Krishna KarwaMoneycontrol Research

Bata India is one of India's most popular footwear players. Its brands include Bata, Mocassiono by Bata, Ambassador by Bata, Hush Puppies, Scholl, Bata Comfit, Marie Claire, Bubblegummers, Weinbrenner, Power, North Star, Naturalizer, Sundrops and Red Label.

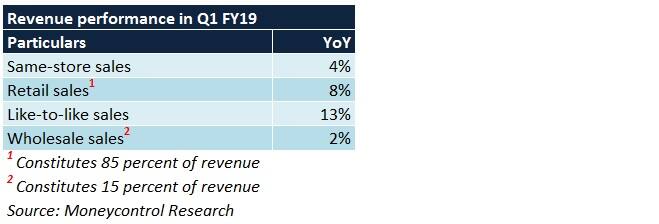

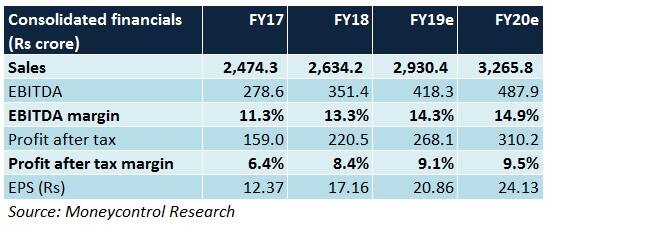

The company reported a strong set of numbers for the quarter ended June. An increase in average selling prices of footwear was the key contributor to its overall top-line growth, while year-on-year volume growth was minimal.

Despite the company's advertising expenses for the quarter under review coming in at twice the amount it spent in the corresponding quarter last year, its operating profit margin inched up on account of a higher proportion of premium product sales to total revenue, lower rental expenses and cost control measures.

The path ahead

What will drive revenue growth?

Higher promotional spends, particularly through tie-ups with celebrities, should help Bata attract more footfalls. This should result in same-store sales picking up pace.

The company's continued emphasis on product premiumisation will be crucial in triggering revenue growth (by virtue of increased realisations per pair of footwear).

Introduction of the 'Red Label' brand of women's footwear in India will be complemented by initiatives on fronts such as visual merchandising enhancement and addition of 'Red-concept' stores.

In the economy category (products priced in the range of Rs 500–1,000 per pair), reduction of Goods and Service Tax rate from 18 percent to 5 percent should also boost sale volumes.

Bata's management has chalked out an aggressive expansion strategy, wherein 150 new stores will be added to the company's existing count of 1,375 outlets.

Placement of online kiosks in major retail outlets, tie-ups with payment partners, and an increase in product offerings through e-commerce portals will enhance the visibility of Bata's brand and its products.

How can margins improve?

Bata's management aims to curtail the company's rental expenses by resizing its stores and renegotiating the terms of agreement for them with property owners.

The share of back-to-school footwear products, the average selling price of which is lower than other adult-based variants, is expected to gradually reduce in Q2 FY19 vis-à-vis Q1.

In order to keep the business model asset-light and generate higher returns on capital, network augmentation will be largely driven by franchise-operated outlets, particularly in tier-2 and tier-3 cities.

What should investors do?

Given its healthy cash flow position, Bata should be able to fund the proposed Rs 100 crore capital expenditure in FY19 through internal accruals.

Should the company succeed in deriving high fixed asset turns from this investment, the benefits of operating leverage will reflect in the form of improved margins.

Also, steps undertaken to improve the product mix (in favour of value-added premium footwear), tap unserved and under-served markets, and achieve brand differentiation across categories could augur well for Bata.

Nonetheless, concerns relating to the company's sluggish same-store sales growth and stiff competition in the high-end segment (especially observed in metros and tier-1 cities) ought not to be overlooked.

Though we remain optimistic about Bata's prospects, the stock has had a steep re-rating during the past 6 months of the ongoing bear phase and is currently trading at 37.3 times its projected earnings for FY20. We recommend investing on declines.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.