Small investors are flocking to cryptocurrency, particularly Bitcoin, according to a new study. This surprising trend was revealed in a research report by Grayscale, titled, "Demystifying Bitcoin's Ownership Landscape.

Contrary to popular belief, the majority of Bitcoin holders are not large-scale investors or financial institutions, but small investors. This finding is particularly relevant to the Indian market, where digital currency is gaining momentum among a diverse range of investor, the report says.

The small investor phenomenon

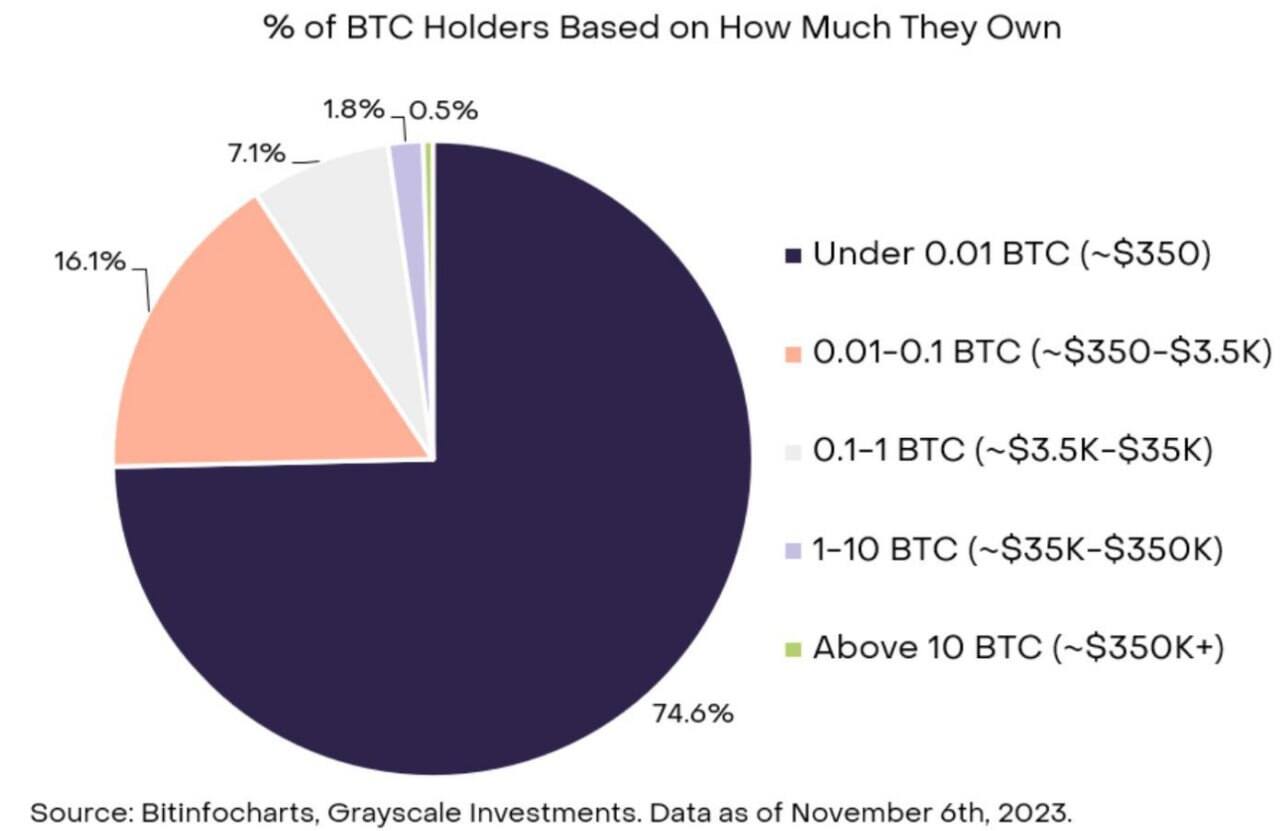

The report highlights that approximately 74 percent of Bitcoin addresses hold less than 0.01 BTC, equivalent to around $350 as of November 6, 2023. This statistic is a clear indicator of the widespread adoption of Bitcoin among small-scale investors, not just in India but globally. Unlike traditional high-risk, high-return assets like private equity and venture capital, which are typically accessible only to accredited investors, Bitcoin offers an entry point to the average person with internet access.

Bitcoin's ownership structure

Bitcoin's decentralised and open-source nature is reflected in its ownership structure. Only a small fraction (2.3 percent) of Bitcoin owners possess 1 BTC or more. This distribution pattern is significant, considering the value of 1 BTC stands at around $35,000 as of November 6, 2023. The majority of Bitcoin's largest holders are not individuals but entities such as crypto exchanges and government bodies. For instance, the top five Bitcoin wallet addresses are owned by exchanges like Binance and Robinhood or government entities.

Institutional involvement

About 40 percent of Bitcoin's total supply is attributable to identifiable groups, including exchanges, government entities, public and private companies (like Tesla and Block Inc.), and mining companies. This diverse ownership underscores Bitcoin's appeal across different sectors and its growing acceptance as a legitimate asset class.

The Indian context

For the Indian investor, these findings are particularly noteworthy. The Indian market has shown a keen interest in cryptocurrencies, with a significant uptick in investments and trading activities. The fact that small investors constitute the majority of Bitcoin holders is a testament to the digital currency's accessibility and potential for democratising investment opportunities.

Implications for the future

The report also discusses the concept of "sticky supply," referring to owners who take a long-term position on Bitcoin. A significant portion of Bitcoin's supply, around 14 percent, has not moved in 10 years, indicating a strong belief in the long-term value of this digital asset. This trend is crucial for the Indian market, where investors are increasingly looking at Bitcoin as a long-term investment rather than a short-term speculative asset.

Upcoming events and their impact

Looking ahead, two major events loom on the horizon: the 2024 Bitcoin halving and the potential approval of a spot Bitcoin ETF in the US. These events could significantly impact the global Bitcoin market, including India. The halving event, in particular, is expected to reduce the rate at which new Bitcoins are created, potentially increasing their value.

The Grayscale report sheds light on the evolving landscape of Bitcoin ownership, highlighting the significant role of small investors.

As the world of cryptocurrency continues to evolve, the Indian investor stands at the cusp of a new era in digital finance.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.