Reliance Industries is expected to announce Q3 FY25 financial results on January 16, with analysts forecasting a mixed performance led by strong telecom earnings growth, improvements in refining margins, and moderate retail growth. RIL's Q3 revenue is expected to rise on a quarter-on-quarter basis, but the net profit is seen growing at a faster rate sequentially. Analysts also expect consolidated EBITDA to benefit from stronger refining margins and higher ARPU in digital services despite weakness in petrochemicals.

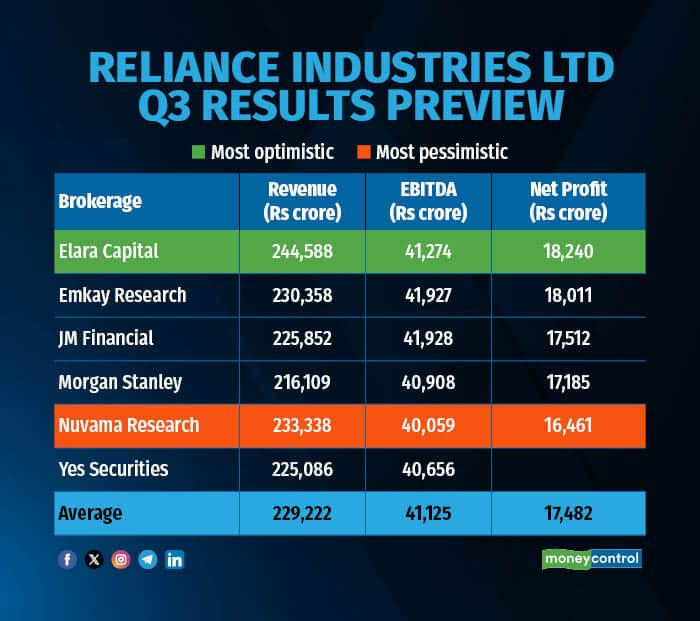

According to a Moneycontrol poll of brokerages, Reliance Industries is expected to post a robust 6 percent sequential growth in net profit to Rs 17,482 crore and a healthy 5-percent plus quarter-on-quarter expansion in EBITDA to Rs 41,125 crore in the October-December quarter.

RIL Q3 FY25 Results Estimates

RIL Q3 FY25 Results EstimatesBrokerages also estimate RIL’s fiscal third-quarter EBITDA margin in the range of 18.2-18.9 percent - improving from the previous quarter - led by higher GRMs in the refining business and the residual impact of tariff hikes in digital services.

Among the brokerages polled by Moneycontrol, Elara Capital rolled out the most bullish projections, estimating a more than 10 percent sequential rise in net profit and 6 percent QoQ EBITDA growth.

Also read | Whitespace Alpha's Puneet Sharma sees strong possibility of tariff hike by telecom giants in 2025

What factors are driving the earnings?O2C Business: The recovery in diesel cracks and reduced crude premiums will drive sequential improvement in O2C earnings, said Emkay Research. Analysts expect refining margins (GRMs) to range from $8.7-10.8 per barrel, driven by better ex-China supply-demand dynamics and a favourable cost base. However, petchem margins are likely to remain under pressure due to unresolved supply and demand issues for olefins and certain aromatics, Goldman Sachs said.

Digital Services: Reliance Jio is expected to deliver robust performance. Jio’s EBITDA is likely to surge 17 percent YoY and 4 percent QoQ on high ARPU, which is estimated to rise to Rs 203-205 due to tariff hikes, according to Elara Capital. Subscriber additions are forecast to remain muted but stable.

Retail Business: The retail segment is expected to show growth, with EBITDA likely up 5-6 percent QoQ. The growth in Retail EBITDA would be driven by higher footfalls and urban consumption recovery. However, analysts cited challenges from a more calibrated approach in the B2B business.

Also read | Britannia, HUL, Nestle, other FMCG stocks fall up to 31% from 2024 peaks: Here's what investors should do

What to look out for in the quarterly show?O2C refining margins:Any commentary on the sustainability of GRMs and the outlook for petrochemical recovery will be crucial.

Digital services growth:Analysts will keenly monitor ARPU trends, subscriber base dynamics, and Jio’s broadband growth trajectory.

Retail segment outlook:Updates on urban consumption recovery and plans for store network expansion will be important.

Capex and debt trends:Investors will focus on capex moderation and net debt reduction, along with potential updates on the timeline for Jio’s listing.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.