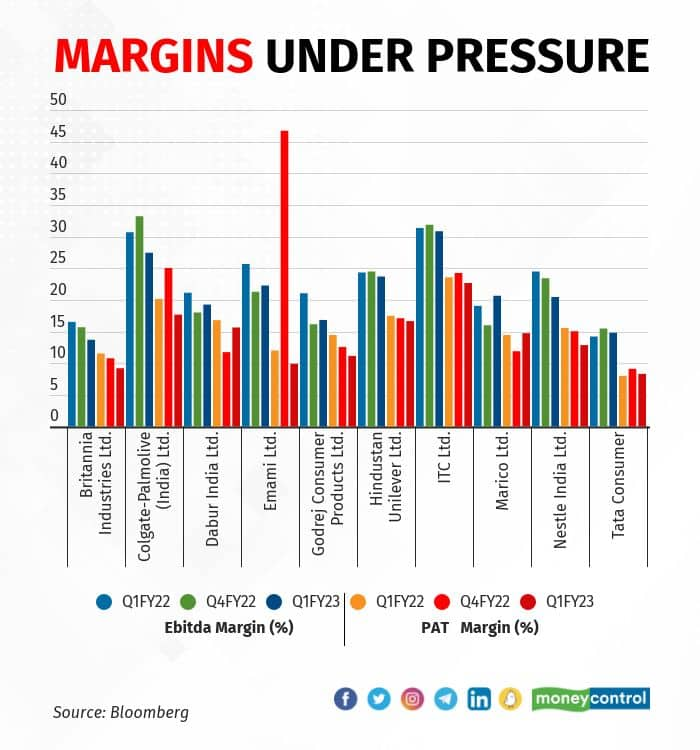

Raw-material inflation acted as a drag on margins of FMCG players in the first quarter of this fiscal.

Nearly all of them saw a year-on-year fall in operating profit margins, despite trying to pass on price hikes by shrinking packet sizes and raising the mark-up.

Operating profit margins of the biggest listed FMCG players dropped by an average of 258bps year on year; PAT margins fell by an average 197.87bps year on year.

(Graphic by Rajesh Chawla; data compiled by Ritesh Presswala)

(Graphic by Rajesh Chawla; data compiled by Ritesh Presswala)

Marico and Tata Consumer beat this sectoral trend though.

Marico’s EBITDA margin for this June quarter was 20.64%, which was slightly higher than last June quarter’s 19.05% and considerably more than this March quarter’s 16.01%. This was because of an unexpected dip in the price of copra, which accounts for half of its input costs.

Tata Consumer’s EBITDA margin went up year on year but fell quarter on quarter. Its yoy numbers are better despite rise in input costs and higher ad spends. Going by the press release from the company, their salt portfolio continues to grow at a healthy pace with double-digit, yoy increase this quarter too, despite its high base last June quarter. The premium salt portfolio recorded a 36% growth during the quarter. Its Kannan Devan tea brand has also reported “outstanding” growth because of brand building and on-ground execution.

Also read: GST on unbranded goods will level the field: Adani Wilmar's Angshu Mallick

Shrinking percentages

Godrej Consumer seems to have had the deepest fall of 420 bps in EBITDA margin year on year; that said, the margin did go up quarter on quarter by 67 bps. The company’s sales volume declined by 5% yoy and its revenue growth of 8% was largely price led, which impacted demand. According to ICICI Securities, home improvement had a weak quarter and price increases in personal wash impacted offtake. “Margin trajectory further weakened (RM and also mix-led) but is likely to have bottomed out,” wrote the analysts. Its international business has weighed heavily on the margins too. While its India business’ operating profits fell by 4%, profits from international markets such as Indonesia and Africa fell by 34%.

Nestle and Emami saw the second and third-steepest fall in operating profit margins year on year, with 404 bps and 341 bps drops respectively. Nestle’s profitability was affected by elevated price levels of milk, green coffee and wheat. Analysts at ICICI Direct also think that higher freight cost due to sharp increase in fuel prices have affected the company’s bottom line. The analysts add that, with Nestle intent on growing its volumes, it is reluctant to pass on higher input costs to consumers. “Though, the company is undertaking cost rationalisation measures, the recovery is margins would come with considerable dip in commodity prices,” they wrote in a report.

Shrinking packages

High wheat and palm-oil prices were a drag on Britannia’s EBITDA margins, which fell to 13.7%, from 16.52% a year ago and 15.67 a quarter ago. A large portion of Britannia’s sales come from biscuits and high-protein food (70% of sales) and bread, cake and rusk contribute the second-largest share (18%).

Though their consolidated revenue went up by 9%, volumes fell by 2% yoy, possibly because of the sharp price increases of around 11% yoy they took, according to Nomura. “Sharp price increases of c.11%, driven two-thirds by grammage cuts in convenience price-point packs (c.50-50% of volumes and c.40% value) and one-third from MRP increases weighed on volumes,” stated its report.

Colgate has been trying to be more margin focussed over the last few quarters, according to ICICI Securities. After posting healthy margins for the last many quarters, the company’s EBITDA margin hit a 9-month low this June quarter, their report added.

Inflationary inputs, especially of packaging material, and an adverse product mix dragged down the margins, according to the analysts.

These are the two factors that put pressure on Dabur’s margins too. The company’s operating margin fell to 19.26% from 21.14% a year ago (rose from 18.01% a quarter ago). The product mix was adverse because the share of foods went up and that of healthcare declined, according to a Jefferies report. According to the brokerage, half of the gross margin decline (around 100 bps) was because of the adverse mix.

While the company did manage to pass on higher costs to consumers by increasing prices by 5% and decreasing grammage by 1%, inflation in the basket was higher at 9%.

Heavy ad spends

Advertising spends shot up for HUL in this quarter, by 30% year on year. It was Rs 1,328 crore in Q1FY23 versus Rs 1,024 crore in Q1FY22. This was because of the new product launches, according to a Nomura report. The second-highest expenditure on its books was for materials, which saw a 27.2% rise year on year. It was Rs 7,514 crore in Q1FY23 versus Rs 5,905 crore in Q1FY22. The brokerage expects the second quarter margins to contract sequentially too, because the company has high-price inventory, and stated in its report that only in the third quarter will softening prices of inputs start to improve margins.

The segment that delivered the largest share of EBITDA margin (29% of the margin) was Beauty and Personal Care. But, its profitability shrunk year on year–with the EBITDA margin falling by 184bps, to 26.3% from 28.1%. The company posted strong sales numbers in soaps and hair care, but its mass-consumption portfolio with Glow & Lovely and Talc and Colour Cosmetics are still selling at pre-Covid levels because consumers picked essentials/staples in the face of inflation, said the report.

Also read: ITC run-up: Is there more steam left?

Great quarter rained on

ITC had a great quarter, with operating profit growing 41% yoy, which was 10% above consensus estimates. The numbers were led by their paperboards and hotels business, and slightly better-than-expected cigarettes business, according to Jefferies. The company’s FMCG vertical reported healthy growth in revenues too, up 20% yoy thanks to schools reopening, demand for out-of-home goods keeping up and “a decent show in staples and convenience foods”. Despite the strong revenue performance, inflation dragged down the operating profit margins by 20 bps yoy, according to Jefferies. That said, the brokerage added, FMCG EBITDA grew 16% yoy and was in-line.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.