India's top non-bank lender Bajaj Finance is set to present its earnings report for the second quarter of fiscal FY25 on October 22. Analysts expect the lender to benefit from its stake sale in Bajaj Housing Finance done via a mix of fresh issue and offer-for-sale route as well as solid loan growth.

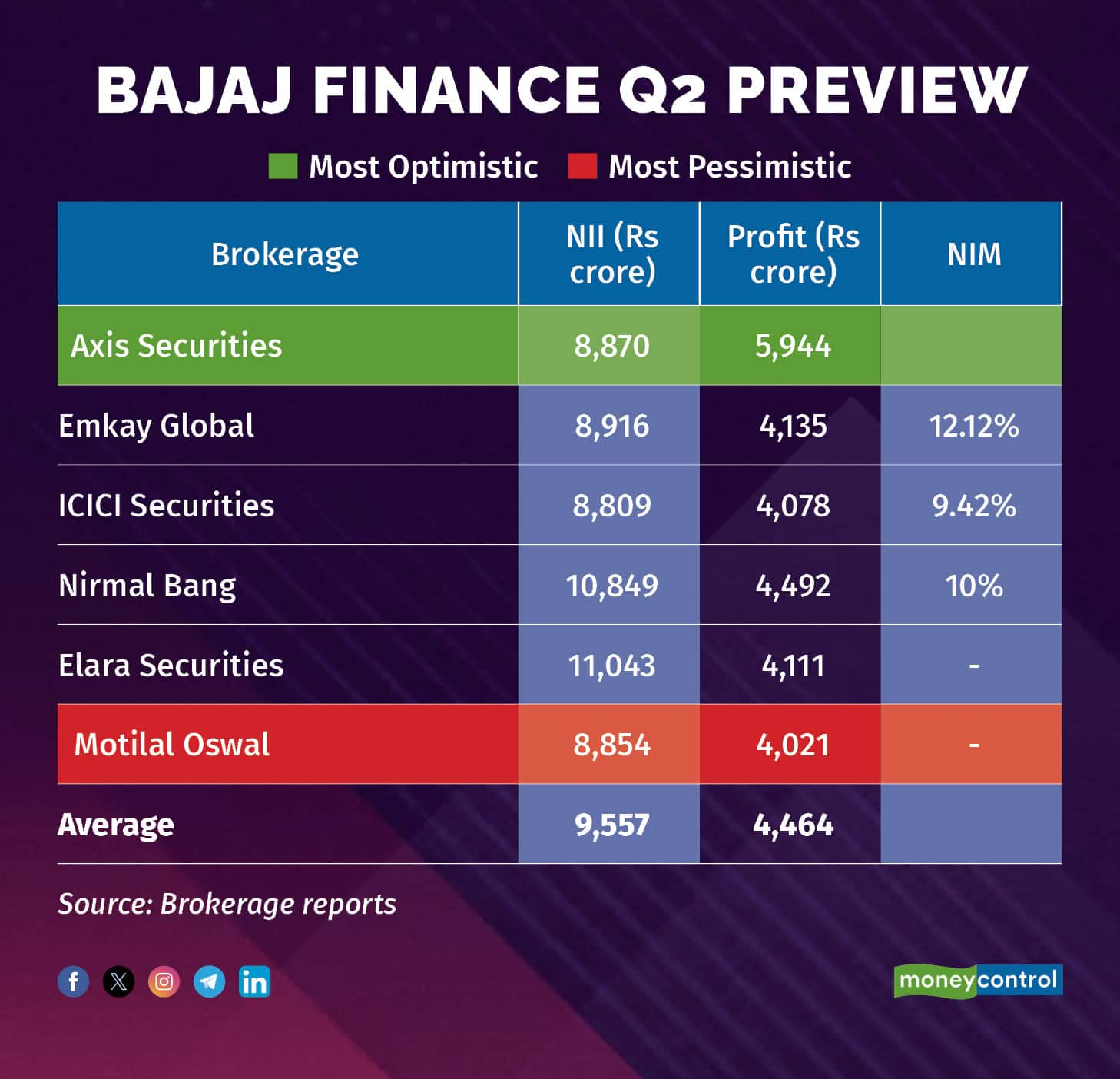

According to Moneycontrol's poll of 6 brokerages, Bajaj Finance's net interest income is expected to increase by 32 percent year-on-year (YoY) to Rs 9,557 crore in Q2FY25 from Rs 7,197 crore in the year-ago period. Profit, too, is likely to jump 33 percent YoY to Rs 4,464 crore in Q2FY25 versus Rs 3,551 crore in Q2FY24.

Earnings estimates of analysts polled by Moneycontrol are in a positive range, so any surprises may elicit a sharp reaction in the stock.

What factors are driving the earnings?

Healthy loan growth: According to Motilal Oswal analysts, Bajaj Finance is expected to report AUM growth of 30 percent YoY or 7 percent QoQ in the September-ended quarter. Axis Securities, too, concurred with the view and projected 6 percent sequential growth in AUM for Q2FY25.

Limited margin contraction: Despite the increase in cost of funds, Bajaj Finance's margin compression is likely to be lower, said Axis Securities. The highest margin was pegged by Emkay Global at 12.12 percent for Q2FY25, as compared to 12.63 percent in the year-ago period.

Higher liquidity surplus: The consolidated liquidity surplus stood at Rs 20,100 crore versus Rs 16,200 crore on a sequential basis. Surplus liquidity stood at 5.4 percent of AUM versus 4.6 percent a quarter back. Motilal Oswal analysts attributed elevated liquidity on the balance sheet to fresh equity raise of Rs 35,600 crore in Bajaj Housinf Finance IPO in September.

What to look out for in the quarterly show?

Brokerages said commentaries on NIM trajectory, credit costs, and growth outlook will be the key monitorables going ahead.

In the July-September quarter, shares of Bajaj Finance have surged over 8 percent, beating Nifty 50's 7 percent surge during the same period.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.