The Ministry of Finance may budget for gross tax collections of Rs 38.3 lakh crore in 2024-25, while net tax collections may be estimated to rise to Rs 26.6 lakh crore, according to a Moneycontrol survey of 10 economists.

Both the gross and net tax collection estimates for the next financial year are around 14 percent higher than the 2023-24 Budget numbers of Rs 33.61 lakh crore and Rs 23.31 lakh crore, respectively.

GDP growth-tax collections relationship is now complicated

Net tax collections are arrived at after deducting transfers to states from gross tax collections.

"In 2024-25, we expect gross tax revenues to grow faster at 12.2 percent to around Rs 38 lakh crore driven by strong growth in corporate, income tax, and GST collections," Rahul Bajoria, Managing Director and Head of EM Asia (ex-China) Economics at Barclays said.

| ORGANISATION | ESTIMATE FOR FY25 GROSS TAX COLLECTIONS | ESTIMATE FOR FY25 NET TAX COLLECTIONS |

| ANZ | 38.3 | 26.4 |

| Barclays | 38.0 | 26.6 |

| CareEdge | 38.2 | 26.7 |

| Elara Capital | 39.5 | 27.4 |

| ICICI Bank | 38.5 | 26.7 |

| ICRA | 38.0 | 26.4 |

| IDFC First Bank | 37.2 | 25.5 |

| Kotak Institutional Equities | 38.4 | 26.6 |

| Motilal Oswal Financial Services | 39.2 | 26.9 |

| Nomura | 38.0 | 26.3 |

"2023-24 tax revenue continued to imitate the non-linear relationship between economic activity and taxes, significantly outdoing nominal GDP growth," noted economists Madhavi Arora and Harshal Patel of Emkay Global Financial Services. According to them, increasing formalisation, better compliance, improving growth momentum, healthy corporate profitability, and "stealth benefits of GST-led formalisation" have driven the rise in direct tax collections this year.

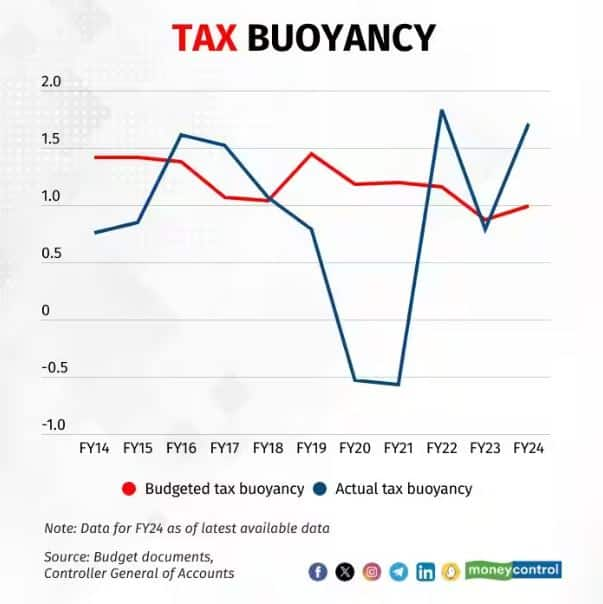

Tax collections this year have indeed been impressive, with the available numbers, so far, suggesting a tax buoyancy of 1.7 – far higher than the average of 1.2 across the five pre-pandemic years from 2014-15 to 2018-19.

No Econ Survey, but Fin Min report says FY25 GDP growth may be close to 7%

Tax buoyancy is the ratio of growth in tax collections to nominal GDP. As such, the buoyancy is said to be greater than 1 when tax collections grow faster than nominal GDP. However, economists see the tax buoyancy declining in 2024-25. According to India Ratings and Research, the net tax revenue buoyancy, or the ratio of growth in net tax revenue to nominal GDP, maybe 1.2 in 2024-25, down from their forecast of 1.9 for 2023-24.

Last year's Budget numbers had suggested a net tax revenue buoyancy of 1.1.

To be sure, the budgeted and actual tax buoyancy can differ substantially, as the above chart shows. The government's actions on compliance have in particular meant that tax collections have been better than expected. And the same could happen next year.

"The GST audits by the government are also helping to unearth cases of under-reporting, inappropriate input tax credit, and fake invoices. This may also provide some further legroom for GST collections as compliance continues to improve," Elara Capital said in a note.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.