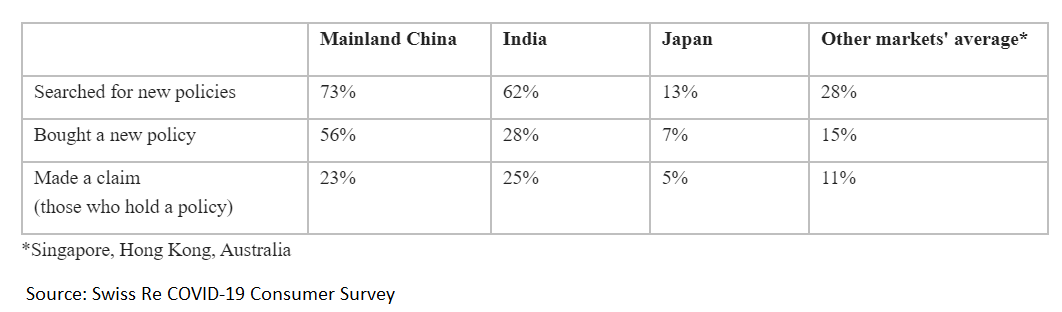

China, followed by India, are the most active nations in the Asia Pacific region as far as buying insurance during the Coronavirus (COVID-19) outbreak is concerned according to the Swiss Re COVID-19 Consumer Survey.

The survey revealed that 28 percent Indians bought an insurance policy amidst the pandemic.

This is based on a survey done in Mumbai and Bengaluru among 1,000 respondents in the last week of May.

"Indian consumers are among the most active and engaged when it comes to insurance, trailing only China when it comes to researching new policies and satisfaction levels, proving the potential and importance of insurance in this growing market," said Amitabha Ray, Head of P&C client markets for India, Swiss Re.

Track this blog for latest updates on the coronavirus crisis

The survey showed that in India, there is not only a rise in demand for insurance with a 62 percent rise in new policy searches, but also more outreach by insurers. Due to the lockdown, agents adroitly used digital modes and phone calls for selling policies.

The Swiss Re survey showed that 61 percent insurers actively reach out to customers. Here, 32 percent used text and e-mail while 29 percent used phones. Here, 65 percent of customers contacted by insurers in India showed an intention to buy insurance.

There has been a rise in uncertainty among Indians due to COVID-19 with increased fears about both health as well as financial conditions. This has pushed up the demand for products like term insurance, health insurance and guaranteed savings plans.

As per the survey, almost one-third of consumers in India are feeling anxious about their financial future, the second highest among APAC markets surveyed. Further, 64 percent of the consumers surveyed are concerned about their mental health, which is the highest of all surveyed markets.

To make up for this financial strain, many Indian consumers were happy to sacrifice home / motor insurance (28 percent) while a quarter would cut life insurance premiums (25 percent) to help ease the burden. These were some of the highest figures in the region.

A majority (68 percent) felt that insurance helped to ease their stress and provide financial support during this time and 78 percent said that their claims experience matched their expectations.

Unlike other surveyed markets, Indian consumers said the flexibility to mix and match coverage was the most important feature when choosing an insurer, followed by the ability to process online.

In the event of a similar health crisis, Indian consumers echoed the sentiments reflected across APAC – higher value is placed on a faster claims process, more flexible conditions and the ability to purchase online. When it comes to future insurance purchases, most will look more closely at coverage details (54 percent) and be more vigilant about having a broader range of cover (47 percent).

The Swiss Re commissioned poll of 1000 residents in Mumbai and Bangalore was conducted by global market research company, Ipsos, in the last week of May 2020. The same survey was conducted in the APAC economies of Australia, Singapore, Hong Kong and the Chinese megacities of Beijing and Shanghai in April.

Follow our full coverage of the coronavirus pandemic here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.