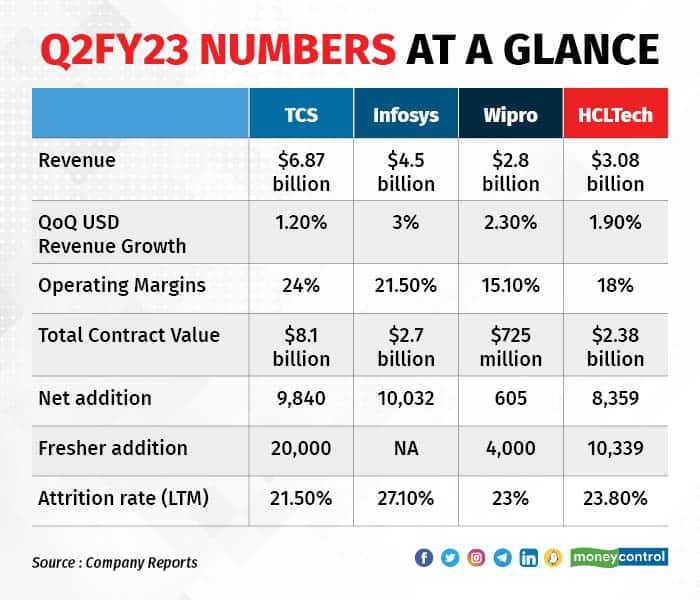

Tata Consultancy Services (TCS), Infosys, Wipro, and HCLTech, the top four Indian IT companies, all reported positive to mixed numbers for the second quarter, which ended on September 30.

Despite worries about an impending recession, inflation, US H-1B visa delays, a toughening environment in major markets like north America, the UK, and Europe, and delays in hiring freshers, the IT sector showed resilience this quarter as demand stayed stable.

Commentary from company executives largely conveyed that demand remains strong, with only a few pockets experiencing a slowdown. However, company executives expressed caution and stated that they were keeping a close eye on the situation.

While TCS and HCLTech outperformed analyst expectations in terms of key performance metrics, the other two lagged slightly.

TCS and HCLTech beat analyst estimates with revenue growth of 4 and 3.8 percent QoQ (quarter-on-quarter) in constant currency (CC) terms, respectively.

While Infosys too grew by around 4 percent QoQ in CC terms, it missed estimates that were pegged at 4.5-5 percent. Though it had missed revenue estimates, Infosys beat analyst estimates on profit. For the year, Infosys tightened its revenue guidance and upped it on the lower end —from 14-16 percent to 15-16 percent.

In CC terms, Wipro's revenue grew by 4.1 percent from the previous quarter. Wipro projected revenue growth of 0.5-2 percent in constant currency terms for the December quarter. However, it maintained its guidance for double-digit growth in FY23.

Given healthy bookings in the first half and expectations of a strong deal pipeline for the upcoming quarters, HCLTech’s management revised overall revenue guidance for FY23 to 13.5-14.5 percent YoY CC growth, from earlier 12-14 percent YoY growth.

Deal winsWhile all the companies reported healthy and stable deal wins this quarter and bullish expectations for the upcoming quarter, they remained wary of the ongoing global market uncertainty. TCS and Infosys have highlighted delays in deal closure conversations with clients. TCS also added that some sectors like retail and insurance have started to show signs of a slowdown in the US.

Regarding Infosys, analysts at ICICI securities said in their report: “Signs of cautious behaviour among clients are visible in terms of delay in decision-making in select verticals. Management pointed to emerging weakness in telecom and high-tech verticals, especially in discretionary spends, apart from the retail and mortgage sub-segment in BFSI called out in the previous quarter.”

Wipro too reported healthy total contract value (TCV) growth of 24 percent YoY (year-on-year) in Q2. HCL Tech also clocked a strong TCV, with new deal wins at $2.38 billion, growing at around 6 percent YoY and 16 percent QoQ. It reported annual contract value (ACV) growth of about 23.5 percent YoY. It won a mega deal with an ACV of $125 million over 5 years. Its products and platform business helped in closing this new deal.

Operating marginsOperating margins have been under pressure, leading to companies slashing employees’ variable pay last quarter. This fiscal has seen the erosion of margins due to supply-side pressures, wage inflation, higher travel costs, etc. However, some constraints have begun to ease.

The July-September quarter benefited from several tailwinds such as a weakening rupee, easing travel restrictions, lower subcontracting costs, and reduced wage hike pressures. With attrition subsiding, companies are now focussed on utilisation and realisation. All of this has led to an improvement in margins across the board.

Infosys lowered its EBIT margin guidance on the upper end. The company, which had previously said that its EBIT margin would be within 21-23 percent, narrowed it to 21-22 percent.

“Looking at margin levers going ahead, there will be some abatement from the attrition side, but because it is a seasonally weak quarter, we will have headwinds due to furloughs and lower working days. We will try to offset some of these through cost optimisation, etc. Therefore, like we said, 21-22 is a narrow band which we will be comfortable with for this year,” Infosys CFO Nilanjan Roy said while addressing the press after the earnings call.

HCLTech’s management narrowed its EBIT margin guidance to 18-19 percent from 18-20 percent earlier for FY23.

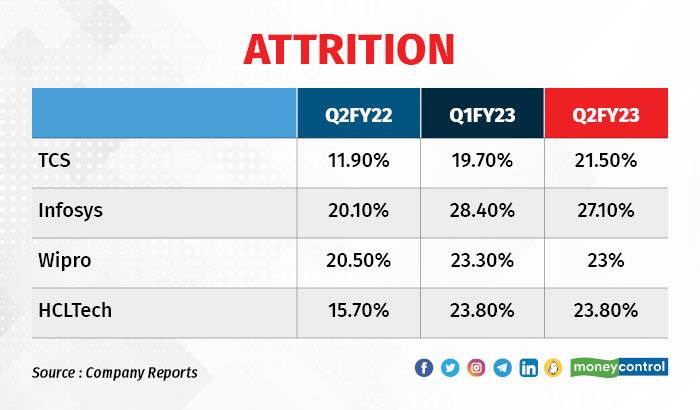

AttritionElevated attrition has been a pain point for several quarters for IT companies, and it continues to remain above 20 percent. However, it may be the beginning of the end of demand far exceeding supply, causing an employee’s market with fizzy salaries.

Company managements have said that attrition has begun to reduce on a quarterly basis, even though it remains elevated on an LTM (last twelve months) basis. TCS was the only one of the four major firms to see an uptick in attrition. HCLTech was flat on a sequential basis, while Infosys saw a decline, and Wipro’s slight downward trajectory continued.

After the crazy numbers that companies hired in 2021, there is saturation-related moderation in the sectors that over-hired last year, leading to a reduction in job openings in the IT sector.

Net employee addition has reduced, and is down 45 percent from last quarter. The second quarter is typically a strong hiring quarter for the companies in question. The commentary by companies is that they want to use the manpower they have hired, as well as train freshers and bring them up to speed.

The dip in net employee addition comes at a time when companies are delaying on-boarding and making offers to freshers. While companies say that all offers made will be honoured, except HCL Tech, all these firms saw a decline in net adds in Q2 compared to Q1. Wipro saw the steepest decline — from 15,446 in Q1 to 605 in Q2.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.