As Russia-Ukraine war rages on, precious metals have gone on a swing. Palladium, a rare shiny metal, has hit a six-month high since August 2021.

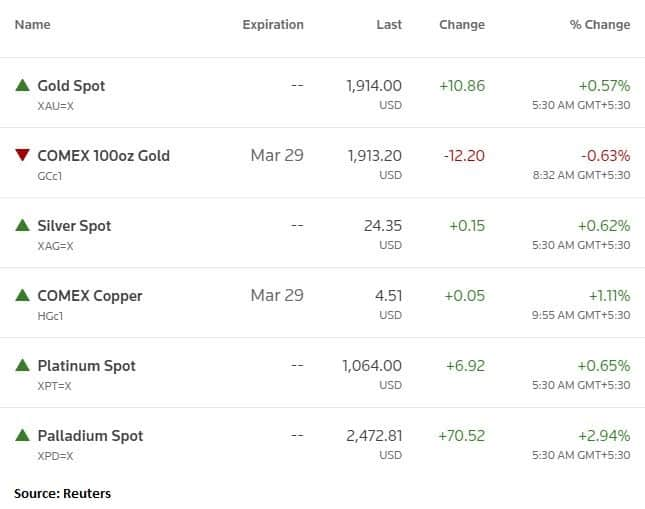

Palladium rose 4.5 percent on February 23 on fears of a hit to supply from top producer Russia, while gold firmed up above the key $1,900 level as Ukraine declared a state of emergency.

Russia's Nornickel is a major producer of palladium and platinum, both of which are used in catalytic converters to clean car exhaust fumes. Nornickel produced 2.6 million troy ounces of palladium last year or 40 percent of the global mine production and 641,000 ounces of platinum or about 10 percent of total mine production.

Russia is the world's third largest producer of gold after Australia and China and accounts for about 10 percent of global mine production which, according to the World Gold Council, totalled 3,500 tonnes last year.

It’s a sharp reversal in fortune for palladium, which was the worst-performing major commodity in 2021. The impact of the semiconductor shortage on car production soured the demand outlook, causing prices to plummet in the second half of the year.

Only iron ore, hit by China’s property market crisis, and silver have come close in terms of losses, according to media reports.

Precious metals reversed course on February 24 with gold slipping below the key $1,900 per ounce level and palladium shedding more than 5 percent as equities rebounded after US President Joe Biden unveiled harsh new sanctions against Russia.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.