Pharmaceutical company Lupin is all set to report its April-June quarter earnings on August 3. Analysts are hoping for a positive set of earnings from the drug maker thanks to a favourable base, and healthy sales in the US generics market.

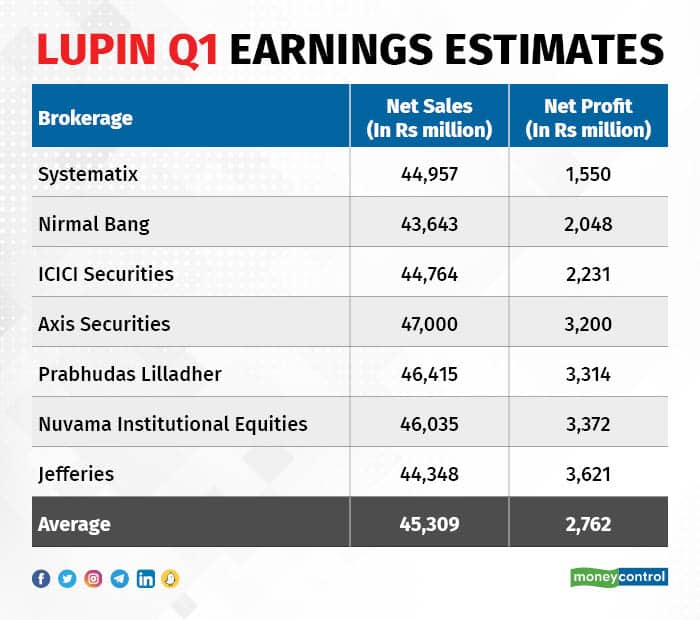

A poll of brokerages collated by Moneycontrol pegged the drugmaker's net profit for the quarter at Rs 276.2 crore, marking a stark improvement from a loss of Rs 89 crore in the same period of the preceding fiscal.

Shelf stock adjustments, price erosion in the US market and inflation of raw materials were the factors that dented the company's financials in the year ago period. However, with much of these headwinds out of the park, the company's financials are expected to improve in Q1 on a year-on-year basis.

Also Read: Lupin gets USFDA nod for birth-control pill

Moreover, a ramp-up in some drugs and some new launches in the US are also expected to lift the topline for Lupin. A consensus of analyst estimates expects Lupin to record a topline of Rs 4,530.9 crore in the first quarter of the current fiscal, up 21 percent from Rs 3,743 crore clocked in the year ago period.

Among brokerages, Systematix Shares and Stocks had the lowest net profit projections for Lupin, while Jefferies had the highest.

Brokerage firm Axis Securities also predicted sales of $182 million in Lupin's US base business aided by a stable market share in the generics of Albuetrol, Solosec and Levothroxine. Nirmal Bang Institutional Equities also expects the majority of markets to report double-digit growth for Lupin, led by new launches and currency tailwinds.

As for domestic revenue, Nuvama Insitutional Equities pegged an 8 percent growth for the segment on the back of a slow recovery as the addition of 1,000 medical representatives (MRs) starts contributing.

Also Read: With roadblocks out of the way, is Lupin finally on the growth path?

Most brokerages also estimated an EBITDA margin of around 12-13 percent for the drugmaker during the April-June period. For context, Lupin's margin stood at 4.4 percent in the April-June period of the previous fiscal.

Aside from quarterly earnings, investors will remain much more focused on the company's future plans, given that a mega drug launch by Lupin is awaited in the ongoing quarter. Prabhudas Lilladher also believes that the company's margin guidance and an update on the launch of the blockbuster respiratory drug Spiriva will remain key monitrables for the drug maker.

Margin improvement has remained a prime concern for Lupin in the previous fiscal, especially due to intense price erosion and raw material inflation. With that backdrop, the commentary on margins and the launch of the drug which can help turn fortunes for the drugmaker will take precedence in Lupin's earnings call.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.