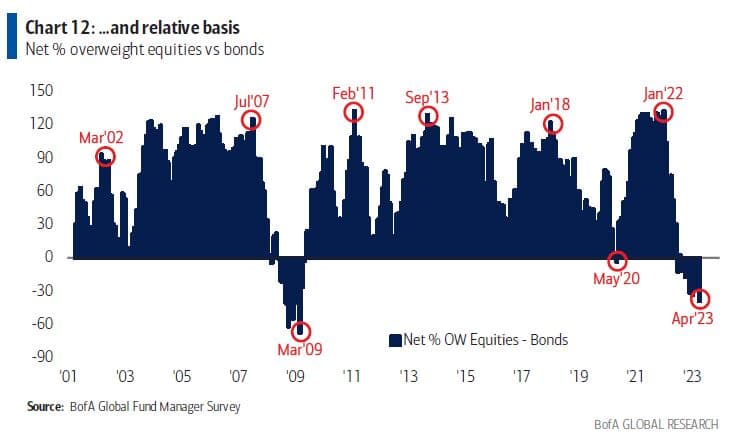

Investors' allocation to equities relative to bonds has dropped to its lowest level since the global financial crisis as worries about a recession take hold, according to Bank of America Corp.’s global fund manager survey.

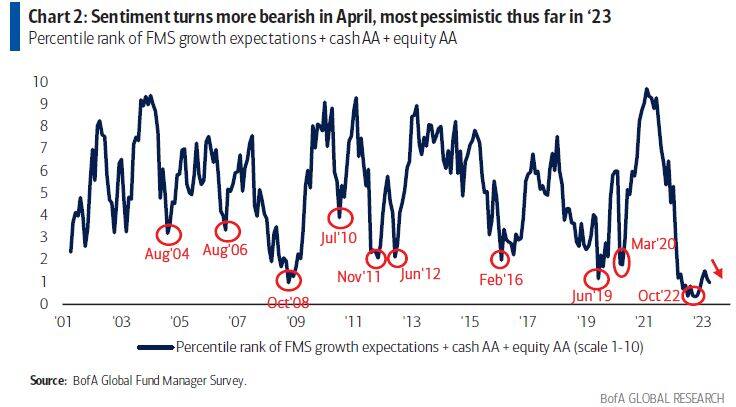

In the most bearish survey of this year — the first after banking turmoil roiled markets last month — investors indicated that fears of a credit crunch had driven up bond allocation to a net 10 percent overweight — the highest since March 2009. A net 63 percent of participants now expect a weaker economy, the most pessimistic reading since December 2022.

Still, the bearish turn in sentiment is a contrarian signal for risk assets, strategist Michael Hartnett wrote in the note. If “consensus lust for recession” isn’t satisfied in the second quarter, the “pain trade” would be a rally in bond yields and bank stocks, he said. Hartnett was correctly bearish through last year, warning that growth fears would fuel a stock exodus.

US stocks have bounced back from last month’s lows that were sparked by the collapse of some regional US lenders, including Silicon Valley Bank. Still, the rally has moderated this month as data show a softening in the labour market, fueling worries that the economy could contract later this year.

US stocks have bounced back from last month’s lows.

US stocks have bounced back from last month’s lows.

A credit crunch and a global recession are seen as the biggest tail risks to markets, followed by high inflation that keeps central banks hawkish. A systemic credit event and worsening geopolitics are also among the risks, according to the survey, which ran between April 6 to 13 and canvassed 249 participants with $641 billion in assets under management.

Other highlights from the survey include:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.