Axis Bank is expected to report strong growth in its net profit as well as topline aided by improvement in asset quality and a conducive environment for credit offtake in the economy.

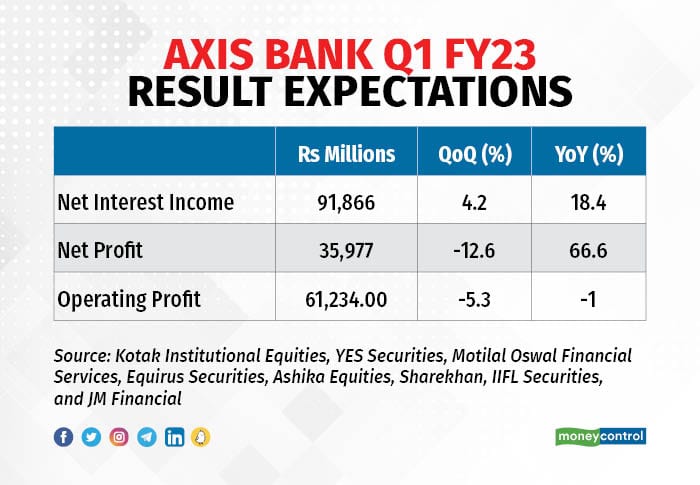

The private sector bank is likely to report a 66.6 percent year-on-year (YoY) rise in net profit to Rs 3,597.7 crore for the quarter ended June, according to an average of estimates from eight brokerages polled by Moneycontrol.

The lender will report its June quarter earnings on July 25.

The sharp rise in profit will be aided by a near-70-percent on-year decline in provisions in the quarter to Rs 997 crore as the lender continues to see improvement in its asset quality. Brokerage firm Motilal Oswal Financial Services expects the lender’s gross non-performing assets (NPA) ratio to come in at 2.7 percent compared to 2.8 percent in the previous quarter.

Kotak Institutional Equities believes slippages in the quarter will come in at around 2 percent of the lender’s advances book or Rs 3,500 crore for the reported quarter. “Expect strong commentary on asset quality performance and we see an improvement in NPL ratios aided by stronger recovery,” Kotak Equities said in a preview note.

That said, on a sequential basis, Axis Bank’s net profit is expected to decline 12.6 percent because of heavy losses in the treasury department of the bank. The private sector lender will report treasury losses worth Rs 2,070 crore for the reporting quarter due to sharp rise domestic government bond yields.

Government bond yields jumped more than 60 basis points (bps) in the June quarter on the back of a 90-bps hike in repo rate by the Reserve Bank of India (RBI) to tame multi-year retail inflation measured by the Consumer Price Index. Bond prices move in opposite direction to their yield.

The high treasury losses will also weigh on the operating performance of the lender as analysts expect pre-provision operating profit to slide 1 percent on-year, and 5.3 percent on-quarter, to Rs 6,123.3 crore in the reporting quarter.

The topline performance of Axis Bank will be strong, as net interest income is expected to grow 18.4 percent on YoY basis to Rs 9,186.6 crore, aided by healthy growth in advances. Loans are likely to grow north of 18 percent on-year in the reported quarter, led by the retail loan portfolio.

“Advances are expected to grow by 19 percent YoY with a revival of the economy and improvement in asset quality,” brokerage firm Ashika Institutional Equities said in a note.

Besides the lender’s June quarter results, analysts and investors will await the company’s commentary on loan growth and asset quality. “Progress of the Citibank portfolio and direction of operating profit growth will be a key discussion area for the quarter,” Kotak Equities said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.