Paytm's parent One97 Communications is likely to report increased operating profitability in the quarter ended December 2023, driven by the festive season.

“Paytm’s Q3 will see festive season-led strong payments business growth while optimising operational performance,” said Dolat Capital in a report.

Paytm is scheduled to report its third quarter financial year 2023-24 (Q3 FY24) earnings on January 19.

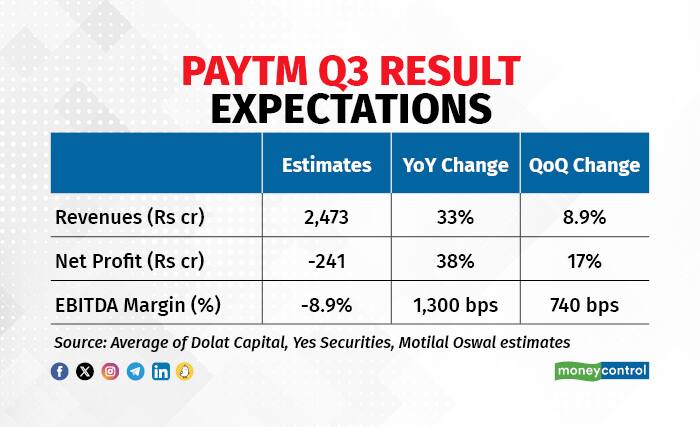

The fintech's losses are expected to narrow further in the quarter under review to Rs 241 crore, down 38 percent on-year. Its revenue is seen rising 33 percent on-year to around Rs 2,743 crore, according to an average estimate of three brokerages.

While analysts expect healthy growth in total revenue and the number of subscription payment devices, disbursements and gross merchandise value (GMV) are expected to decline in the quarter. GMV is the value of merchant transactions settled by Paytm.

Paytm's earnings before interest, taxes, depreciation, and amortisation (EBITDA) margin is seen improving by 1,300 basis points (13 percentage points) to around -8.9 percent on account of an improvement in contribution margin and direct and indirect costs balanced between capturing the festive season growth and improving profitability.

Contribution margin is the money left over from sales after paying all variable expenses associated with producing a product.

Also Read | UBS forecasts Paytm's EBITDA breakeven in FY25, initiates coverage with 'buy' callLoan disbursal to moderate; contribution margin to growPaytm's loan disbursal growth, however, is expected to take a hit in the December quarter because of the fintech's cautionary approach to personal loans and postpaid loans after the Reserve Bank of India's (RBI) tightening of unsecured loans.

In November, the central bank announced an increase of 25 percent in the risk weight on consumer credit exposure for both commercial banks and non-banking finance companies (NBFCs). Furthermore, the RBI increased the risk weight on credit card receivables for scheduled commercial banks (SCBs) and non-banking finance companies (NBFCs) by 25 percent.

Following this development, Paytm, in December, decided to cut down on disbursing loans of less than Rs 50,000 and expand higher-ticket loans. As Paytm's post-paid loans account for a significant part of its total loans, this move is likely to cause a sharp drop in loan volume, Bhavesh Gupta, President and Chief Operating Officer of Paytm had said.

Citi expects Paytm's loan disbursal growth to slow to 48 percent year-on-year (YoY) in Q3 FY24, compared to 122 percent YoY seen in Q2. The international brokerage sees the fintech's gross payment margins to come in at 15.3 bps compared to 15.7 bps in the previous quarter.

Growth seen in payment services, PPC revenueYes Securities is estimating a six percent quarter-on-quarter (QoQ) growth in payment services to consumers and 12 percent to merchants. Growth in financial services and other segments is seen at six percent QoQ. The brokerage estimates 8.1 percent QoQ growth in revenue from operations.

The brokerage projects Payment Processing Charges (PPC) as a percentage of payments revenue to likely be around 54.5 percent, a slight uptick from the 54.4 percent recorded in the previous quarter. PPC is the fee charged to merchants for processing credit card payments and online payments from customers.

Analysts at Yes Securities anticipate Paytm's total expenses (excluding PPC) to exhibit a sequential growth of six percent, a noteworthy improvement compared to the three percent growth in the September quarter.

Meanwhile, Motilal Oswal expects Paytm's contribution margin to come in at 55 percent for the quarter ended December 2023. The brokerage sees adjusted EBITDA at Rs 204 crore and contribution profit to grow 42 percent YoY to Rs 1,490 crore.

Key monitorablesPaytm's update on loan business, merchant business, and consumer payment business scale-up are the key monitorables in the forthcoming result, according to analysts.

Also Read | Domestic retail investors raise stake in Paytm to 12.85%Paytm's EBITDA breakeven in 2025Earlier this month, international brokerage UBS initiated coverage on Paytm with a target price of Rs 900. The global firm said in a report that Paytm’s strong topline compounded annual growth rate (CAGR) of 54 percent in FY21-24E has been driven by its core payment business and supported by device and loan origination monetisation.

Paytm's profitability dynamics have also improved, with its contribution margin rising to 50 percent of revenue and positive EBITDA (ex-ESOP costs), UBS said.

Analysts at UBS expect a moderating 21 percent topline CAGR in FY24-28 while "operating leverage plays out as marketing expense requirements ease and ESOP costs moderate", it said, adding, "As a result, we forecast the company breaking even on EBITDA in FY25 and reaching a 20 percent EBITDA margin by FY28."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.