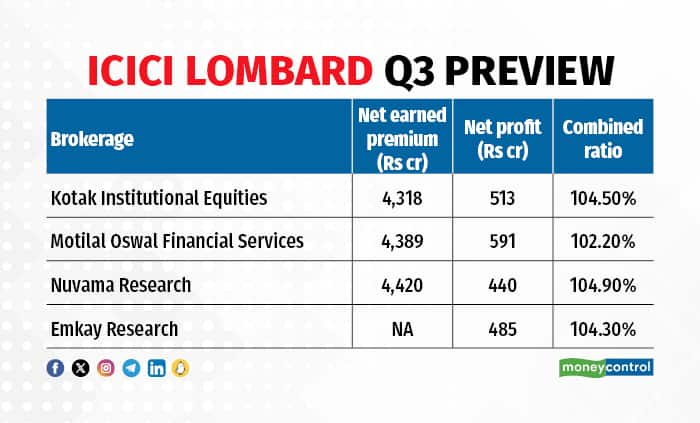

ICICI Lombard General Insurance on January 16 is likely to report a net profit of Rs 507 crore for the October-December 2023 quarter, up 44 percent year-on-year. This will come on the back of 15 percent YoY growth in net earned premium to Rs 4,376 crore, as per a poll of brokerages.

Net earned premium is the measure of income earned by insurance companies less the expenses associated with the policy. Meanwhile, the company's gross direct premium income (GDPI) is likely to come in at Rs 6,351 crore, up 13 percent YoY.

ICICI Lombard's combined ratio is likely to remain elevated at 104 percent due to the impact of Chennai floods. However, this is going to be an industry-wide trend.

"Combined ratios for non-life insurers are likely to remain elevated due to Chennai floods and higher hospitalisations," as per Nuvama Research.

The combined ratio is the sum of incurred losses and operating expenses measured as a percentage of earned premiums. A combined ratio above 100 percent is bad news for the company as well as investors.

According to Emkay Research, ICICI Lombard's claims ratio is expected to remain elevated for the quarter at 71.3 percent versus 70.3 percent for Q3 FY23, driven by natural catastrophes and slightly higher claims in the health segment.

The increased claims ratio would lead to claims incurred increasing 14.4 percent to Rs 3,040 crore, Emkay added.

Also Read: HDFC Life shares fall 2% post mixed Q3 performance; here's what brokerages say

Meanwhile, the company's premium growth will be strong, driven by the health segment, more so the group segment, noted Motilal Oswal Financial Services. Competitive intensity in the motor insurance segment remains elevated so management commentary and market share need to be watched out for.

Starting December 1, 2023, Sanjeev Mantri took over as the managing director and chief executive officer at ICICI Lombard General Insurance Company Limited. Thus, investors and analysts will be keenly monitoring his comments on any change in strategy and growth prospects going ahead.

On January 15, the stock closed at Rs 1,375.20 on the NSE, down 1.36 percent from the previous close.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.