Listed Indian companies have been announcing the issue of bonus shares this year even though market conditions are challenging and higher inflation and geopolitical tensions are eroding earnings.

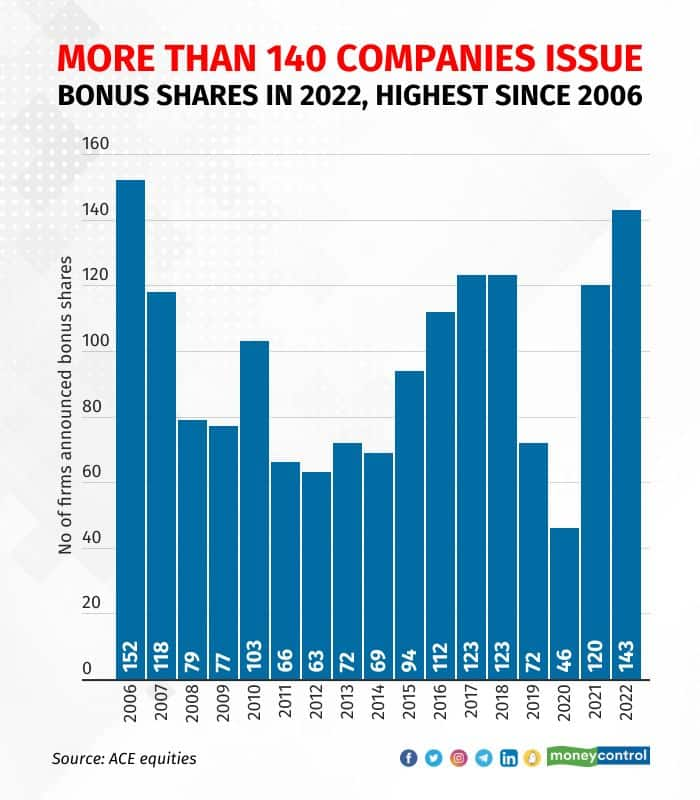

At least 143 companies have announced bonus shares so far in 2022, the most since 2006, when 152 companies issued free shares, according to data from ACE Equities. In 2021, about 120 companies announced bonus issues, while in 2019 and 2020, the figures were 72 and 46, respectively.

Analysts said bonus issues surged this year ahead of a change in tax rules. The government amended Section 94 (8) of the Income Tax Act in the budget in February to stop bonus stripping. The new rules are applicable from April 1, 2023.

Dr VK Vijaykumar chief investment strategist at Geojit Financial Services said although this year has been difficult from an earnings perspective amid weak margins and higher interest rates, some sectors and some companies within sectors are doing well.

Even though the pharma sector’s performance has been average, Torrent Pharma (1:1 bonus) and GMM Pfaudler (2:1 bonus) have done well and their promoters are confident of continuing to do so.

Fence sittersShareholders don’t get any immediate benefit from bonus issues because stock prices adjust immediately after the record date. However, companies that issue bonus issues are perceived by the market as investor-friendly, analysts said.

“At times, the management may use the bonus issue as a price manipulation tool. Announcing bonuses may prevent some sellers sitting on the fence from selling, while attracting another set of buyers who would want to buy to get tax breaks,” said Deepak Jasani, head of retail research at HDFC Securities. “Sometimes, the management may want to make the stock more affordable and hence may announce bonuses even if the performance of the company may not be on the improvement path. In all such cases, the strategies backfire after a brief period.”

Analysts said companies announce bonus shares with different objectives. When the performance of a company improves sustainably over a few years, the management may decide to issue bonus shares as a reward to investors who have held on to the shares.

Companies may also issue bonus shares when its performance is expected to improve over the next two to three years to maintain the earnings per share, analysts added.

Motherson Sumi Wiring India, Sheela Foam, Maharashtra Seamless, Easy Trip Planners, FSN E Commerce Ventures, eClerx Services, Gail India, Sonata Software, REC, Indian Oil, Nazara Technologies, Ajanta Pharma, and AU Small Finance Bank are among the 143 companies that have announced bonus issues this year.

“During the past few years, we have seen a sharp run-up in several quality stocks. Increased investor participation post the strong run-up could be one of the reasons why several companies are opting for bonus announcements,” said Pankaj Kumar, deputy vice president for fundamental research at Kotak Securities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.