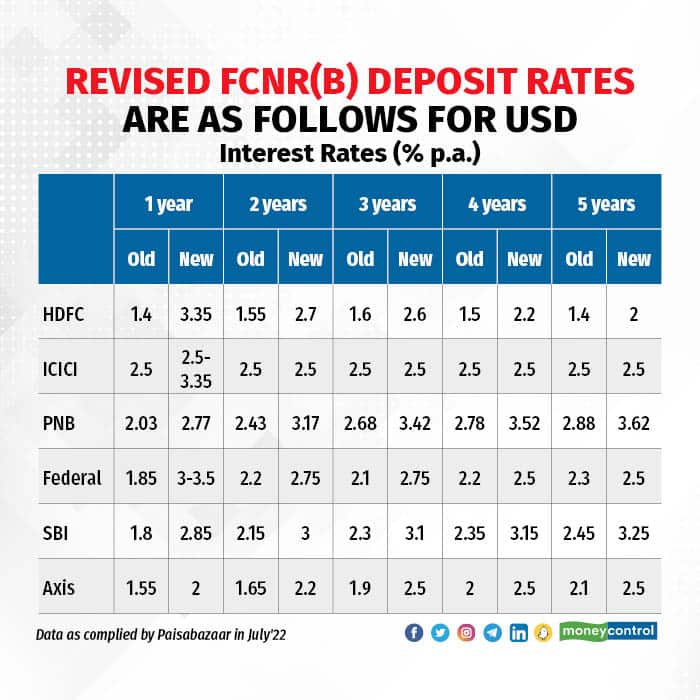

Recently, a clutch of banks, including State Bank of India (SBI), HDFC and ICICI Bank, sharply increased interest rates on Foreign Currency Non-Resident (Bank) or FCNR(B) deposits. The move to hike rates was in sync with the Reserve Bank of India’s efforts to boost fund inflows and support the freefalling rupee by shoring up forex reserves, which fell to a 14-month low at the end of June.

FCNR(B) deposits are essentially fixed deposits held in foreign currency. They are used by non-resident Indians, persons of Indian origin and overseas citizenship of India card holders to invest their money in India, using foreign currency, for good returns.

These deposits constitute a minuscule portion of Indian banks’ total deposits. They were equivalent to slightly over 2 percent of total savings deposits at the beginning of this financial year, at $16.14 billion (April). Total savings deposits stood at Rs 15.79 lakh crore or approximately $750 billion in March, according to the latest RBI data.

While their quantum is modest, experts believe the rise in FCNR (B) deposit rates will spark a surge in the inflow of these deposits.

Analysts, meanwhile, believe the move to raise the FCNR(B) deposit rate will affect banks' profit margins as their cost of funds may end up rising. The experts added that it is difficult to say by how much the cost would go up because there will be variations across banks, tenors and the currency of deposit.

Is bank profitability at stake?

Be it the FCNR (B) rate hike or domestic rate hikes, banks’ profit margins will only be affected in case they are not able to pass on the rate hikes to customers through lending rates and other measures as their cost of funds will also go up, say bankers.

Additionally, even if they are unable to lend, they can park excess liquidity with the RBI’s standing deposit facility (SDF) which has risen compared to its pre-pandemic level, according to economists. Under the new monetary policy, SDF helps the central bank absorb liquidity (deposits) from commercial banks without giving government securities in return to the banks.

The SDF rate is currently 25 bps below the policy repo rate of 4.90 percent, while the Marginal Standing Facility rate, or the rate at which banks obtain liquidity overnight, is 25 bps above the policy repo rate. Hence, with these rate hikes, the RBI has restored the width of the Liquidity Adjustment corridor to the pre-pandemic 50-basis-point symmetry around the policy repo rate.

With measures to pass on the rate hike through lending operations as well, banks manage to balance the impact of the hike and protect their profit margins.

“In 2013, the RBI had announced a similar FCNR deposit scheme, and after that, the RBI and banks had tried to precisely address forex risks. Now, deposit rates are going up — not only for FCNR deposits but also for local deposits — following the rate hike cycle. Credit growth is picking up and loan rates are also going up,” says Sakshi Gupta, principal economist, HDFC Bank.

If banks are able to take calculated measures in terms of lending, investments and other aspects, they can safeguard their profitability even with the rise in the FCNR(B) rate.

“It has always been seen that whenever deposit rates go up, lending margins also improve. Moreover, we have about $400 million (Rs 3,000 crore) in FCNR (B) deposits whereas the total deposits we have are more than Rs 1.8 lakh crore,” says Ashutosh Khajuria, ED, Federal Bank.

“If banks transmit the full impact of the rate hike to customers, margins will be protected. But lending rates are market driven,” explains Virat Diwanji, Group President and Head – Consumer Bank, Kotak Mahindra Bank. He adds that banks offering lower rates of interest on loans are likely to attract more customers. So, passing on interest hikes through lending rates may not help them to completely balance profit margins.

But analysts and bankers expect the rate transmission to be better on the lending side as most floating loans are linked to external benchmarks. “Since external benchmarks have gone higher than other benchmarks like MCLR, banks should benefit in terms of margins in the near-term. However, deposits are also expected to reprice upward gradually, and the improvement in margins may not sustain barring changes driven by changes in product mix,” added Choksey.

Increase in demand from overseas deposits

Experts say that with higher FCNR (B) rates, overseas investors can earn a safer return compared to rupee-denominated deposits. Banks will now attract greater participation from overseas deposits.

“Currently, inflation in India is hovering around the 7% range, which is higher than the RBI’s inflation target. Inflation is expected to remain high in the coming months. When the currency depreciates because of inflation, FCNR deposits work like a hedge against it,” explains Adhil Shetty, CEO of BankBazaar.com.

Naveen Kukreja, CEO and Co-founder, Paisabazaar, concurs. “As many of the advanced economies are registering steeper rate increases, higher FCNR deposit rates offered by the banks should increase the attractiveness of these deposits among NRIs. Higher inflows from NRIs would then provide some support to our forex reserves and the rupee,” he says.

Inflows are likely to go up, specifically from the US, as the yield in the US T-Bill and some other bonds offer lower returns. “Currently FCNR (B) rates vary from 2.85-3.50 percent for a one-year deposit, which is higher than the 2.8-2.9 percent yield on the 1 year US$ T-bill. The flow from overseas deposits will depend on the short-term rates in overseas markets and associated hedging costs for the banks,” said Aashay Choksey, Assistant Vice President, Financial Sector Ratings, ICRA.

Quantum of hike surprises economists

After the RBI announced its forex measures in the first week of July, some economists were expecting a rate increase of 25-30 bps. But the banks have hiked the rate by nearly 100 basis points to improve domestic FX liquidity conditions.

Banks are trying their best to be at par with the rates offered by banks in foreign countries and with the Fed rate hikes, so they have increased rates more than expected.

“FCNR is a deposit denominated in foreign currencies. In countries like the US, for deposits with a tenure of two to five years, the rate is close to 3 percent and more. The interest rate here can’t be lower than that offered in US government bonds,” said Federal Bank’s Khajuria.

Moreover, banks have taken calculated measures keeping in mind the probable rate hikes that may happen in the upcoming policy meetings, added bankers.

“Given the Fed rate hike guidance, median policy rates are expected to be 3.8 percent by December 2023, which means that the cost of raising these overseas deposits will rise further for Indian banks. Unless the hedging costs decline, or the RBI assures banks of the exchange rate in future being at competitive rates, the deposits may not be lucrative for overseas depositors,” says Choksey.

“While interest rates are rising in India, so are the interest rates in other countries. They have to think about the opportunities that are available there. There will be banks falling over each other to get more money from NRIs,” added Diwanji of Kotak Mahindra Bank.

Moreover, banks are pricing in future rate hikes as well, counting those that may happen in upcoming policy measures — it is likely that there may be a hike of 50-75 bps. “The FCNR rate was last revised long ago, pre-pandemic. It has been done this time to cover up their costs,” adds Sarbartho Mukherjee, economist, Mahindra Group.

The inflationary pressures in India are lower than in the US and some of the other advanced economies. Thus, the quantum of policy rate hikes in India should be lower than the rate hikes executed by the Federal Reserve. However, apart from the repo rates, the rate hikes by Indian banks have been determined by overall credit demand and liquidity in the Indian financial system, as well as their overall asset-liability management requirements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.