Five Star Business Finance on November 11 filed its draft documents to raise Rs 2,752 crore via an Initial Public Offering(IPO). The non-bank lender is one of the fastest growing new age private-equity-backed NBFCs in the country. Five Star's journey though is an uncommon one, as Moneycontrol has previously reported- of building away from the attention, of hiring from uncommon places, keeping its distance from digital lending, and resisting the temptation of growth for many years.

Moneycontrol parsed through its Draft Red Herring Prospectus, and sums up the company's management, finances and pitch in 5 charts-

Some of the promoters as well as early investors are selling a part of their stake

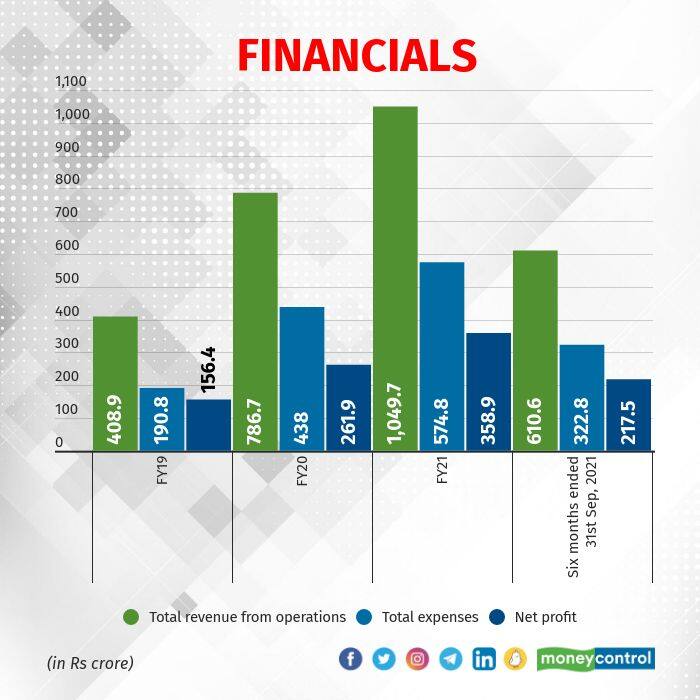

Some of the promoters as well as early investors are selling a part of their stake Five Star has consistently been profitable, even through the pandemic when small business lending was among the hardest hit sectors

Five Star has consistently been profitable, even through the pandemic when small business lending was among the hardest hit sectors Five Star's capitalisation table (or cap table) for short include the who's who of venture capital and private equity. Another early investor Morgan Stanley Private Equity exited its investment earlier this year with a 5x return

Five Star's capitalisation table (or cap table) for short include the who's who of venture capital and private equity. Another early investor Morgan Stanley Private Equity exited its investment earlier this year with a 5x return

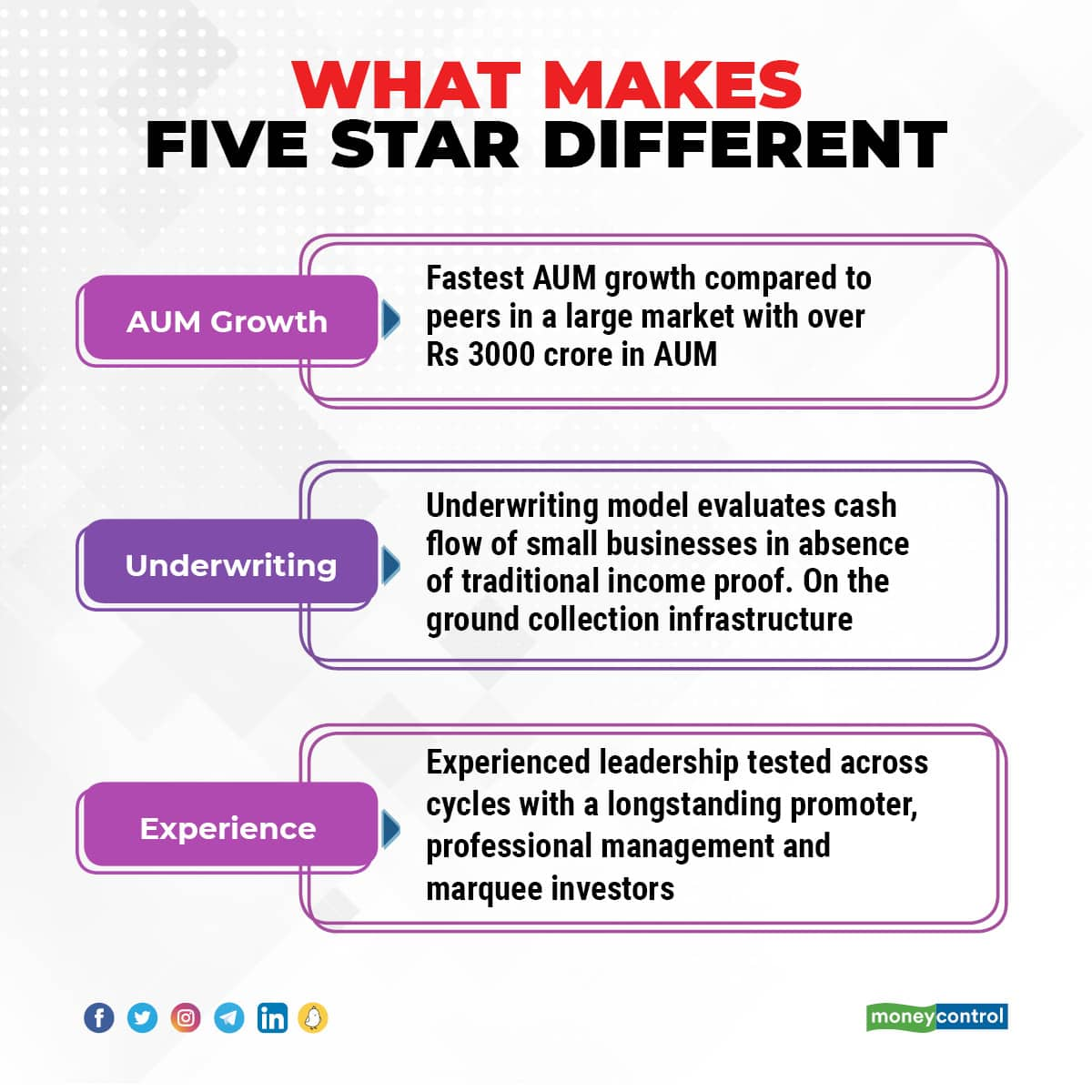

Five Star is pitching to investors that its combination of rapid growth, profits and a pressure-tested model will help it succeed in the public markets

Five Star is pitching to investors that its combination of rapid growth, profits and a pressure-tested model will help it succeed in the public markets

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.