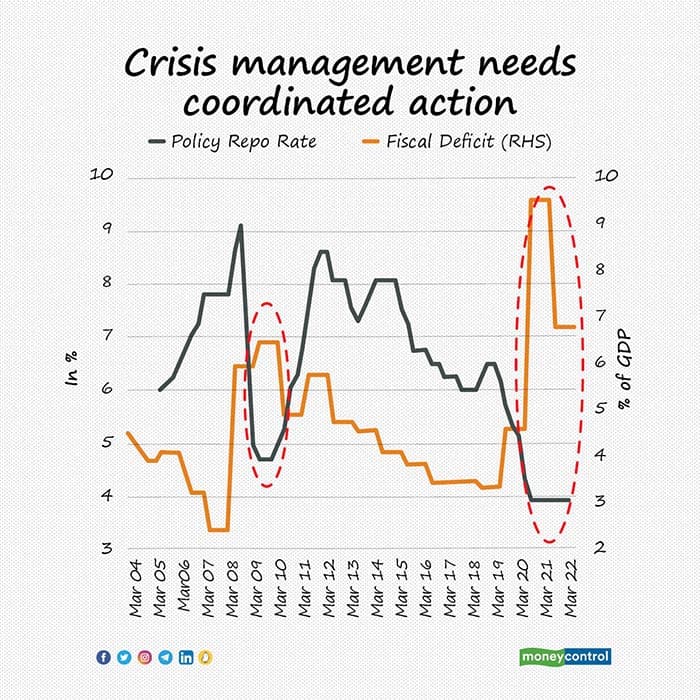

The reason was pretty evident–to reduce the damaging impact of the virus on growth, the economies needed artificial support and the policy making strived to provide it. We saw a coordinated monetary and fiscal action, with the government borrowing more to spend more and the central banks reducing rates to help the government borrow easily. This, however, is the outcome and not the objective.

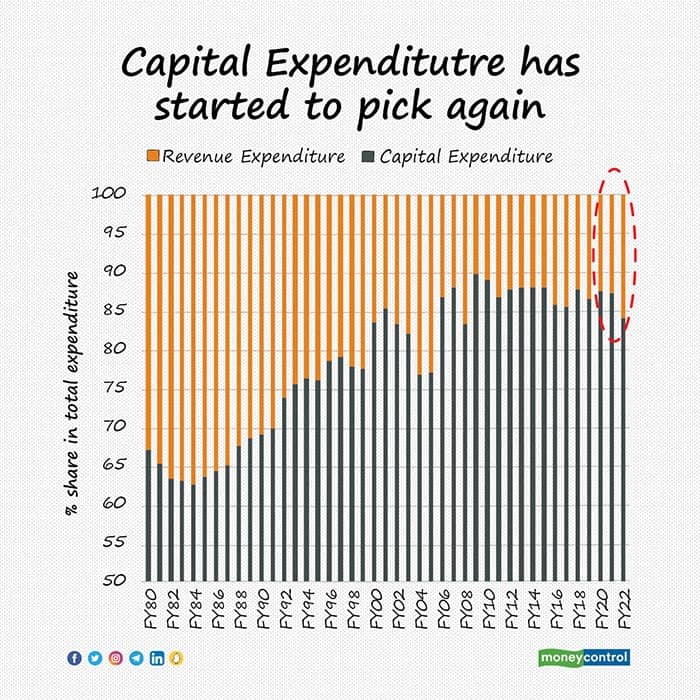

The objective of both actions was higher growth while having prices under control. It means maintaining a fine balance. For example, if the government spends more, it will help with growth but lead to demand-driven inflation. Then, the monetary policy may need to start cutting down on money supply/liquidity by hiking rates, but this action can somewhat dampen demand. The dynamics of the IS-LM curve–which captures how production of goods moves against money supply–of classroom economics is more complex in the real world. In times of crises, the output gap–which measures how far below the production of an economy is from its potential–widens so much that a coordinated policy action is needed to revive growth. Ever since the Fiscal Responsibility and Budget Management (FRBM) Act of 2003, India has been trying to cap its fiscal deficit at 3%. Fiscal deficit was sustainably brought down from 5.8% in FY12 to 3.4% in FY19. However, the pandemic driven economic crises demanded fiscal support.Therefore rightly, the deficit targets were raised by temporarily aborting the FRBM. Fiscal deficit for FY21 stood at a whopping 9.5% and that for FY22 is estimated at 6.8%. India has committed to a slow taming of the fiscal deficit.

For example, if the government spends more, it will help with growth but lead to demand-driven inflation. Then, the monetary policy may need to start cutting down on money supply/liquidity by hiking rates, but this action can somewhat dampen demand. The dynamics of the IS-LM curve–which captures how production of goods moves against money supply–of classroom economics is more complex in the real world. In times of crises, the output gap–which measures how far below the production of an economy is from its potential–widens so much that a coordinated policy action is needed to revive growth. Ever since the Fiscal Responsibility and Budget Management (FRBM) Act of 2003, India has been trying to cap its fiscal deficit at 3%. Fiscal deficit was sustainably brought down from 5.8% in FY12 to 3.4% in FY19. However, the pandemic driven economic crises demanded fiscal support.Therefore rightly, the deficit targets were raised by temporarily aborting the FRBM. Fiscal deficit for FY21 stood at a whopping 9.5% and that for FY22 is estimated at 6.8%. India has committed to a slow taming of the fiscal deficit.Besides the fiscal support, India extended a friendlier monetary policy. Today, interest rates in the country stand at their lowest-ever level–4%--and for the longest ever (seven straight quarters). Pre-pandemic, interest rates in India averaged 6.8% with few volatile movements.

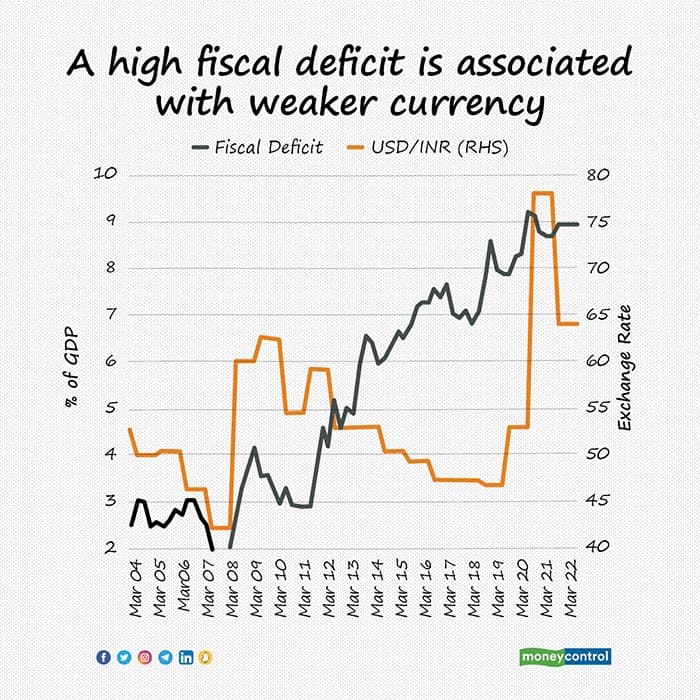

Currently, despite the high deficit, monetary policy continues to be accommodative since it remains growth-focused and believes inflation to peak out soon.Now, if the fiscal deficit is what has helped us get past the pandemic, is an elevated fiscal deficit really a bad thing? There are two sides to this argument. One, a higher fiscal deficit is positive for demand and output. But there’s a flipside. Output(AD)= Private Consumption (C)+Government Consumption (G)+Investments(I)+Net Exports(NX) If the government deficit is higher, it will have to do either of two things–a) increase tax or b) increase borrowing. Higher taxes reduce disposable income and bring down resources available for private consumption. Similarly, if the government borrows more, it leaves behind little for the private sector. Also, higher borrowing drives up interest rates and makes it more expensive for the private sector to borrow. In both ways of managing the deficit, the rise in G is compensated by fall in C. There are more factors or caveats to be considered. A high fiscal deficit devalues currency, makes imports more expensive and harms the current account, creating a double whammy of high internal (fiscal) and external (current account) deficit. The impact of fiscal deficit on the economy cannot be known ceteris paribus–that is the effect of one factor on another when all other factors remain the same. All other factors rarely, if ever, remain the same. Fiscal deficit impacts macro variables such as inflation, interest rates, currency movement and consequent action from the monetary policy.

There are more factors or caveats to be considered. A high fiscal deficit devalues currency, makes imports more expensive and harms the current account, creating a double whammy of high internal (fiscal) and external (current account) deficit. The impact of fiscal deficit on the economy cannot be known ceteris paribus–that is the effect of one factor on another when all other factors remain the same. All other factors rarely, if ever, remain the same. Fiscal deficit impacts macro variables such as inflation, interest rates, currency movement and consequent action from the monetary policy.

Fiscal deficit’s effect on asset classes

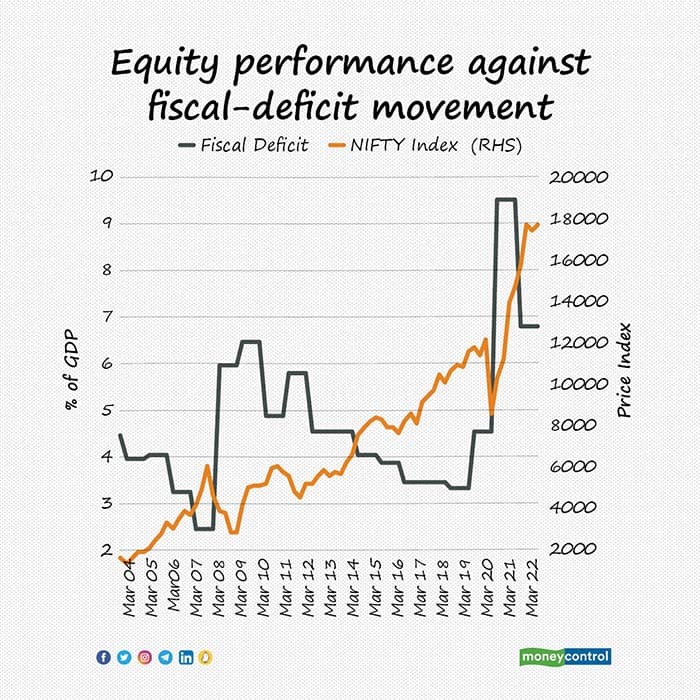

Considering that fiscal deficit invites monetary action to address the side-effects on several macro variables, let’s turn to what this means for our asset classes. Let’s split this into three–a) impact on equity b) impact on debt and c) impact on currency. When it comes to impact on equity, there are two opposing factors in action. As per the discounted cash flow (DCF) model, current price is a function of expected cash flow. A high fiscal deficit raises interest rates and therefore increases the denominator of this model and hence reduces the real cash flow expectation from equity after adjusting the cost of capital( as reflected via interest rates). Again, higher future taxes will impact aggregate demand negatively.

However, if the fiscal deficit is from high and unproductive expenditure–let’s say on subsidies–it can be overall bad for the markets. They do not increase corporate earnings but the higher taxes reduce the expected cash flow of companies, and hence it can have a negative impact on the market.

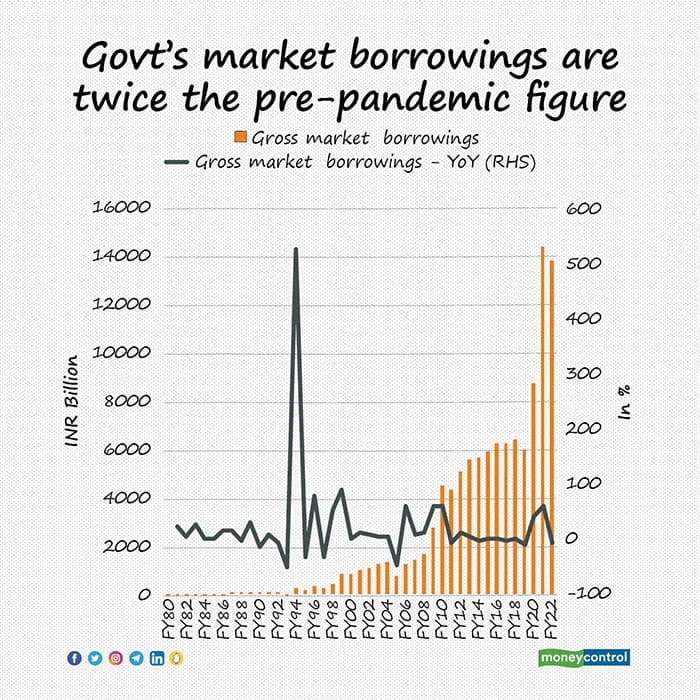

Above all, a high fiscal deficit can be positive in the short term but, when rates/tax go up after a lag, it could bite back with lower equity performance.Let’s turn to a high fiscal deficit’s impact on debt.Theoretically, a high deficit translates into higher bond issuances, and therefore higher interest rates and consequent lower bond prices. Clearly, bond supply exceeds bond demand here and therefore the prices go down.Typically, bonds carry a fixed coupon when issued by the government. So when the government has to start issuing higher coupon bearing bonds to push additional supply because of a bigger borrowing programme, prices of lower-coupon bearing bonds trading in the secondary market fall to ensure that the yield on these securities are aligned to the new rates. However, here’s the catch–if the central banks step up and increase bond demand by absorbing the excess supply, bond prices necessarily do not fall. Additionally, if inflation and growth are low, central banks can cut interest rates that can increase bond prices even when the fiscal deficit is high (usually in a crisis-like scenario). Also, a lot of it depends on movement of global asset classes. If a country is increasing fiscal deficit in isolation, it is likely to be bad for asset classes since the country stands a risk of rating downgrade, which could bring down the foreign flows into the country. However, if it is a global wave, impact will be judged on a relative basis.Emerging markets (EM) versus developed markets (DM) yields matter for fund allocation and relative yields matter for bond prices of a country. Therefore, a high fiscal deficit while being theoretically negative for bond prices has many ifs and buts playing in the opposite direction.Now, to a high fiscal deficit’s impact on currency. Usually, a high deficit translates into a weaker currency.

What to expect from Budget 23?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!