State-run oil marketing major Bharat Petroleum Corp Ltd (BPCL) is expected to see a sharp sequential decline in earnings for the December quarter, primarily because of a significant inventory loss, normalisation of GRMs, and a slightly lower marketing margin.

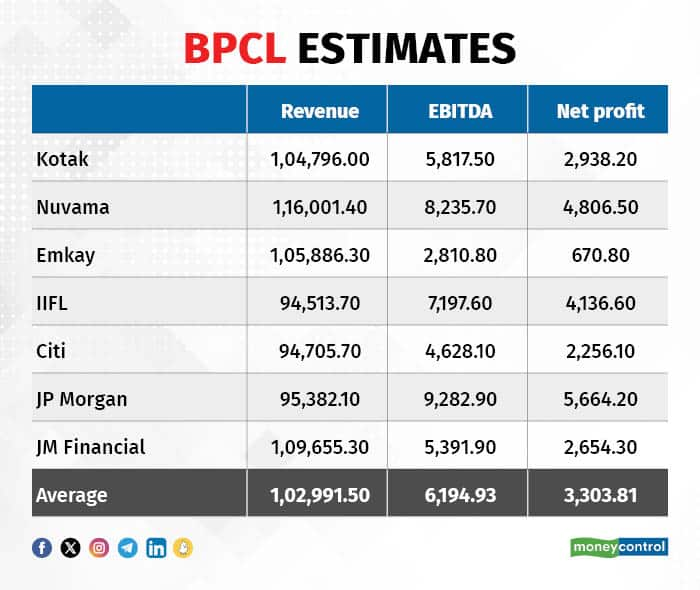

Anticipated net profit is around Rs 3,303.80 crore, down around 70 percent QoQ, with a YoY increase of about 30 percent. Net sales are expected to drop 18 percent on-year and 6 percent on-quarter to Rs 10,2991.50 crore. EBITDA for the quarter is projected to decline around 60 percent QoQ to Rs 6,194.90 crore, as per seven analysts polled by Moneycontrol.

Analysts expect BPCL to report a Gross Refining Margin (GRM) of $8.5 per barrel for the upcoming quarter, down from $18.5 in 2QFY24. This projection is based on a core GRM of $11.5, a crude inventory loss of $3.0 on each barrel, crude throughput at 9.3mmt (a 1 percent QoQ decrease), and marketing sales volume at 12.8mmt (a 2.4 percent QoQ increase).

Additionally, the anticipated decline in auto fuel gross marketing margin to Rs2.8/ltr in 3QFY24 (compared to Rs3.3 per litre in 2QFY24) and an expected product inventory loss of $1.2 a barrel contribute to this outlook.

Analysts said retail margins remained strong in the quarter, with estimated diesel retail margins at Rs 2 a litre (Rs -6 YoY, Rs -1 QoQ). Analysts also expect a 5 percent on-year growth in domestic retail sales. However, Singapore GRMs fell 14 percent YoY and 43 percent QoQ due to weak global product cracks. Analysts anticipate GRMs to remain flat both QoQ and YoY. Additionally, BPCL reported high inventory gain in Q2 due to an 11 percent QoQ increase in crude prices.

JM Financial predicts that Oil Marketing Companies (OMCs) are likely to face a substantial crude inventory loss of $3-5 per barrel in the upcoming quarter. This is attributed to a QoQ decline of $16 in the Brent crude price (averaging $78 a barrel in December 2023, compared to $94 in September 2023). Additionally, analysts anticipate an inventory loss of $1.2 a barrel in the marketing business.

Due to a moderation in diesel cracks and a reduction in Russian crude discounts, the reported gross refining margin (GRM) for OMCs (adjusted for inventory loss) is expected to sharply decline to $6-8.5/bbl, in contrast to the $13.3-18.5/bbl reported in 2QFY24.

The weighted average auto-fuel gross marketing margin for OMCs has also decreased to Rs2.8/ltr in 3QFY24, down from Rs3.3/ltr in 2QFY24, and below the normalized margin of Rs3.5/ltr. As a result, analysts project a significant 50-70 percent QoQ decline in OMCs' EBITDA for 3QFY24, compared to the record-high earnings reported in 1HFY24.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.