Highlights:- - Retail will be a key driver of Reliance Industries’ growth

- Network augmentation will gain further momentum- Reliance Retail would be listed in the next 5 years

--------------------------------------------------

Reliance Retail (RR), India’s largest retailer by revenue and network, has been on an upward spiral in recent years. It is ranked among the top 100 global retailers, and for good reasons. RR’s FY19 revenue touched Rs 1,30,000 crore mark, growing at a pace faster than any other retailer in the world. RR is also bigger than all other major listed Indian retail players put together.

(Also read: Why is Reliance Retail getting increasingly important for Reliance Industries?)

What underscores Reliance Retail’s hypergrowth story?

- Its wide footprint of stores across the country helps attract industry-leading footfalls. As on June 30, 2019, RR’s 10,650-odd outlets, with an aggregate retail space of 23 million square feet, were spread across 6,700 cities and towns. In FY19, over 500 million customers visited RR’s stores.

- Integration of offline and online retailing through technological platforms would help derive the benefits that both formats have to offer.

- Product designing and development capabilities give its private labels better visibility.

- A large assortment of products is available across different price points. These comprehensively cover categories such as food and grocery, home accessories, fashion and lifestyle products, electronics and fuel.

Going forward, what can one expect?

Reliance New Commerce

India’s unorganised retail (comprising 90 percent of the total industry size) is a whopping business opportunity of $700 billion. RR is targeting this base to propel itself to the next level. A slew of initiatives have been outlined to achieve this objective. These include:-

- Onboarding of more than 3 crore merchants and kirana shop owners with RR’s digital systems

- Deployment of modern-day technological tools (Blockchain, Internet of Things, Artificial Intelligence) pan-India for data analytics

- Linking producers, traders, small merchants, consumer brands and consumers

- Improving efficiencies across the trade channels

- Introduction of Jio Prime Partner points-of-sale terminals (similar to card swiping machines at stores) at the merchants’ end (to cover inventory management, customer relationships and financial services, among others)

- Modernisation of neighbourhood stores to enhance last-mile connectivity

Continued investments

In his speech at the company’s AGM, Chairman Mukesh Ambani sounded upbeat about the consumer businesses (Jio and Retail) in the years to come. Since most of the capex requirements in Jio have been taken care of, cash flows will be predominantly directed towards scaling up RR. In FY19, on an average, nearly 8 new stores were opened every day.

Market leadership

RR is the largest modern trade grocery retailer in India. In FY19, roughly 50 percent of the fresh food and vegetables (through the modern retail ecosystem), totalling 6.4 lakh tonnes, were sold by RR alone. Reliance Trends’ and Reliance Digital’s sales have also been ahead of its competitors. RR will continue to capitalise on this advantage to generate higher asset turns, the benefits of which should translate into better operating leverage.

Asset turnover is calculated as sales divided by net block (of tangible assets such as plant, property and equipment). It represents the degree of efficiency with which a company’s fixed assets are utilised to generate sales. For instance, if the asset turns of a company in FY19 was 2x, it indicates that for every Rs 100 invested in fixed assets, the revenue was Rs 200. The higher this number, the better.

Impetus towards smaller regions

In FY19, nearly 65 percent of the total new stores were added in India’s tier 2,3 and 4 cities and towns. This assumes importance since higher disposable incomes and better awareness about brands/fashion/quality have led to a spurt in spends on discretionary products in such geographies.

Considering the fact that such markets are pretty underpenetrated/unpenetrated vis-à-vis the ones in metros and tier 1 cities, the headroom for growth is immense. Furthermore, these areas are connected with RR’s modern supply chain solutions to ensure seamless product distribution.

Margin accretion

By virtue of its sheer scale, sourcing efficiencies and adoption of operating discipline, RR’s margins are likely to improve. A diversified presence of supply chains and warehousing facilities (capacity: more than 10 million square feet) in different regions of India enables it to manage its working capital efficiently.

New categories

By acquiring UK-headquartered Hamleys in May 2019, RR entered the premium toys, games and gifts segment. Hamleys operates in 18 countries globally. This acquisition could well be the starting point for RR in terms of selling such products in more countries.

Tie-ups with more foreign brands

RR has been the preferred partner for several international marquee brands in India. As of now, approximately 45 foreign retailers have entered into partnerships with RR to promote and sell their products in India. Some noteworthy licensed brands in RR’s kitty include the likes of Armani Exchange, Emporio Armani, Marks and Spencer, GAS and Superdry.

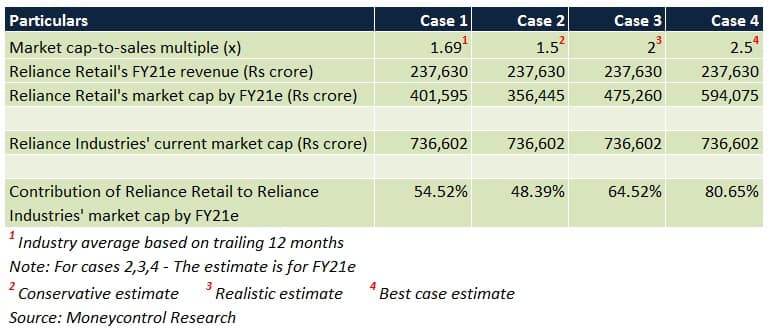

How much value can Reliance Retail add to Reliance Industries’ market capitalisation?

RR’s top-line trajectory remains intact and strong, and with profitability improving steadily, it should be able to command better valuation multiples. The capital-intensive sectors of the Indian economy face headwinds periodically. Yet, the country’s consumption story, notwithstanding the ongoing slowdown, is more durable. Another positive is that there are signs of some strategic interest from global investors for buying a stake in RR.

Collectively, the above-mentioned factors will strengthen RR’s potential to add significant heft to Reliance Industries’ growth. This, coupled with a rich parentage (Reliance Group) and a leadership team with strong proven execution record, would enable RR to fetch a good premium in the primary markets, as it gears up for listing in the next 5 years.

At a time when the erstwhile flagship segments (petrochemicals, oil and gas, refining) have been facing growth challenges and Jio’s investment cycle is now complete, most of Reliance Industries’ future cash flows would be priortised to expand RR. In conclusion, quite clearly, RR will be the driving force for one of India’s largest conglomerates.

For more research articles, visit our Moneycontrol Research page.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd. Moneycontrol Research analysts do not hold positions in the companies discussed here.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.