BUSINESS

I-banker turned author Nishtha Anand on why corporate India still remains a man's game

How do women establish themselves in the workplace besides juggling it with home? Can they really have it all? Nishtha Anand breaks down the issue of poor gender diversity at Indian workplaces and offers solutions in her debut book.

BUSINESS

Visit to a dark store: Here’s what it takes to deliver that bag of groceries to you in 10 minutes!

With express grocery delivery becoming the new normal, Moneycontrol brings you a picture of the functioning of dark stores – an indispensible facet of the new-age economy.

BUSINESS

2021: The year venture debt took off in India

The emerging asset class seems to have had a breakout year in 2021. Will the next year be any different?

BUSINESS

OfBusiness valued at $5 billion, eyes 2022 IPO

This is OfBusiness' fourth funding round in 2021.

BUSINESS

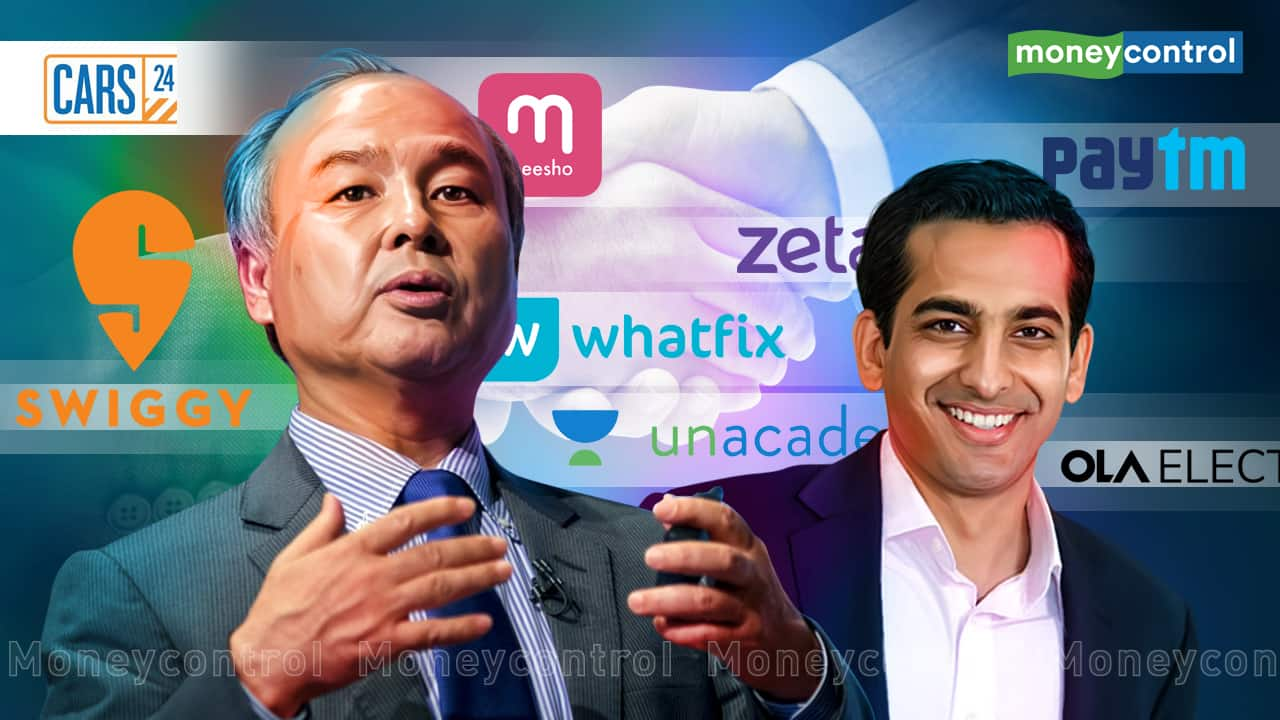

'They are unrecognisable': Inside the ‘new’ SoftBank India of 2021

SoftBank, the Japanese investor who made billion-dollar cheques common, is now unrecognizable in India. The world's most influential technology investor has been India's most cautious and conservative late-stage investor this year. Why and how did this happen? Moneycontrol decodes previously unreported details on the inner workings of SoftBank India, Masayoshi Son's ambitions and how the New SoftBank came to be.

BUSINESS

SaaS startup MoEngage raises $30 million led by Steadview Capital

Founded in 2014, MoEngage helps companies measure customer engagement and analyse metrics in order to improve it, which may help firms formulate their marketing and data strategy.

BUSINESS

Spinny becomes 42nd unicorn of 2021, raises $283m from ADQ, Tiger Global & others

The round saw investments from Abu Dhabi’s ADQ, existing backers Tiger Global Management and Avenir Growth, and Feroz Dewan’s Arena Holdings and Think Investments, valuing Spinny at $1.8 billion

BUSINESS

P2P lending firm LenDenClub raises $10 million from Kunal Shah, Hardik Pandya & others

Other investors in the round include Tuscan Ventures, Ohm Stock Brokers, Artha Venture Fund, Policybazaar co-founder Alok Bansal, Livspace co-founder Ramakant Sharma and GVK Infra board member Krishna Bhupal

BUSINESS

Indian SaaS startups raise record $4.5 billion in 2021: Bain report

Indian SaaS startups have had a breakthrough year, with a lot of unexpected factors. What led to this boom, and will it sustain?

BUSINESS

Exclusive: Swiggy, Meesho backer Elevation Capital eyes $600 million fund

Having minted 6 unicorns in its portfolio in 2021 alone, Elevation Capital (earlier SAIF Partners) is raising its largest ever fund. Analysing its 2021 strategy shows it has been more aggressive than ever before.

BUSINESS

CRED to acquire Happay in cash and stock deal valuing the platform up to $180 million

Happy currently has more than 6,000 clients including Dominos, PriceWaterhouse Coopers and Oyo and processes transactions worth over $3 billion annually

BUSINESS

Bessemer goes bullish on India, raises $220 million to deepen local ties

Bessemer, one of Silicon Valley's largest VC firms, was rumoured to be planning an exit from India a few years back. Instead, now it has raised an India-dedicated fund.

BUSINESS

Exclusive | $30 billion fundraising, 40 unicorns in 11 months — startups break records, spark bubble fears

Privately held startups have raised $31.2 billion, nearly three times 2020’s $11.2 billion, and more than double the previous record of $13.1 billion in 2019.

BUSINESS

Rash decisions, insecurity and burnout: The dark side of India’s startup funding boom

India's epic and unprecented startup funding boom has birthed unicorns, minted millionaires and taken companies public at record valuations. In the process though, founders are getting burnt out, employees are veering towards fraud and insecurity is driving people to the dark side. Moneycontrol takes a look

BUSINESS

Blume Ventures eyes $200 million fourth fund, hits $105 million first close

Despite the funding boom, Blume's managing partner Karthik Reddy warned that companies should spend the money carefully.

BUSINESS

SoftBank's Sumer Juneja promoted to managing partner

The promotion makes Juneja one of 13 globally to report to Rajeev Misra, CEO of SoftBank's ambitious Vision Fund.

BUSINESS

Exclusive: Infra.Market eyes $4.5 billion valuation

Infra.Market was founded by Souvik Sengupta and Aaditya Sharda in 2016,

BUSINESS

Exclusive: Kunal Shah’s CRED in talks to acquire Dineout, Wint Wealth

The two acquisition talks shed significant light on the strategy of CRED, one of India's hottest but least understood internet startups by many

BUSINESS

Scenes from Paytm's listing: Laughter and joy amid falling shares

Vijay Shekhar Sharma's masterful showmanship could not stop fintech firm Paytm's shares from falling on public debut in a white-hot market. Here's what it felt like at the BSE to witness a historic IPO, even though emotions and reality were poles apart.

BUSINESS

Solo VC Vaibhav Domkundwar raises debut fund of $15.2 million

A growing trend in Silicon Valley and now India, solo venture capitalists are changing the rules of the startup game

BUSINESS

Mensa Brands becomes India’s fastest unicorn with $135-million funding

Mensa has been valued at a billion dollars just six months after it launched.

BUSINESS

Governance is more important than valuations: A91 Partners

A91 Partners, founded by three former partners at Sequoia Capital India, has closed its second fund at $550 million. In their first interview since quitting Sequoia, the trio- VT Bharadwaj, Abhay Pandey and Gautam Mago talk about the challenges of a fund manager, why investing is a brutal business and the importance of governance.

BUSINESS

SoftBank could invest $10 billion in India next year, says Rajeev Misra

A number of SoftBank-backed Indian startups are expected to list soon. It started with insurance firm Policybazaar, and followed with Paytm

BUSINESS

Decoding Five Star Business Finance's IPO documents in 5 charts

Sequoia, KKR and TPG-backed Five Star has been among the fastest growing small business lenders in recent times