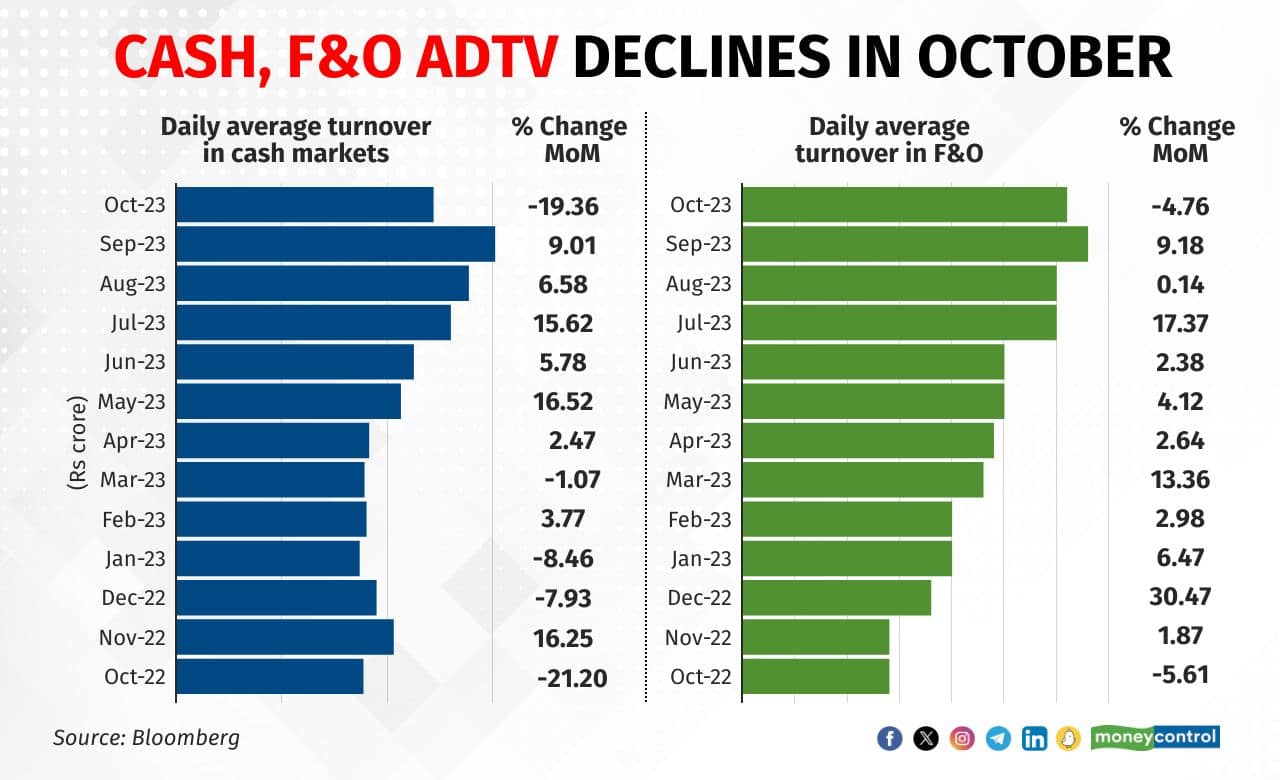

Indian markets saw a significant drop in investor participation, with daily cash and derivative volumes in October dropping from a month ago for the first time in many months due to heightened local as well as global stock market volatility.

In October, the combined average daily turnover (ADTV) of the BSE and NSE hit its lowest point at Rs 72,512 crore, a 20 percent drop from the previous month, marking the largest decrease since June 2022. This is the first month-to-month decline since March 2023.

Additionally, ADTV for futures and options decreased by nearly 5 percent to Rs 315.56 lakh crore to Rs 315.56 lakh crore, the first month on month decline since September 2022, with options turnover falling by 14.5 percent to Rs 52,003 crore. Until September 2023, the average turnover in F&O was hitting record highs every month for the last 12 months.

No new highs

Indian markets steadily climbed from their March low until mid-September. However, their attempt to reach new highs in October were unsuccessful, and in the latter half of the month, both the Nifty and broader market indices saw a significant decline. Analysts said volumes in both the cash and derivative segments continue to fall amid geopolitical tensions and rising crude oil prices.

Also Read: Buzzing Stocks: Tata Motors, P&G, TVS Motor, Colgate Palmolive, Bank of India, others in news

“As the structural uptrend in the markets seems to have ended, participants reduced their trading turnover both in the cash and F&O segments. This situation can continue till we see a resurgence in sentiment that will be dependent on the resolution of geopolitical issues, interest rates not seen to be rising but falling soon, and inflation coming under control globally,” said Deepak Jasani, Head of Retail Research, HDFC Securities.

Global markets saw huge volatility in October as US bond yields reached a multi-year high of 5 percent and crude oil prices neared $90 per barrel. The Israel-Hamas conflict raised risk-off sentiments, strengthening the US dollar, and affecting emerging market currencies.

Tightening regime ahead?

According to economists, Asian central banks are expected to raise interest rates in the coming six months due to the stronger dollar and rising oil prices. Indonesia and the Philippines have already increased rates and signalled further tightening is on the anvil. Other Asian central banks, including India’s RBI, have been using foreign currency reserves, but this approach may have limits.

The combination of a weak currency and inflation may lead some Asian central banks to return to tightening, economists added. The US Fed is likely to keep rates unchanged, but may acknowledge persistent US economic strength, a stand that could be seen as hawkish and disappoint both equity and bond markets.

Apart from the global headwinds, at home, selling pressure in the midcap and smallcap sectors have also worried investors. Analysts expect the fall in mid-small caps to continue amid higher valuations. Further, Q2 earnings are as expected, with slow topline growth on a large base and faster profit growth on a lower base. Certain sectors, such as IT services, have underperformed or given a more conservative guidance than anticipated, analysts added.

Also Read: Trade Spotlight | Your strategy for Prism Johnson, Welspun India and Finolex Cables

Challenging outlook for IT companies

According to a Kotak report, tier-1 IT companies saw revenue declines or slow growth due to weak discretionary spending in North America and Europe, particularly in the financial services, telecom, and hi-tech sectors. Infosys had the highest growth at 2.3 percent, while Wipro and TechM lagged.

Mid-tier companies had mixed growth, with Persistent leading. Infosys and HCL Tech reduced their guidance, and Wipro gave a weaker guidance than expected, citing a challenging outlook for the second half of FY24 and delays between deal signing and ramp-ups.

The recent Securities Exchange Board of India (SEBI) measures, including Additional Surveillance Measures (ASM) and trade-to-trade settlement, aim to reduce volatility in small and medium enterprises and have also dampened investor sentiment. These measures target speculative trading in the SME sector, which has seen growing retail participation. In a joint surveillance meeting, it was decided to extend the short-term ASM and trade-for-trade framework to SME stocks with specific modifications, as indicated in circulars from the BSE and NSE.

(Bloomberg contributed this story)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.