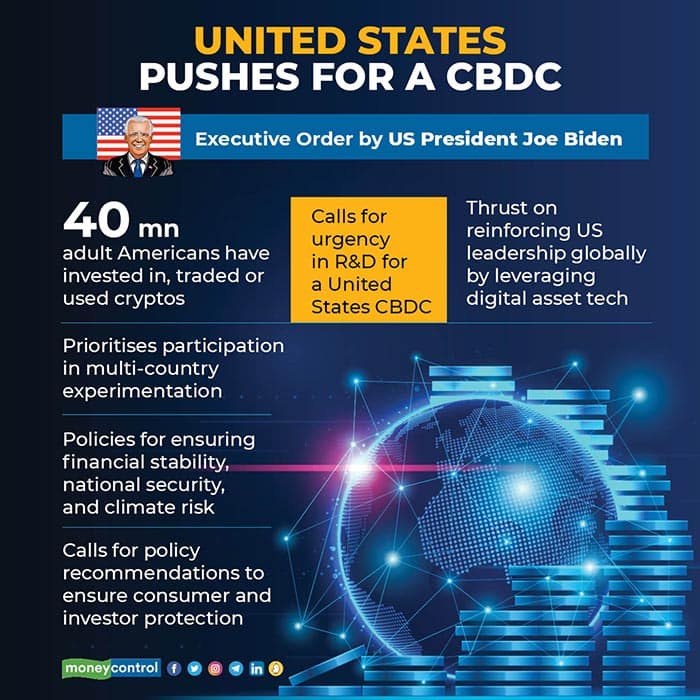

On March 10, US President Joe Biden signed an executive order that is bound to set the future course of digital assets and cryptocurrencies in the US, with massive implications on a global scale.

The executive order, which is essentially a directive, calls for expediting research and development to launch a US Central Bank Digital Currency (CBDC). Besides that, the order also directed various regulators and government arms to ensure that the usage of cryptocurrencies does not threaten the country's financial stability and national security.

But it was hard to mask the gravity and exigency the current administration has accorded to the development of the digital sovereign currency, an arena that already has over 100 countries actively researching, experimenting, and in some cases, even full-fledged implementing native CBDCs for mass adoption.

We break down the focus areas of the executive order and how it impacts India.

Focus on national security, financial stability, and consumer protection

While the order was pillared on six main themes, some of which prominently include national security, consumer protection, financial inclusion, and responsible innovation, it also addressed the impact of cryptocurrencies on the environment.

Notably, crypto mining, which is the process of generating new coins and verifying new transactions on a blockchain, involves a lot of processing power and computers on the network. The US wants to ensure that any negative climate impacts are reduced while using these technologies.

The country wants to explore how these technologies cant be used to advance the efforts to tackle climate change globally. Subsequently, the administration demanded all major government authorities like the Environmental Protection Agency to provide a detailed submission in the next 180 days.

But most significantly, the order mentioned the exploration of a "U.S. Central Bank Digital Currency (CBDC) by placing urgency on its research and development, should issuance be deemed in the national interest, noting that its research and development should "ensure US financial leadership internationally".

Why the rush?

Experts believe that the USA already is a latecomer in this space, and is only trying to make up for the lost time. If the development of CBDCs by the global government is a classroom, the USA is easily that one student who still has a ton of coursework left to finish, as it nervously stares at its classmates finishing their revisions.

Said Edul Patel, CEO, and Co-founder, Mudrex, A Global Crypto Trading Platform, “The executive order signed by Joe Biden is majorly based on assessing the risks and benefits associated with central bank digital currencies. Several governments have already initiated the process of implementing a CBDC".

Also Read | Indian-American among 2 indicted by US court for role in cryptocurrency money laundering

"Although the US seems to be a late entrant to this, it is a progressive step by the administration. Weighing the pros and cons of CBDCs would also aid in assessing the scope of regulations across the crypto ecosystem”, he continued.

Globally, many countries are already ahead by leaps and bounds of the USA. Closer home, the Reserve Bank of India announced that a CBDC pilot program will hit the ground running this year. The Central Bank of Nigeria has already launched its CBDC, namely eNaira in October 2021.

And then there’s the class topper China, which has begun working on this project in as early as 2014. The country has already rolled out e-renminbi, the digital version of its paper currency Yuan that is made accessible to merchants and consumers sans the need for internet, credit, or bank account. To date, it has already seen around $5 billion dollars worth of transactions as well, with its retail adoption gaining good ground rapidly.

Per accounting behemoth PwC’s CBDC global index, which keeps an eye on the development of CBDCs across various countries, the USA stands at the 18th rank, far behind countries like Bahamas, Ecuador, South Korea, Turkey, Sweden, and more.

And if analysts are to be believed, the country could well be a decade away from issuing a digital dollar backed by the Federal Reserve. And this could deal a major blow to the already dwindling dominance and power of the dollar, just as the world shifts to a more digital, cashless, seamless, and financially inclusive order.

Darshan Bathija, CEO and Co-Founder of Vauld also concurs. “The Administration intends to promote affordable financial services for the country’s underbanked. Digital assets and digital assets companies working with the traditional banking sector will greatly help in this objective. This could lower costs, increase security, and bring more efficiency to the financial services sector”, he added.

Why CBDCs?

For the uninitiated, a central bank digital currency is the virtual, cashless form of a country's fiat currency or legal tender, managed and regulated by the country’s apex bank or monetary authority. It carries the exact same value and gravitas as the money we physically carry in the form of notes and coins, except storing and carrying goes completely digital and paperless.

And not just this. The introduction of CBDCs will have a cascading impact on increased financial inclusion and stability, alongside the development of better monetary and fiscal policies, given that many banks across the world are potentially considering CBDCs to provide that elusive last mile financial reach to the underbanked by removing all physical intermediaries.

“It may be especially important in the future as the use of cash declines and new forms of "value transfer alternatives" become more widely used in the payment cycle”, it reads ominously and perhaps, right from the future.

How does this impact India?

In the 2022 Budget, India made two key announcements in this space. One was on the 30 percent tax on gains from virtual digital currencies (including cryptocurrencies), and the second was to direct the RBI to began the issuance of CBDC within FY23.

On the other hand, India is yet to formulate structured regulations on what it now calls virtual digital assets. These regulations have been much awaited and have also found mention in the agendas for Parliament sessions on multiple occasions. However, the Bill is far from being tabled in the Parliament and the government maintains that work is ongoing on the preferred regulatory framework.

Industry experts believe that India will be looking at the US before formulating a policy set in stone. According to Barnik Chitran Mitra, Managing Partner and CEO at management consulting firm Arthur D Little, "A regulatory policy framework from the US will be very eagerly anticipated, observed, and analyzed by Indian policymakers before a policy framework will come out in India. It is unlikely that India will go ahead and issue a policy framework before the US does, or before at least carefully studying the US policy framework.

In such a scenario, US' policy approach becomes important in setting the path that India may consider and may also impact the timeline for the Bill to be framed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.