Hyundai Motor India, which has filed its draft prospectus for an initial public offer (IPO), boasts of better financial metrics in terms of margins and ratios when compared to its competitors, including Maruti Suzuki and Tata Motors.

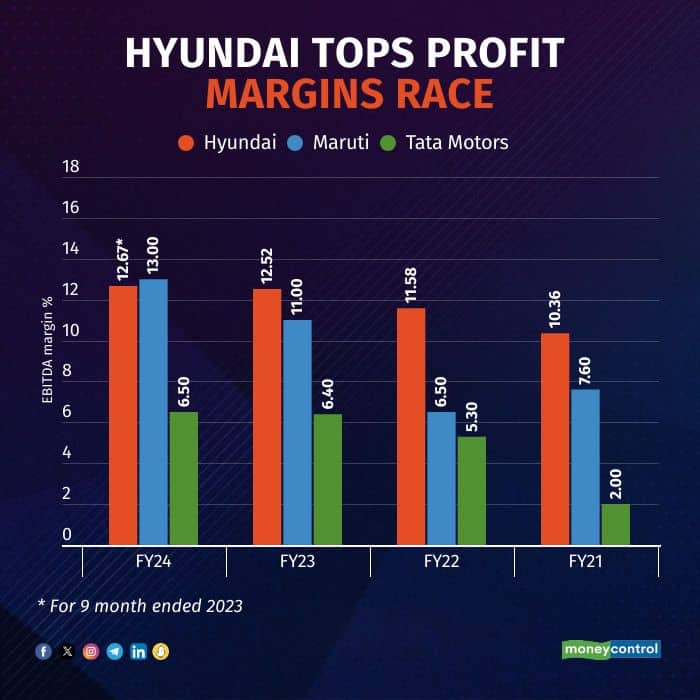

Data disclosed in the IPO prospectus shows that Hyundai Motor India's EBITDA margin for the nine months ending December 31, 2023, was pegged at 12.7 percent, outperforming Tata Motors at 6.1 percent and just below Maruti Suzuki India, which was at 13 percent for full 12 months.

Further, Hyundai Motor India's earnings (Ebitda) surpass those of Maruti Suzuki India and Tata Motors when we look at their segment numbers for passenger cars.

Interestingly, Hyundai has consistently achieved double-digit operating profit margins over recent years: 10.4 percent in FY21, 11.6 percent in FY22, and 12.5 percent in FY23. On the other hand, Maruti Suzuki's margins were in single digits for FY21 and FY22 (7.6 percent and 6.5 percent respectively) before improving to 11 percent in FY23 and 13 percent in FY24.

Tata Motors also saw improvements, with EBITDA increasing to 2 percent in FY21, 5.3 percent in FY22, 6.4 percent in FY23, and 6.5 percent in FY24.

The reason for better metrics for Hyundai Motor India is the significant contribution from SUVs, particularly the highly successful Creta model, known for its higher margins.

Hyundai

Hyundai

In May 2024, Hyundai Creta maintained its lead in the compact SUV segment, selling more than 10,000 units. Over the last six months, Creta averaged 13,575 units sold, while Maruti's Grand Vitara averaged 9,708 units. Currently, Creta commands a market share of 36 percent, whereas Maruti's Grand Vitara holds 25.92 percent of the market.

Analysts believe that within the Creta lineup, sales predominantly skew towards the top-end or mid-segment models rather than the base model. This trend towards premiumisation and higher sales of higher-end models generally enhances profit margins for a company.

Hyundai's Return on Capital Employed (RoCE) and net worth for FY23 stood at 27 percent and 26 percent, again higher than Maruti's 17 percent and 14 percent; Tata Motors’ 9 percent and 13 percent; M&M's 18 percent and 16 percent respectively.

Incidentally, Mahindra & Mahindra's financial disclosures combine automotive operations across passenger vehicles, LCVs, three-wheelers, and MHCVs. This holistic reporting approach makes direct comparisons with Hyundai challenging.

Therefore, while Hyundai demonstrates strong performance in the passenger vehicles segment, Mahindra & Mahindra's broader financial reporting prevents a direct assessment of its performance against Hyundai specifically in the passenger vehicles segment.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.