In late 2018, when SoftBank approached ecommerce logistics firm Delhivery for an investment, the company and some of its investors were not enthused. Delhivery was in fact talking to investment banks for a possible stock market listing, and people at and close to Delhivery were not thrilled by the reputation that came with SoftBank’s big cheques- pushing entrepreneurs to burn large sums of money to become market leaders, antagonize rivals, and aim for improbable world domination.

“They were not burning too much money. There was always a focus on profits. This was one of the few internet companies which could have gone public even then (when markets weren't as hot)," said a person involved in negotiations, requesting anonymity.

"In that situation, do you want SoftBank, which has a reputation of encouraging founders to splurge, not focus on profits, and be the dominant voice in the room? We worried we would stay private with a lot of money and become inefficient” the person added. Delhivery did not respond to a query seeking comment.

After some deliberation Delhivery did take the money, a decision that has worked out, with its valuation zooming from $1 billion to $3 billion in three years and could hit $5 billion in an imminent public listing early next year. But the decision also worked out because SoftBank, long seen as the 800-pound-gorilla in the startup world, has transformed in the last three years. When the Delhivery investment was being finalised, it was also a time of change for SoftBank, which had just hired its India head- Sumer Juneja from Norwest Venture Partners.

Japanese giant SoftBank’s misadventures globally, led by co-working firm WeWork’s implosion, along with the India team’s conservative investing style have made SoftBank India in 2021 unrecognisable from SoftBank India in 2018, when it was renowned for bets on Paytm, Oyo and others. People close to SoftBank have been impressed and surprised by its dealmaking in 2021, a year like none other for Indian startups. While SoftBank has invested about $3.2 billion in India this year and been part of deals worth $8.3 billion, it has taken smarter and less riskier bets, people say.

The reputational issues that have long accompanied SoftBank’s money— large ownership stakes, a desire to dominate company boards, pushing unfriendly mergers and a brutal win-at-all-costs approach— may finally be put to rest.

At $51 billion, SoftBank’s Vision Fund 2 is still the world’s second biggest pool of private capital, but it is significantly smaller than both founder Masayoshi Son’s ambitions and his debut $100-billion fund. Troubled bets globally (Wag, Katerra, Oyo, Greensill Capital), and the India team’s measured approach means SoftBank has been among the more cautious investors amid an overall epic funding boom in India, where rival investors such as Tiger Global Management and Falcon Edge Capital have run riot, breaking all the rules of traditional venture capital.

In fact, some investors even say that during the current unprecedented funding boom, SoftBank has been too cautious, a stance unimaginable a few years ago.

Moneycontrol spoke to founders and investors who work with SoftBank, investment bankers, lawyers, competitors and recruitment firms to understand how the ‘new’ SoftBank came to be. They requested anonymity. SoftBank declined to comment on a detailed query from Moneycontrol.

“Sumer is a sensible guy”

The entrepreneur was in a fix. He received an investment offer from SoftBank early this year, but was not sure whether he wanted to raise money from SoftBank. He had heard stories of entrepreneurs being pushed to burn billions to chase market leadership and not care about profits, and about SoftBank wanting to be the loudest voice in the room.

But the India team said that’s not what SoftBank stands for today and urged the founder to check SoftBank’s claims of turning a new leaf. The founder did so and raised money from SoftBank. Six months on, he sees a stark difference between what he expected and what he got.

“They are not at all what I feared. They have become more mature. In fact, they are the ones saying we should prepare a long-term business plan. One or two quarters can be topsy-turvy but let's have a 2-3 year business plan. It is a pleasant surprise,” said the founder.

The change in approach, from a hard-nosed win-at-all-costs mentality to being more calibrated, is a result of SoftBank’s India team, led by Juneja. The approach also reflects Juneja’s own investing journey. Far from the glitz and glamor of technology investing, with its high valuations for slick apps, Juneja’s investments at Norwest mainly consisted of traditional financial services firms such as Cholamandalam, Indusind Bank, Yes Bank and National Stock Exchange (besides some new age companies such as Swiggy and Quikr).

Before Norwest, he worked on investments in Bharti Infratel, IRB Infrastructure and IL&FS Transportation Networks for Goldman Sachs. Not exactly path breaking technology or an application of artificial intelligence, something SoftBank founder Masayoshi Son has bet his vast fortunes on.

“Sumer is a sensible guy. He looks for EBITDA (Earnings Before Interest Taxes Depreciation Amortisation, a metric to measure operating profits). He doesn’t want you to burn money endlessly chasing so-called growth. He won’t make wild projections. That is just not in his DNA,” says an entrepreneur close to Juneja. Juneja was also promoted to managing partner recently, making him one among 13 senior investors with SoftBank globally.

Similarly, Vishal Gupta, Director and second-in-command after Juneja, also joined SoftBank after stints at private equity major TPG and Credit Suisse, where as an investor and investment banker respectively, he worked on deals in the offline retail space, financial services and aviation, among others.

Similarly, Vishal Gupta, Director and second-in-command after Juneja, also joined SoftBank after stints at private equity major TPG and Credit Suisse, where as an investor and investment banker respectively, he worked on deals in the offline retail space, financial services and aviation, among others.

In late 2018, executive search firms Egon Zehnder and Michael Page were working to hire SoftBank’s India team. Before approaching Juneja, the India head of a private equity growth stage investor was SoftBank’s pick to lead India investments. The fact that even SoftBank’s other choices were more traditional investors and not pure technology or venture investors indicates that a strategy rejig was on the cards.

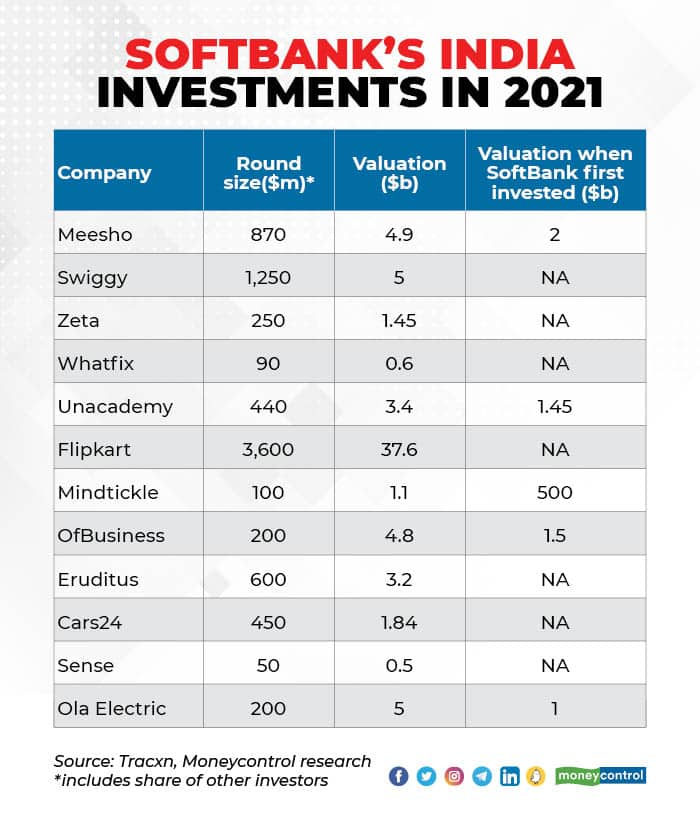

SoftBank’s investments this year include commerce firms Meesho and OfBusiness, software firms Whatfix, Mindtickle, Zeta, executive education provider Eruditus and online car seller Cars24. Co-investors with SoftBank and entrepreneurs point out that these companies are more stable, burn less money than SoftBank’s first generation of internet investments, and the founders of these companies are not huge personalities with cult followings, such as Vijay Shekhar Sharma, Sachin Bansal or Ritesh Agarwal.

There are still exceptions, such as online learning firm Unacademy and ecommerce firm Meesho, which are burning over $20 million dollars a month in pursuit of rapid growth, but investors contend that a late stage internet investor will take some of these aggressive bets, which is what marks it out from a private equity fund which goes for a lower risk but stable return model.

SoftBank founder Masayoshi Son gets along famously with big-thinking founders who focus less on the numbers and more on a world-changing vision. Son is famous for committing massive amounts of money after a single meeting, betting on a founder’s vision and audacity along with the muscle that billions of dollars can provide. For instance, Son committed over $4 billion to WeWork on a scrap of paper in a car ride in New York, following a a 12-minute meeting, according to Cult of We, a book about WeWork.

Juneja and his team, however, work differently. For many of its investments recently, including Unacademy, Eruditus, OfBusiness and Zeta, SoftBank executives have tracked and kept in touch with these founders for as long as 18 months before making an investment. SoftBank has passed up the opportunity to invest in these companies earlier at lower share prices, instead choosing to track a company’s performance longer and build conviction.

From 2015-18, SoftBank was also seen as the harbinger of unicorns, the one investor who underwrote a vision while the valuation could be whatever number the founder picked. Son-led SoftBank did not mind aggressive valuations on unrealistic multiples of revenue or GMV because he was betting on a decades-long tectonic shift in technology trends. In 2021, a year with over 40 new unicorns in India, the mythical creature has become passé. Unicorns have become a by-product, rather than the front and center of SoftBank’s strategy.

“They aren’t just jumping on the hot deals today. They want to take their time, and if the company finds another investor in that time, well, hard luck is how they look at it. They think there is enough money to be made without jumping headlong into something that’s tempting but not fully understood, that too at high valuations,” said a person who has worked with SoftBank on multiple deals.

For instance, SoftBank recently held early talks with Razorpay, which did not proceed further among other reasons because SoftBank balked at Razorpay’s asking price of $7 billion, more than double in six months or so. However, one person insisted that talks didn’t proceed because Razorpay was engaged seriously with other investors before SoftBank entered the fray. SoftBank is also investing in competing company JustPay, according to a report from The Economic Times.

Similarly, it held early conversations with Navi, the digital lender founded by Flipkart co-founder Sachin Bansal. But Bansal was expecting a valuation of about $3.5 billion earlier this year, which SoftBank couldn’t agree with, people said. Razorpay and Bansal did not comment.

SoftBank has also cut smaller cheques from its second Vision Fund, allowing it to enter companies far earlier, and at more reasonable valuations than it would from the first Vision Fund. Its average investment in a company fell from $943 million in to $192 million from the first fund to the second, a SoftBank investor presentation shows. Its ownership also came down from 22% to 15%, a positive sign for entrepreneurs wary of ceding control. SoftBank last week led a $50-million round in HR tech startup Sense, a deal size that was unheard of from its debut Vision Fund.

“SoftBank India has also got lucky to some extent. Their cheque sizes have been smaller this time in all countries, but it has really helped them in India, where the market size does not always allow you to absorb billions in capital. If $100 million is all you need, but $500 million is pushed down your throat in an emerging market, it can be a recipe for disaster,” said an investor.

The Masa Factor

Despite Juneja and his team’s prowess, founders say that ultimately, power at SoftBank resides with founder Son, followed by his deputies Rajeev Misra and Munish Verma. People close to SoftBank say that all investment calls are finally Son’s and that he speaks to every entrepreneur before SoftBank finalises an investment.

“The India team’s role is to act as a filter. They bring the good deals to Masa (as he is known internally and to founders) and can make suggestions, but he will make the final call. And that’s the final word,” a SoftBank-funded founder said. In some cases, Juneja and his team have brought a deal to Son, optimistic, but yet undecided because of sector-specific concerns, valuations or competitive environments. Son, whose energetic demeanor and futuristic thinking wows most entrepreneurs over, has told the team to “get the deal done,” giving the final go ahead, said the founder.

Moneycontrol spoke to six SoftBank-funded entrepreneurs about Son, and all of them are visibly blown away after a conversation with Son, whose approach is still based on macro future outlooks rather than numbers.

“Masa is in the top decile of people you will ever know. His ability to distill information and filter the noise from a five minute conversation is incredible. A conversation with him is never about the present, it is about what if. He is always thinking 5-10 years ahead,” said one founder.

Despite a shakeup such as WeWork, which laid bare the perils of excess capital, poor governance and burning money without profits, Son advises entrepreneurs to not focus on profits or EBITDA and chase growth, said three entrepreneurs.

“The India team is much more conservative. But Masa told me to go win the market and not focus on profits right now. He is the big thinker,” one added.

The power equations at SoftBank are concerning for entrepreneurs, who want board members who can take decisions quickly, without needing levels of approval. One company which became a unicorn recently decided not to raise money from SoftBank because the company was afraid that SoftBank will operate under Son’s whims, and that if he grows cold on the company, its fortunes will be severely dented.

While local investors even take board positions, make-or-break decisions at SoftBank boil down to Son, despite having a globe-spanning investment team of hundreds of people, founders say.

This is unlike venture firms such as Sequoia India or Accel India, where the local teams have complete control over investments, exits, operations and strategy. It is however similar to large private equity funds, where domestic investors cut cheques, but have to confer with overseas heads and global leaders before key investment decisions. People close to SoftBank said that while Son can be heavy-handed, the India team has shown that they are capable of making promising investments.

“With Sumer being promoted, he has a seat at the high table and is becoming a key person for SoftBank. That should alleviate some founders’ concerns,” another investor said.

Exits and past baggage

SoftBank has invested over $14 billion in India, nearly all of it in the last five years. Despite the last $3-4 billion being more cautiously invested than before, SoftBank’s reckoning will stem from whether its big bets on Paytm, Oyo and Ola will work. It has backed over 15 companies since Juneja joined, but in none of those has SoftBank bet the house the way it did with Paytm, Oyo and Ola, in which it has over $5 billion invested.

It made two exits recently - earning Rs 1,689 crore and Rs 1,875 crore from Paytm and Policybazaar Initial Public Offerings (IPOs). It also plans to sell Rs 750 crore in Delhivery’s IPO next year. These exits, aggregating to about $550 million, are still a fraction of its investments.

“SoftBank has more realistic expectations today. But if they don't make good returns from those early, big bets, it will be an indictment of a much-hyped strategy that changed how people look at tech investing,” a partner at a top venture fund said.

SoftBank’s India team has also been stable when over a dozen SoftBank partners have quit globally. Thirteen of the 23 investment partners listed on the Vision Fund’s website as of mid-2019 have since departed or recently announced they would leave, according to The Information.

SoftBank’s mood has often been seen as the bellwether for technology sentiment. Son’s debut Vision Fund led to other marquee investors such as Sequoia, Tiger, Insight and General Catalyst raise larger funds and adapt to the new game. This accompanied rising technology valuations, with private companies valued over $100 billion (Stripe, ByteDance).

Today, SoftBank isn’t looking so pretty anymore. For the quarter ended September, the Japanese company reported a net loss of $3.5 billion, led by China’s regulatory crackdown and falling valuations in the Vision Fund. South Korea’s Coupang, SoftBank’s breakout success the previous quarter, fell 33% during the latest quarter.

And yet, India’s internet industry is charging ahead with record unicorns, massive funding rounds, new billionaires and record salaries, when its largest investor has become more cautious.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!