Chyawanprash-maker Dabur India is set to showcase its earnings report for the quarter ended March on May 7, 2025. The FMCG player is likely to see flat revenue growth as demand trends were benign for the quarter.

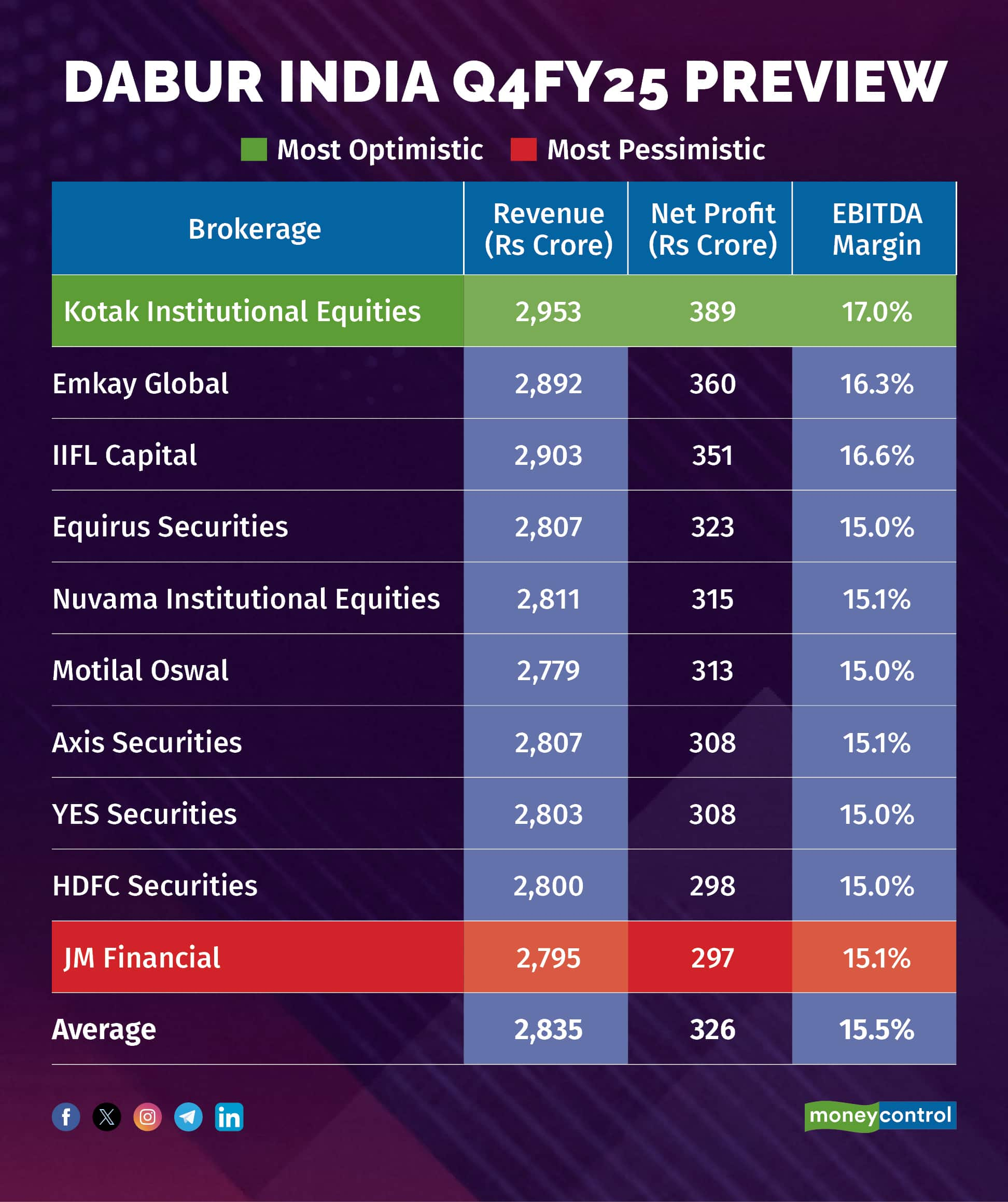

According to a Moneycontrol poll of 10 brokerages, Dabur India is likely to report revenue at Rs 2,835 crore, remaining flat on-year compared to Rs 2,815 crore in the year-ago period. Net profit for the quarter is likely to come in at Rs 326 crore, sharply lower on a yearly basis, down nearly seven percent from Rs 350 crore during the corresponding quarter last year.

Earnings estimates of analysts polled by Moneycontrol are in a diverse range, so any positive or negative surprises may elicit a sharp reaction on the stock. The most optimistic estimate sees Dabur’s net profit rising by 11 percent, while the most pessimistic suggests the net profit could tumble over 15 percent on-year.

Dabur India had previously announced that due to the impact of inflation coupled with operating deleverage, the firm anticipates Q4 operating profit margin to contract by around 150-175 basis points YoY.

"During Q4, rural continues to be resilient and grew ahead of urban markets. In terms of channels, organised trade including Modern trade, E-commerce and Quick commerce maintained their growth momentum, while General trade continued to be under pressure. Overall, FMCG volume trends continued to be subdued during the quarter.," added the FMCG major.

What factors are impacting the earnings?

Demand trends have not witnessed an uptick and were further impacted by weak seasonality.

Domestic business: The Indian business is expected to decline to mid-single digits due to a delayed and short winter and slowdown in urban markets. The hair care segment will see low single-digit growth, while oral care is likely to see moderation to low-mid-single digit. Health supplements to post low-single digit growth, while the Beverages portfolio remains stressed amid competitive pressure, noted Emkay Global.

Volumes: The delayed winter season and a slowdown in the urban demand have weighed on the

volume growth. Motilal Oswal sees a four percent decline in volumes for the quarter.

International business: The international business is likely to turn in 15 percent YoY sales growth in CC, but slower growth in INR terms (Nuvama forecasts 10 percent growth) due to forex impact.

Margins: Amid heightened promotional intensity, YES Securities expects A&P spending to be down 50 bps as a portion of sales to 6 percent, while Nuvama expects A&P spends to be seven percent of sales. EBITDA margins to decline due to operating deleverage and inflationary pressure, as mentioned in pre-quarter update.

What to look out for in the quarterly show?

Analysts will be looking forward to commentary on the domestic demand outlook, along with Dabur India's rural expansion plans. Further, the international business performance and distribution expansion plans will also be eyed, coupled with the FMCG player's D2C foray update.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.