Indian banks are expected to gain from provision reversals in the fourth quarter of the current financial year after the Reserve Bank of India (RBI) changed its rule on Alternative Investment Fund (AIF) investments, bankers told Moneycontrol on March 27.

“The revised guidelines will be a relief for banks, and provisions made as per previous guidelines will be aligned with new guidelines. And to that extent any excess provision will be reversed in Q4,” said V Ramachandra Reddy, Head, Treasury, The Karur Vysya Bank.

Arun Bansal, Executive Director and Head of Treasury, IDBI Bank, added that this will be beneficial and add to the bottomline to the extent of the additional provisions made last quarter.

“Last quarter, due to these guidelines, most of the banks have made provisions almost equal to their investment in AIFs. With this circular/ modifications, banks will be able to reverse the provisions over and above the pro rata provisions required,” Bansal added.

An AIF is a special investment category that differs from traditional investment instruments. It is a privately pooled fund, and generally, only institutions and High-Net Worth individuals (HNIs) invest in AIFs as they require substantial investments. There are three types of AIFs: category 1, 2 and 3.

On March 27, the RBI issued a clarification on its earlier guidelines on investments by lenders in AIFs that have further investments in borrower companies linked to the lenders.

As per the clarification, provisioning by lenders that have investments in AIFs will be required only to the extent of investment by the lender in the AIF scheme, which is further invested by the AIF in the debtor company, and not on the entire investment of the Regulated Entity in the AIF scheme, RBI said.

Explaining this, a senior treasury head with a private sector bank said that if a lender invested Rs 5 crore in a Rs 100-crore AIF scheme that in turn invested Rs 2 crore in the debtor company of the lender, the provisioning would be on the entire Rs 5 crore, as per the earlier circular.

But now, as per the clarification in the latest circular, the provisioning will be only to the extent of the money invested.

The central bank also said investments by lenders in AIFs through intermediaries such as fund of funds or mutual funds are not included in the scope of the earlier RBI circular.

Also read: MC Explains | All you need to know about RBI’s clarification on AIF circular

December 19 AIF circularOn December 19, last year, the RBI barred regulated entities, such as banks, non-bank lenders and home financiers, from investing in AIFs that have directly or indirectly invested in companies that have borrowed money from the lenders.

In a press release, RBI highlighted regulatory concerns regarding certain transactions involving AIFs by regulated entities that had come to its notice, and released guidelines for investments in AIFs by lenders.

Also read: AIFs get regulator's nod to pledge equity of investee companies in infra sector

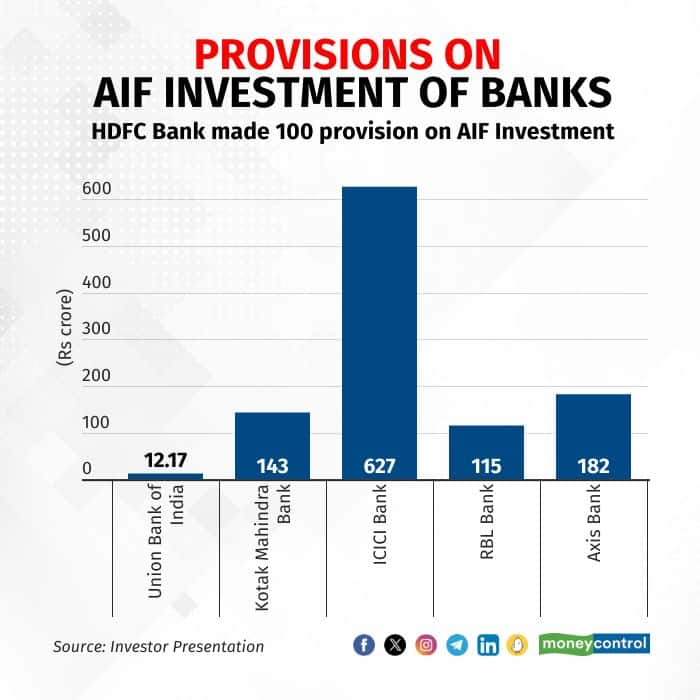

Provisioning by banks in Q3On January 24, a Moneycontrol analysis showed that at least six Indian banks have made a combined provision of over Rs 1,070 crore on their investments in alternative investment funds after the recent diktat from the RBI.

These banks are HDFC Bank, Union Bank of India, Kotak Mahindra Bank, RBL Bank, Axis Bank and ICICI Bank. IDBI Bank and IDFC First Bank did not disclose the amount provisioned.

This was in line with Moneycontrol’s January 19 report citing experts, which said that most lenders are opting to make provisions on their investments in AIFs rather than making redemptions.

AIF Investment

AIF InvestmentIn the third quarter of financial year 2023-24, HDFC Bank made a 100 percent provision on its AIF investment. The total AIF book of the lender stood at Rs 1,220 crore.

Union Bank of India made a provision of Rs 12.17 crore, Kotak Mahindra Bank: Rs 143 crore, ICICI Bank: Rs 627 crore, and RBL Bank: Rs 115 crore.

Similarly, Axis Bank made a full provision on all its AIF investments, aggregating Rs 182 crore, the lender said in a release.

During the Q3 earnings call, B. Ramesh Babu, managing director and chief executive officer of Karur Vysya Bank, said that the bank's AIF investments as at the end of December 31, 2023 stood at Rs 10.86 crore, and that it did not have any credit exposure in companies that have made downstream investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.