Employee Stock Options (ESOP) plans of listed companies are facing enhanced scrutiny from institutional investors, including FPIs, mutual funds and insurers, amid a steep drop in share prices of these companies.

Since March 1, there have been at least ten such ESOP proposals where a significant number of institutional investors have cast a negative vote. However, these proposals managed to sail through in most cases due to large promoter shareholding, and in a couple of cases due to retail support. Incomplete disclosures about ESOPs by companies, along with weakness in stock prices have led to the negative votes by institutional investors, governance experts said.

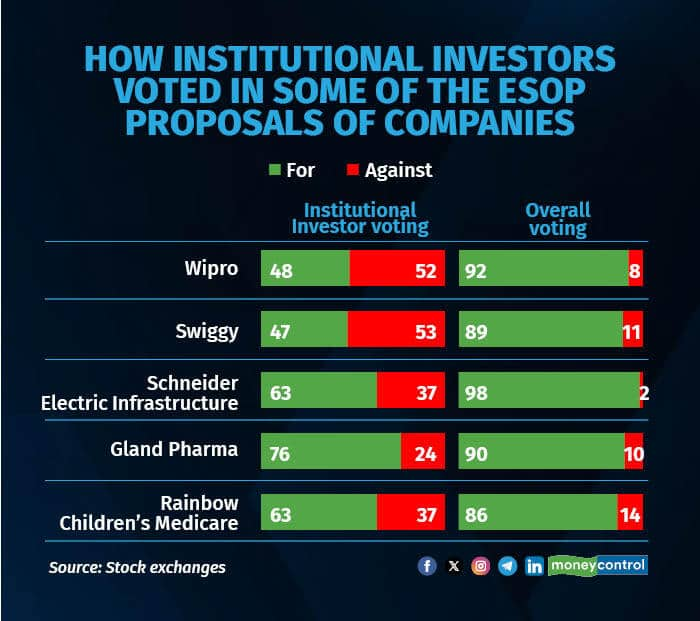

On March 31, as many as 58% institutional investors voted against software firm Wipro’s proposal to cover more employees under the ESOP plan. The Premji family, promoters of Wipro, own a 72% stake in the company and voted in favour the resolution, helping it pass.

Food aggregator Swiggy too sought shareholder approval for tweaking its ESOP policy earlier this month, but about 53% of the institutional investors voted against the proposal, as disclosed by the company on April 2. However, the proposal passed, thanks to overwhelming support from non-institutional investors. Swiggy does not have anyone categorised a promoter, though its founders together own about 10% in the company. They, along with investors who bought shares in pre-Initial Public Offering, own shares under the non-institutional investor category.

Similarly, 37% of the institutions voted against the proposal of Schneider Electric Infrastructure to extend financing to employees availing ESOPs. Gland Pharma, Embassy Developments and Rainbow Children’s Medicare are amongst other companies who have seen more than 25% of the institutional investors voting against ESOP proposals.

A key reason behind the opposition from institutional investors for such proposals is incomplete disclosure on the part of the companies, say governance experts. While Sebi regulations mandate disclosure of ESOPs and getting them approved by the shareholders, there is no prescribed standard disclosure format. Hence, in many cases companies don’t provide granular details such as how many of the employees were being allotted ESOPs, what is the vesting period etc, governance experts added.

While minority investors may not have the requisite voting strength to defeat such proposals, it is seen as a governance red flag. For instance, a leading pharma company had proposed ESOPs in 2021 which were opposed by more than 75% of institutional investors. “This time, when the company wanted to launch ESOPs, they undertook a dialogue with institutions explaining details of the ESOP plan, and the proposal went through smoothly this time,” said a person familiar with the development.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.