After attracting a series of marquee investors to back Jio Platforms, Reliance Industries’ telecom arm, Chairman Mukesh Ambani, addressing the company’s 43rd Annual General Meeting on July 15, indicated that the group’s retail venture, too, has received strong interest from strategic and financial investors and plans are underway to induct some in the next few quarters.

The bar has been set high by Jio, which saw 14 deals to sell a 33 percent stake in Jio Platforms (JPL). This, together with the stake sale in the fuel joint venture and a rights issue, will help RIL raise Rs 2.1 trillion ($28 billion), and become net-debt free.

Chairman Ambani pointed out that Reliance Retail is India’s largest and most profitable retail business and the fastest-growing retailer in the world.

Also Read: Will induct global partners into Reliance Retail, says Mukesh Ambani

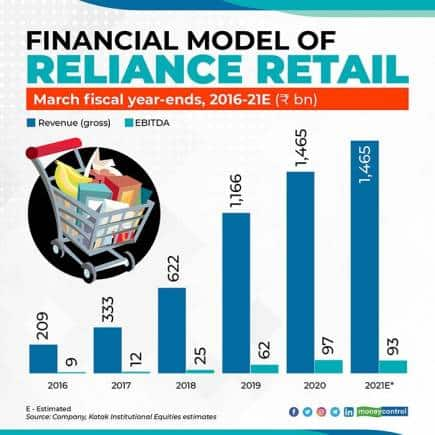

“In the last five years, retail business revenue has grown 8x and profits by 11x. Reliance Retail is the only Indian Retailer to feature in the Top 100 global retailers,” he noted.

Within the organised retail segment, Reliance Retail will continue to be a partner of choice for marquee international brands, he said, adding that the company had been at the forefront of the organised retail revolution in India.

What the competition thinks

Ambani’s announcement has made other players in the sector sit up. “It is positive news if strategic investors or financial investors invest in Reliance Retail. If international money comes to Reliance Retail, it will definitely bring in more stability in Indian retail and growth in organised retail in India,” Lalit Agarwal, Chairman and Managing Director of V-Mart Retail, told Moneycontrol. V-Mart sells everything from low-priced apparel to footwear and has over 265 stores in India.

So, what happens to incumbents when a competitor with deep pockets looks to overhaul the system?

Also Read: Reliance Retail: A bright future in store

Speaking to Moneycontrol, Hari Menon, Co-founder and CEO of BigBasket, which commands a 50 percent share in India’s grocery e-commerce market, said: “It helps us a lot because this is a large market. We get more players coming into the market, the market opens up faster. Today, online is just about 1 percent of the total grocery business, which is as large as $800 billion. We need more and more players,” Menon said.

According to brokerage firm Centrum Broking, the target market for this omni-channel model is not just organised retail ($100 billion) or e-commerce ($40 billion) but the traditional retail channel itself, which is a more than $900 billion opportunity.

Reliance Retail is rapidly augmenting capacity through 'JioMart', a unique platform to transform the Kirana store channel. Beta testing of ‘JioMart—Grocery’ is currently on in 200 cities. JioMart will expand beyond grocery to cover electronics, fashion, pharmaceuticals and healthcare.

Strengths

There are a few things working in favour of the retail business.

Largest & the fastest: With revenues of $12 billion in core retail, Reliance Retail is the largest retailer in the country and is also the fastest growing retailer in the world. Indeed, RRL features among the top 100 retailers globally. Two-thirds of its 12,000 stores are in tier 2/3/4 towns.

New commerce: JioMart has begun operations in 200 cities and this is in the beta stage. Interestingly, within a few weeks of the test launch, JioMart is fulfilling 250,000 orders per day. Based on recent media reports, JioMart's current run rate may not be significantly different from peers such as BigBasket and Grofers.

Merchant connect: As an important step towards its ‘New Commerce’ vision, Reliance Retail has started to connect grocery stores through PoS devices, enabling the merchant to not only accept payments but also place orders on Reliance Retail for supplies, manage inventory, file GST returns etc.

Value for customer: Stores under the JioMart banner offer a discount of at least 7 percent to the printed retail price, according to brokerage firm Jefferies. Reliance Retail also intends to deliver products at the customer’s doorstep. Work is also underway on the JioMart app.

Beyond groceries: JioMart started out with grocery delivery but plans to venture into electronics, fashion, pharma as well as healthcare soon, through an alliance with the traditional channel.

Farmer connect: Reliance Retail has invested in the back-end and forged relationships with farmers. Eighty percent of its fresh vegetables and fruits are bought directly from farmers. This provides a sourcing advantage while ensuring farmers get a fair price.

Digitised kiranas: RIL’s digital commerce business comprises JioMart’s online B2C business and the kirana digitisation programme. According to market experts, the digitised kiranas will be key enablers of Reliance Retail’s online business and stake sales will act as a catalyst.

Fashion & Lifestyle: Reliance Retail has a portfolio of 46 well-known exclusive international partner brands that span the entire spectrum of luxury, from the likes of Armani, Burberry etc to high-premium and high-street lifestyle. Reliance Retail operates around 682 stores with these international brands. Many of these labels have made India a significant market and globally, have their largest store presence in India.

It has set up, built and ‘glocalised’ international brands such as Armani, Diesel, Brooks Brothers, Marks & Spencer, Muji, Mothercare etc. Reliance Retail’s fashion platform AJIO also offers 1,400+ national and international brands.

Reliance Trends, the flagship Reliance Retail concept store for fashion retail, predominantly sells its own labels, which constitute over 70 percent of its sales. Trends has developed a robust portfolio of over 20 own brands, including Avaasa, DNMX, Netplay etc to cater to the diverse preferences of customers.

Significant industry impact

Reliance Retail inducting strategic and financial investors is a “very big announcement and it is going to have a significant impact on the retail industry,” VS Kannan Sitaram, Venture Partner, Fireside Ventures, an early-stage investment platform for consumer brands told CNBC-TV18.

“We have been saying even before the COVID-19 lockdown that more and more customers are shopping online. So, the advent of JioMart and the expansion to more categories are both very significant to accentuate this trend,” Kannan said.

“We invested in a number of consumer brands, and most of our brands tend to be digitally native -- much of their business is on ecommerce platforms. They also have business on their own website. So, we look for brands that are able to acquire consumers and engage with them online, and we think with JioMart coming in, our investment strategy is a big advantage,” he added.

According to RIL’s FY20 annual report, many of these brands have a yearly turnover of approximately Rs 5 billion, making them comparable to many national and international brands operating in the market. Private labels fetch around 70 percent of Reliance Retail’s fashion and lifestyle revenues.

O2O and B2B opportunities

With Reliance Retail having only begun its digital commerce business (JioMart’s online grocery delivery business and the Kirana B2B distribution business), brokerage houses believe value creation from this business will happen only over the medium term.

The brokerage houses are optimistic about this business segment of Reliance Retail as: (1) initial-phase development of the e-commerce market has already happened in India, (2) Jio has already brought a large population online (nearly 400 million subscribers); low buyer penetration implies a large growth opportunity, (3) Reliance Retail’s large physical store presence and associated infrastructure provide it with a competitive advantage and (4) it enjoys a regulatory advantage in its ability to store and sell its own inventory as opposed to the restrictions foreign-owned competitors (such as Amazon and Flipkart) face.

Overall, Reliance is best positioned among its peers as its footprint covers the entire value chain of offline B2C retail, B2B retail and the kirana network, which can all feed the online business.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd that publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.