Will Union Finance Minister Nirmala Sitharaman make any announcements in the interim Budget on February 1 that will maintain the rally in industrial stocks? Experts believe it is unlikely considering the interim nature of the Budget to be presented on February 1 due to general elections this year. Furthermore, the industrial stocks are looking at a lacklustre first quarter of FY25 as order books and execution typically slow down during elections and pick up after the polls.

Pankaj Pandey, Head of Research at ICICI Securities, said the markets should not expect much from the Budget as they will be disappointed. “The Budget is largely becoming a sort of non-event,” he said.

Parikshit Kandpal, Vice President of Research at HDFC Securities, expects announcements regarding EV policy and hydrogen but not in other sectors. “Some announcements on EV policy, hydrogen could be expected. There might be allocations on subsidies for clean fuel initiatives. There are also chances of tax cuts on EV-related components and imports. Beyond that, we don’t expect anything major,” he said.

Increased capex

Industrial stocks have been the beneficiaries of increased capex spending in the previous year.

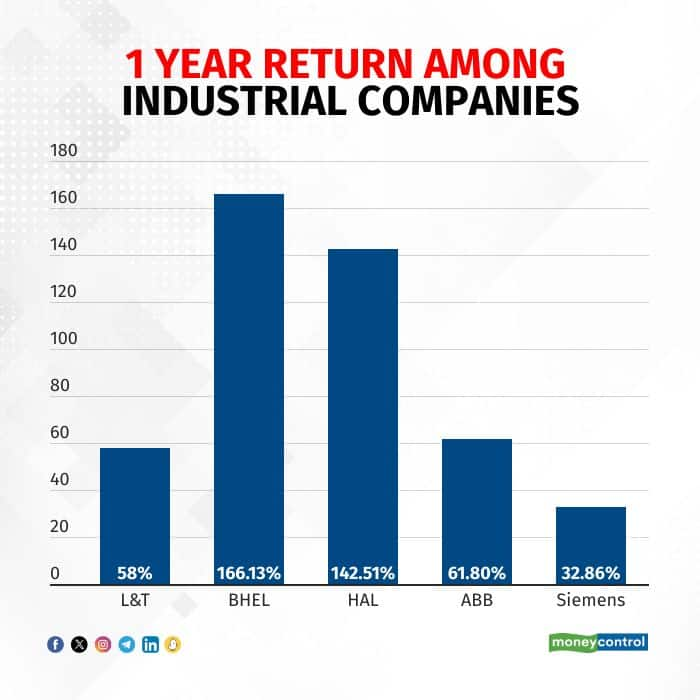

The BSE Industrials index gave a return of 65 percent over the last year. Shares of L&T, BHEL, HAL and ABB have risen between 32 percent and 166 percent over the last one year. This rally has been driven by increased allocation in infrastructure spending allocated by the government during the Budget of FY24.

According to a Nuvama report, the government allocated Rs 14.9 lakh crore in the FY24 Budget to the infrastructure space which was 32 percent higher than the previous year’s allocations of Rs 11.3 lakh crore. Nuvama expects 15-16 percent growth in the coming Budget, which will boost the companies' order books. Kandpal expects a 15 percent growth in Budget allocations.

Jefferies pointed out that the central government capex in the last 5 years has grown at 25.4 percent. The government has increasingly focused on manufacturing indigenously through schemes like Make in India, Aatmanirbhar Bharat and PLI schemes. The order books have zoomed between 31 percent and 300 percent for L&T and Siemens respectively in the last 3 financial years.

However, some analysts believe the first half of FY2025 will be tepid for industrial companies due to an expected slowdown in project execution. Rajarshi Maitra, Senior Analyst at Incred Equities, said the project execution slowed down by 4-5 percent during the previous election years. The order book-to-sales (OB-to-sales) ratio is also expected to go down from 3x in March 2023 to 2.4x in March 2024, Maitra added. This slowdown in order book might result in lower revenue in the first quarter of FY25.

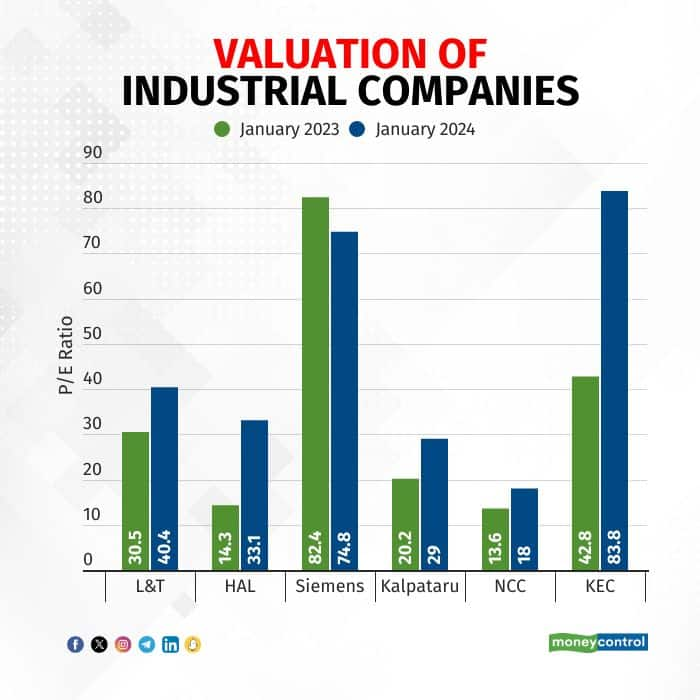

Additionally, most of the companies are near expensive valuations, analysts also advise waiting for corrections.

Kandpal said, “EPC stocks have not corrected so much, these stocks can be entered at more attractive prices. Buy in dips strategy can be used.”

Kandpal said stocks like Larsen and Toubro (L&T), Siemens, ABB, Kalpataru, NCC and BHEL have been the biggest beneficiaries after the last Union Budget and these companies have been successful in securing new orders as well.

Post elections fillip

Companies with sufficient order books can execute their projects as spending is expected to pick up after elections.

L&T recently won a significant order which is valued between Rs 1,000 crore and Rs 2,000 crore from the Maharashtra government’s planning and development authority.

Pandey also said that the EPC (engineering, procurement and construction) companies will largely benefit after the elections. He reasoned the expected decline in interest rates will cause the interest component of the companies to come down and the execution pick up post-election will make them look relatively attractive.

Valuations of most of these companies have run up in the past year. Hindustan Aeronautics which was trading around PE of 14x in last January is now trading at PE of 33x. KEC International's PE zoomed from 42x to 83x in one year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.