Marie Gold maker Britannia Industries will share its earnings report for the three months ended March on May 8, 2025. The biscuit maker will see a degrowth in net profit as the quarter was impacted by price hikes and subdued consumption environment.

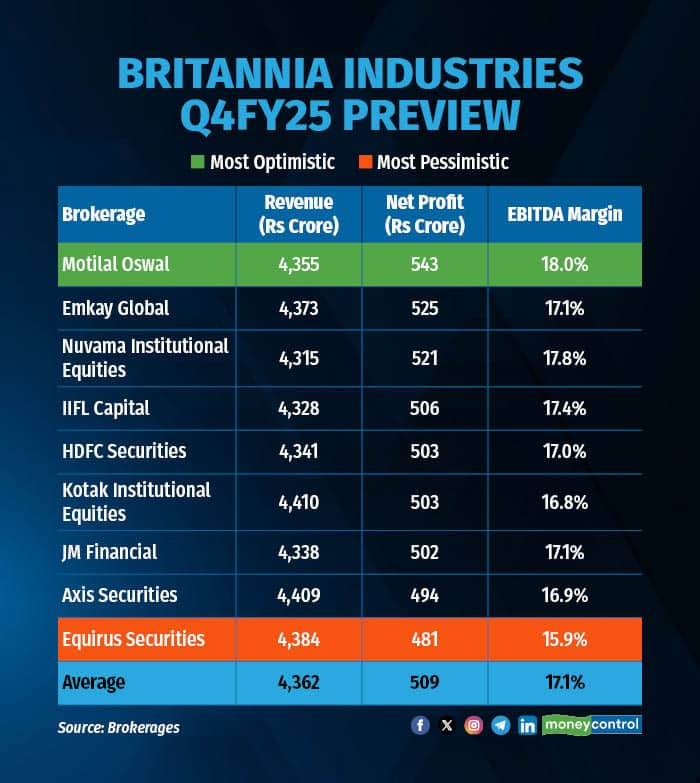

According to a Moneycontrol poll of nine brokerages, Britannia Industries is likely to report a 7.2 percent revenue growth at Rs 4,362 crore. Net profit is likely to come in at Rs 509 crore from Rs 538.2 crore from the corresponding quarter last year, falling 5.5 percent on-year.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock. The most optimistic estimate sees Britannia’s net profit coming in flat, while the most pessimistic projection sees an 10.6 percent on-year fall.

What factors are impacting the earnings?

Britannia Industries is likely to see lower volumes growth compared to H1, while margins take a hit on high commodity inflation.

Volumes: Britannia Industries' volume growth rate is likely to moderate after 8.2 percent growth in H1FY25 due to price hikes and grammage decrease. Britannia had actioned a two percent price hike in Q3, and was expected to take another price hike to the tune of 2-2.5 percent in Q4.

Margins: Amid inflationary stress (wheat and palm together contribute 45 percent to the raw material basket), the company has prioritized volume delivery, which in Emkay Global's view will lead to gross margin compression.

According to Kotak Institutional Equities, the EBITDA margin could contract by 260 bps YoY to 16.8 percent, impacted by RM inflation and adverse operating leverage; further employee cost is expected to normalize to Rs 188 crore, up sharply QoQ as Q3 staff costs were unusually low.

In Q3FY25, there was an impact of Rs 75 crore for provisioning of the stock appreciation rights in the employee cost. In Q4FY25, brokerages do not see a significant impact of the same and hence staff cost is likely to be ~4.1 percent of sales.

What to look out for in the quarterly show?

Analysts will closely monitor demand in metro areas as Britannia Industries reported a significant impact from waning urban consumption in the September quarter. Experts will also pay attention to raw material prices and their effect on EBITDA margins, as well as the heightened competitive pressure from unorganized players.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.