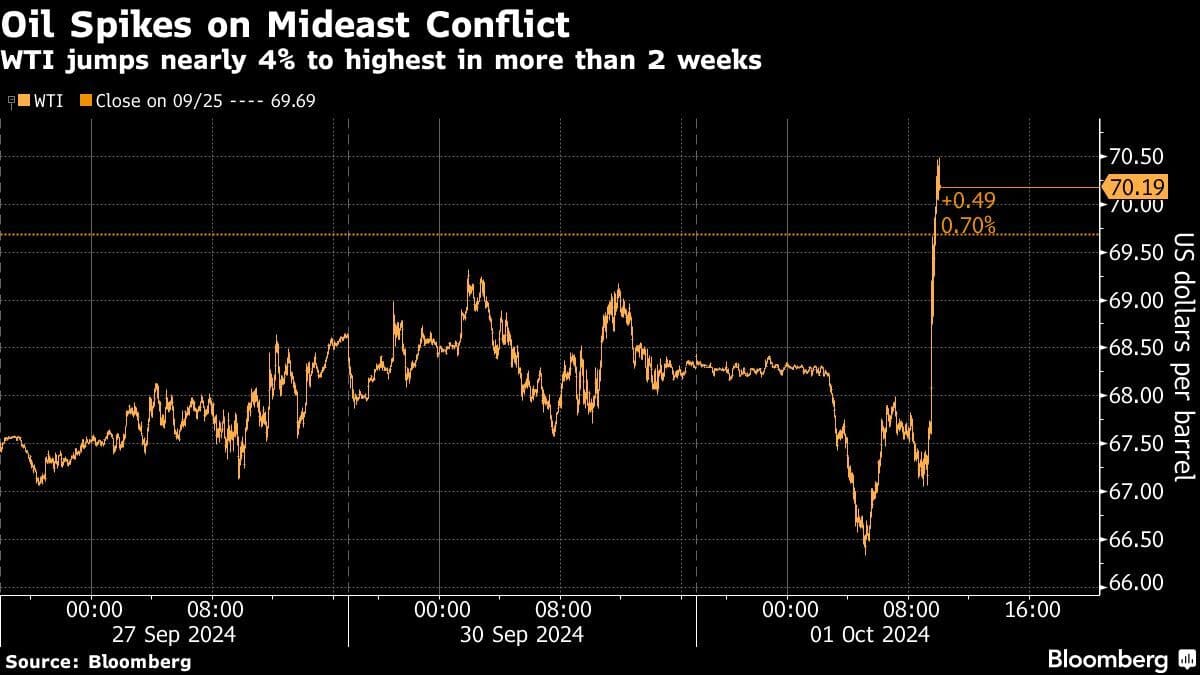

Oil surged on signs that Iran was preparing to launch a missile attack against Israel, widening the conflict in the Middle East and potentially increasing the chance of crude-supply disruptions.

West Texas Intermediate advanced about 3% to top $70 a barrel after earlier slumping as much as 2.7%. Global benchmark Brent climbed above $73 a barrel.

The US has indications that Iran is preparing to strike Israel imminently, according to a senior White House official, who asked not to be identified. The US also is supporting preparations to defend Israel against the possible attack, which would carry severe consequences for Iran, the official said.

The direct involvement of OPEC member Iran in the conflict may increase the possibility of oil-supply disruptions from a region that’s the source of a third of the world’s crude. Israel’s campaign against Iran’s network of proxy militias hasn’t yet significantly reduced flows, and recent escalations in the war did little to boost oil prices that have been weighed down by projections of rising supplies and tepid demand.

“The surprise escalation of Iran threatening to possibly use ballistic missiles definitely escalates the geopolitical premium in the oil complex,” said Dennis Kissler, senior vice president for trading at BOK Financial Securities. “Iran would most likely pay a heavy price if they created a mass-casualty situation — both financially and geographically.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.