In the last one year, while the foreign institutional investment (FII) flow has been erratic, domestic institutions have continued to pour money in the market to keep it rallying.

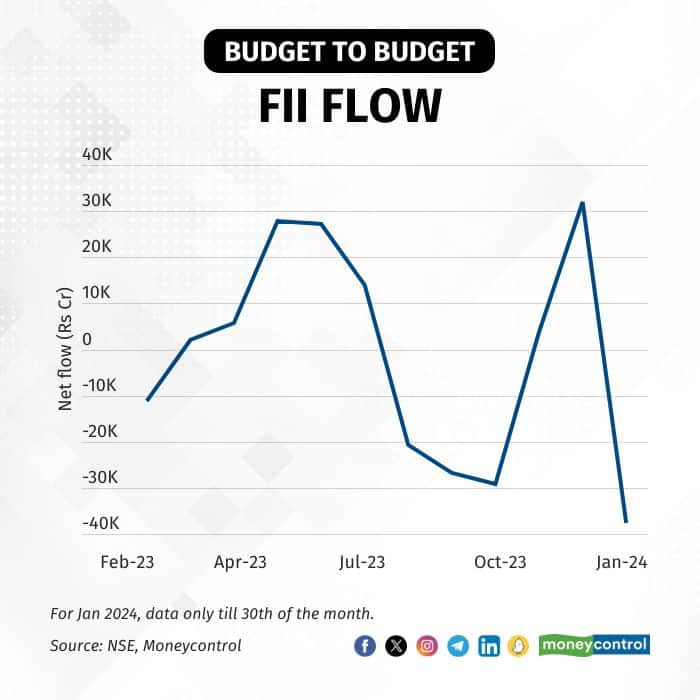

Since the last budget, FIIs have net withdrawn Rs 12,500 crore from equities, a collation of NSE data shows. This does not include flow to and from primary market issues such as IPOs or FPOs. FIIs net withdrew money from the market in five of the previous 12 months.

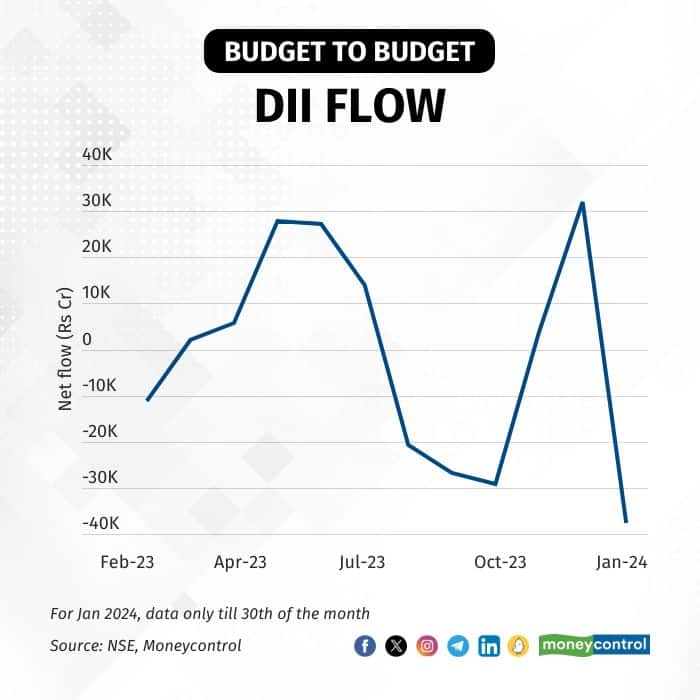

At the same time, DIIs have been extremely bullish on equities, buying stocks worth Rs 1.72 lakh crore. DIIs were sellers in just two out of the last 12 months – May and July. The biggest reason for heavy DII flow is the fact that mutual funds are flush with retail money.

The market has largely been on an uptrend in the period despite some volatility. Nifty has zoomed 23 percent while Sensex 20 percent in the period. Defence, realty and autos have been some of the most booming sectors.

"Since the tug of war between the FIIs and DIIs continues, volatility will remain high in the near-term. This volatility may be used by investors to churn their portfolios,” said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

After a rapid rally, the market has stagnated in the first month of 2024. Sensex and Nifty have lost about a percent. This has largely been attributed to heavy foreign outflow in January – at Rs 37,639 crore (till January 30).

FII flows are mixed due to a lack of fresh triggers, analysts believe.

Analysts, though, are positive about Indian markets in the mid to long term. The budget may just give another wing to the high flying market.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.