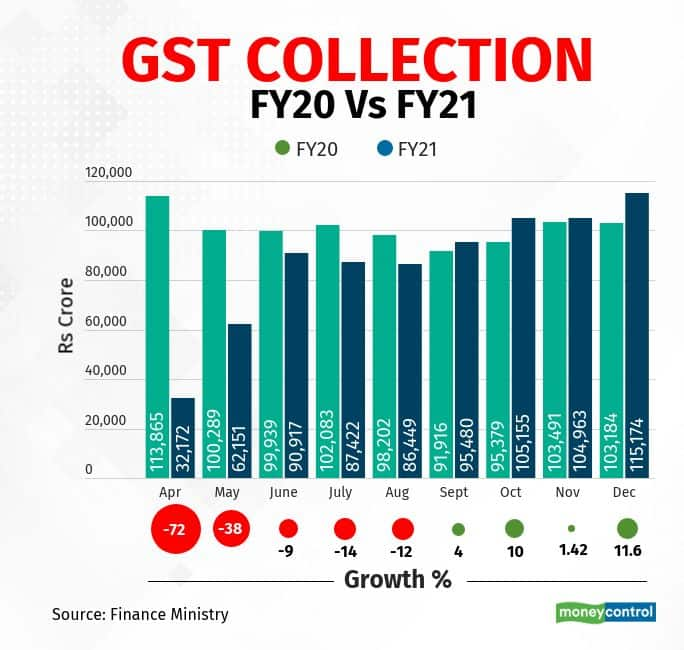

Goods and Services Tax collections for December rose to Rs 1.15 lakh crore, the highest ever since the implementation of the nationwide tax in July 2017, the Finance Ministry said in a statement on January 1.

The previous monthly GST collection record was just short of Rs 1.14 lakh crore in April 2019.

This is the fourth consecutive month this year that GST collections have outperformed comparable months from 2019, a clear sign of strong recovery as the Indian economy slowly came out of its biggest ever contraction in the April-June quarter. A much lower contraction in July-September means that India is officially in a technical recession.

"In line with the recent trend of recovery in the GST revenues, the revenues for the month of December 2020 are 11.6 percent higher than the GST revenues in the same month last year. During the month, revenues from import of goods were 27 percent higher and the revenues from domestic transaction were 8 percent higher that the revenues from these sources during the same month last year," the ministry said.

Out of the headline amount, central GST collected was Rs 21,365 crore, state GST was Rs 27,804 crore, integrated GST was Rs 57,426 crore (including Rs 27,050 crore collected on import of goods) and compensation cess was Rs 8,579 crore. The total number of GSTR-3B Returns filed for the month of November up to December 31, 2020, was 87 lakh, the ministry said.

As per the statement, total revenue earned by the Centre and states after regular settlement in December 2020 is Rs 44,641 crore for CGST and Rs 45,485 crore for SGST.

The ministry said this was the first time that GST collections have crossed Rs 1.15 lakh crore.

"The December 2020 revenues are significantly higher than November revenues of Rs 1.05 lakh crore. This is the highest growth in monthly revenues since last 21 months," the statement said, and added that this was due to the combined effect of the rapid economic recovery post-COVID-19 pandemic and the nationwide drive against GST evaders and fake bills along with many systemic changes which led to improved compliance.

"Till now, GST revenues have crossed Rs 1.1 lakh crore three times since introduction of GST. This is the third month in a row in the current financial year after the economy showed signs of recovery post the pandemic that the GST revenues have been more than Rs 1 lakh crore," the ministry said.

The average growth in GST revenues during the October-December quarter has been 7.3 percent as compared to negative 8.2 percent during the July-September quarter, it said.

As Moneycontrol had reported earlier, December brought good news to the government on direct taxes as well. While overall direct tax collections had dropped 13 percent year-on-year till December 15, corporate advance tax collections for October-December had risen a staggering 49 percent. This was a reflection of strong recovery and quarterly earnings in the corporate sector.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.