Elevation Capital, an early investor in Swiggy, Paytm and Meesho, is said to be in talks to raise $600 million, barely a year after its last fund, to hold ground in an fiercely competitive market.

The venture capital firm, earlier known as SAIF Partners, will raise a $400-million early-stage fund – on a par with previous funds – and a $200-million growth-stage fund, a new addition for one of India’s most influential investors, people aware of the plan said.

The growth component is a key element of the new fund, similar to what rival VC firm Sequoia has, and is increasingly being baked into every venture firm’s strategy.

The growth fund will help Elevation invest more in its best-performing portfolio companies as well as in growth-stage start-ups that it may have missed out on during their seed or Series A fundraising.

The fund – its biggest so far – is expected to be raised by the first quarter of next year.

In response to queries from Moneycontrol, Elevation said it is currently not raising a new fund, and that it does not allocate funds by growth or early stage.

The ongoing funding boom drives home a realisation for investors that not only do they have to pick the right companies to beat the odds but also back them to the hilt across later-stage funding rounds so that they own a significant chunk when the company is mature.

“Going deep into your winners is as important as picking them. VCs have regretted not having enough follow-on capital. You have picked a winner, but your returns are capped out because you can’t invest anymore and your stake gets diluted,” a partner at a venture firm explained.

Picking winners not enough

Early-stage venture firms typically invest in the first two or three rounds of fundraising by start-ups. As companies stay private longer, even after crossing D or E series and raising hundreds of millions of dollars at ever-increasing valuations, the stake of any investor who hasn’t participated in later rounds gets diluted.

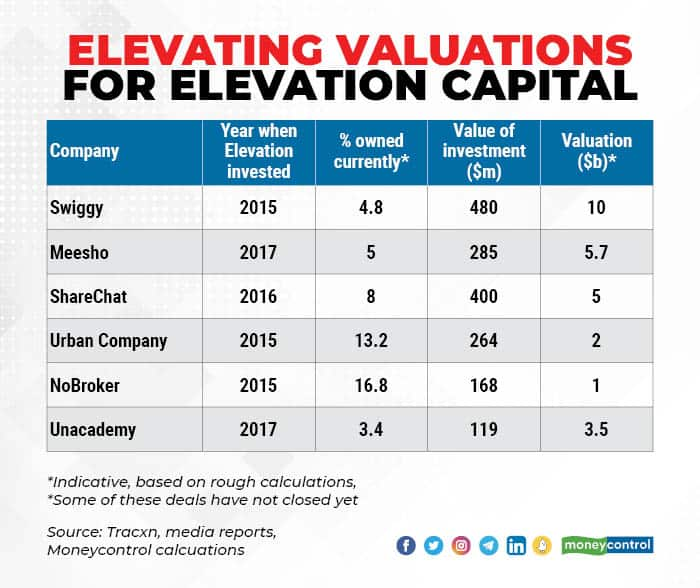

Elevation didn’t participate in social commerce firm Meesho’s last two funding rounds, which valued it at $2 billion and then $5.7 billion. While this is not unusual, it also means that Elevation’s $30-40 million investment for a 4-5 percent stake in Meesho would have returned the equivalent of an entire fund had its stake been a few percentage points higher, as per rough estimates.

Companies have raised three or four rounds of funding in 2021 alone at successively higher valuations. Something the valuations reached levels unheard of.

Elevation has been one of the biggest beneficiaries of the funding boom. Its portfolio has seen six unicorns – start-ups valued at over $1 billion – created in 2021 alone such as social media firm ShareChat and Meesho, home services provider Urban Company, real estate portal NoBroker, and online car-buying app Spinny and Acko Insurance. Its stakes in Swiggy, Meesho, ShareChat and Urban Company alone are worth over $1.5 billion, almost four times the size of its last fund.

Elevation has been among the more prolific private investors in India and most notably, an early backer of fintech firm Paytm. Despite Paytm’s lacklustre listing, Elevation stands to make over a 100 times what it invested in the company. It has already cashed out a few hundred million dollars, with its total stake worth over a billion dollars.

In the previous years, Elevation’s strategy was seen as cautious and measured, especially compared with peers such as Sequoia and Lightspeed. But it stepped up deal-making in 2021, with over 35 investments so far this year, more than double what it did in previous years. These include teenage neobank Fampay, blue collar networking platform Anar and spirituality app AppsForBharat.

Elevation is also in talks to lead a funding round in fintech start-up Uni at a valuation of $150 million, almost four times its valuation from a year ago.

$3 billion assets

“We are definitely faster than ever because we have evolved with the market and consciously pushed the envelope. We are customer (founder) obsessed, just like we want our portfolio founders to be,” Mukul Arora, partner at Elevation, told Moneycontrol earlier this year.

After the new fund, Elevation India will manage over $3 billion in assets, second only to Sequoia India, which manages almost $6 billion. VC funds, including Accel, Stellaris and Blume are raising increasingly larger funds, anticipating widespread digital adoption in India, led by the COVID-19 pandemic and depressed technology markets in China. The CapTable reported on November 22 that Accel is raising an $800 million fund, its largest so far.

SAIF, or SoftBank Asia Infrastructure Fund, was so named because SoftBank contributed about 40 percent of the capital to its early funds in the 2000s for investing in India and China.

Ravi Adusumalli, managing partner, bet on companies such as IT firm Sify, Since 2010, it has raised seven funds of $350-400 million each. SoftBank, however, was not an investor for the past decade, resulting in the name change to Elevation last year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.