Bajaj Auto is expected to post healthy revenue and net profit growth in the December quarter, led by robust vehicle sales and higher realisations amid consistent demand. The two-wheeler company will announce its results on January 24.

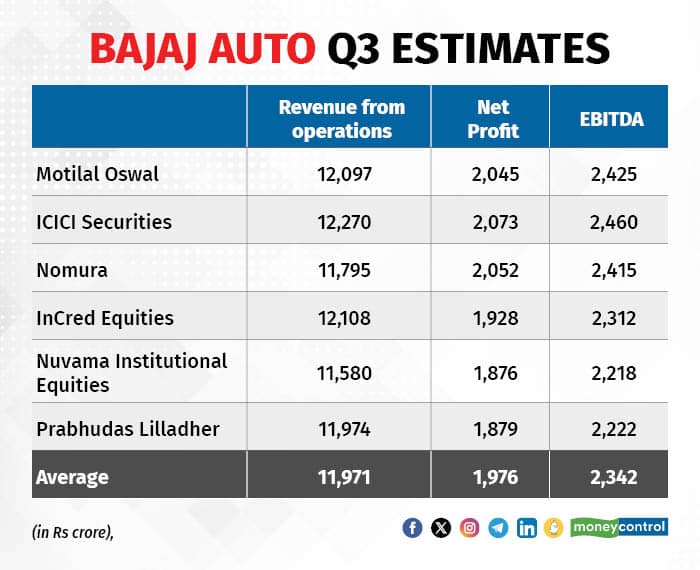

Bajaj Auto’s net profit is expected to increase 32.25 percent on-year to Rs 1,976 crore, according to average of six brokerage firms’ estimates. Revenue is projected to rise 28.5 percent on-year to Rs 11,971 crore.

Follow our market blog for all the live action

The growth in revenue would be aided by a better product mix in favour of premium vehicles, leading to a higher average selling price (ASP).

This, in turn, could give a boost to Bajaj Auto’s earnings before interest, tax, depreciation and amortisation (EBITDA), which are expected to increase 32 percent on-year to Rs 2,342 crore.

Premium segment in top gear

Bajaj Auto’s strategy of focusing on selling bikes in 125 cc and above segments is likely to keep driving its growth at a faster pace than the industry in the coming years, brokerage and research firm Nomura has said.

"We note that the company has improved its market share in the 125 cc segment to 27 percent in Q2FY24 from single-digit pre-COVID,” the brokerage said in a note. The company derives about 70 percent of its volumes from 125 cc and above segments.

"While Bajaj Auto has witnessed an uptick in retail during the festive season, it has not observed a significant drop in demand even after the festive season, given its focus on the 125+ cc segment," Sharekhan said in a recent report. Demand has continued to be better in the 125 cc and above segments, Sharekhan said in a recent report.

While exports are yet to reach previous peaks (average monthly run rate of two lakh units), volumes appear to have bottomed out and are expected to gradually be in line with the improvement in the overseas markets.

Buy or sell?

Recently, CLSA downgraded the Bajaj Auto stock from "underperform" to "sell", citing concerns about valuation given the recent rally. The brokerage firm has turned cautious as valuations are pricing in double-digit volume growth over the next few years, which seems unlikely, it said.

The stock has gained about 96 percent in the last year, the second-best performer on the Nifty, trailing Tata Motors, which delivered over a 100 percent return during the period.

In December quarter, Bajaj Auto gained 34.2 percent against an 11 percent rise in NSE Nifty 50.

On January 23 morning, the scrip was trading at Rs 7,203 on the National Stock Exchange, up 1.5 percent from the previous close .

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.