BUSINESS

Tracking Q2 Results: 10 BSE 500 companies which saw biggest drop in sales

Real estate companies or chemical players are among the biggest revenue losers of Q2. The real estate sector is seeing rapid growth and the drop is numbers largely stems from how a company recognise revenue. The chemical sector, however, is in for a prolonged slowdown as prices and demand take a hit

BUSINESS

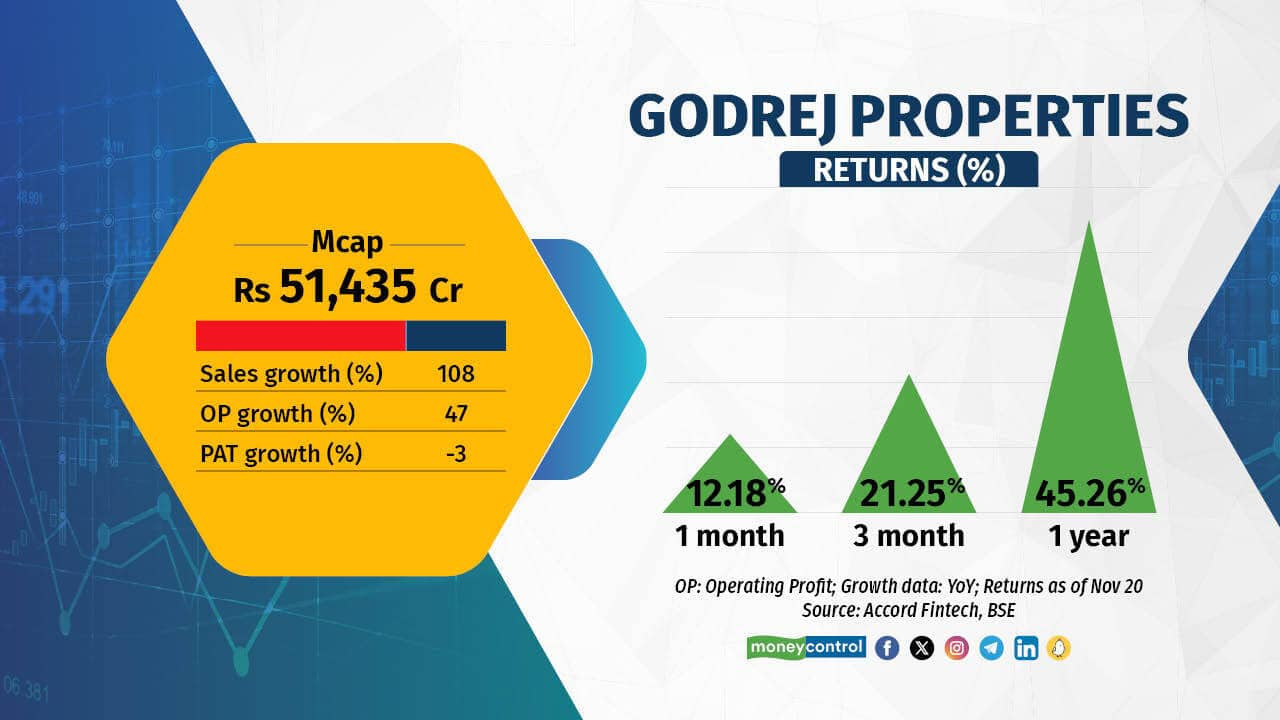

On the Q2 trail: 7 BSE 500 companies more than double their sales

BSE 500 index represents over 90 percent of the total market capitalisation on BSE and covers all major industries. These stocks are usually traded daily and have ample liquidity. This slideshow is part of seres that will analyse Q2 performance of these companies.

BUSINESS

MC investment tracker: Top smallcap stocks that LIC bought in Q2

Life Insurance Corp’s equity investments are worth well above Rs 10 lakh crore and are keenly tracked. The insurance giant’s investments range from marquee names, PSU stocks to smallcaps. Here’s a look at LIC’s smallcap shopping in Q2. We have used AMFI categorisation as the criterion to determine smallcap stocks. As of June, those below the market cap of Rs 17,400 crore are classified as smallcap stocks

BUSINESS

MC PMS Flow Tracker: Here are the funds that saw biggest inflows in September

Money seems to follow performance, at least as far as inflow into PMS funds in September is concerned. ICICI Prudential has got the lion's share of the inflows during the month, followed by some of the other top performers.

BUSINESS

MC PMS Flow Tracker: Here are the funds that saw biggest outflows in September

Big PMS funds tend to see higher outflow compared to smaller peers and September was no different. Relatively better performance of smaller PMS funds and profit-booking or migration of funds after a sharp rally in small and midcap segment abetted the ouflow

BUSINESS

Buzzing Stocks: IRCTC, Bombay Dyeing, NBCC, Venus Remedies & others in news today

Stocks to watch: Check out the companies making headlines before the opening bell, on September 14, 2023.

BUSINESS

Mapping Midcap Rush: These stocks saw returns outstrip earnings growth by the widest margin

Rally in midcaps has left the Street divided. One faction sees a “mad dash” happening in midcaps while the other believes the rally is far from over and the valuations are still catching up. No matter who is right, the fact is most stocks are getting re-rated on a daily basis, i.e., they are seeing their price multiples rising. This means stocks are delivering excess returns disproportionate to their earnings growth, leading to what some term as “froth”. Below are some names that have delivered maximum excess returns in the Nifty Midcap 100 index.

BUSINESS

Buzzing Stocks: L&T, RIL, Power Grid, Gallant Ispat, Laurus Labs, others in news

Stocks to watch: Check out the companies making headlines before the opening bell, on September 12, 2023.

BUSINESS

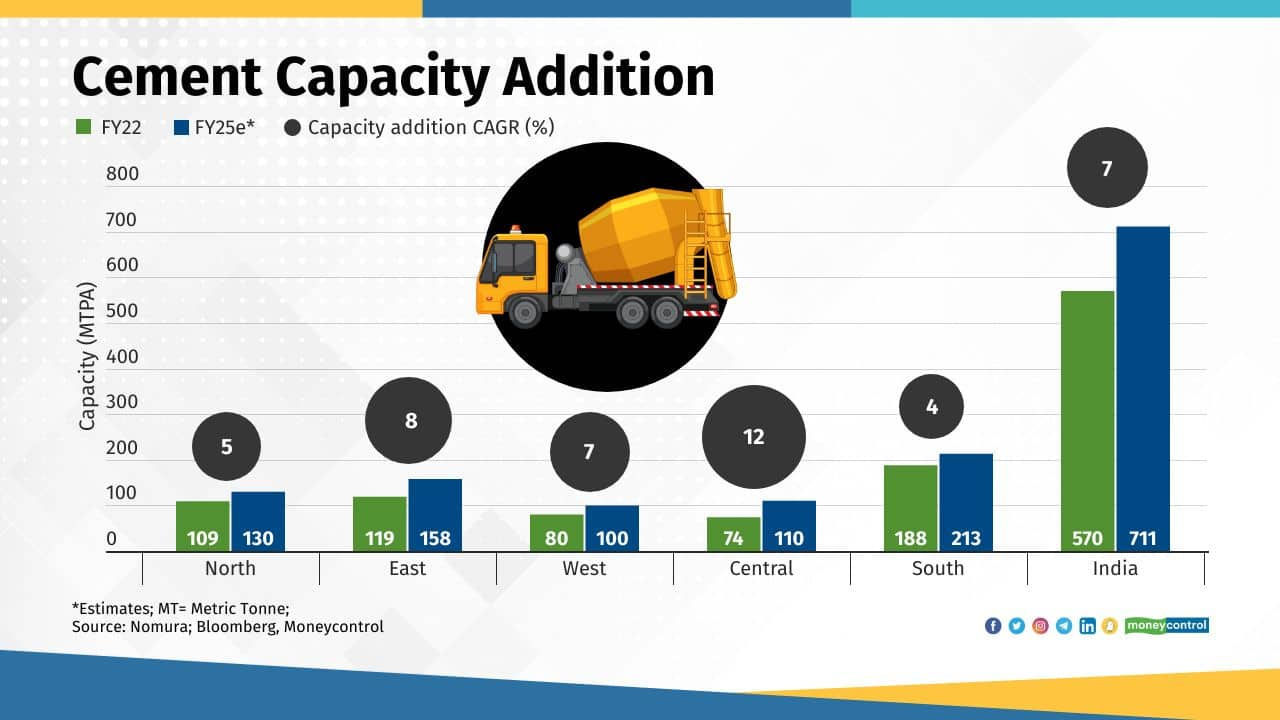

As cement industry sees surge in demand, which stock can deliver maximum returns?

As the monsoon recedes and the general election nears, cement companies have started hiking prices expecting a surge in demand. This is likely to improve the financial performance of cement companies. Investors have also started taking note of this fact. So, if you want to capitalise on this trend, where should you invest?

BUSINESS

Mapping the meteoric rise of Nifty stocks: What drove prices – earnings or enthusiasm?

One of the most quoted adages of the market is that stock prices are slave to earnings. But, are they? We analysed earnings of Nifty 50 companies since 2020, and their price performance to understand how much of that price rise can be explained by earnings and how much has come on the pack of momentum, herd buying or any other reasons.

BUSINESS

The dark side of the moon: 5 Nifty midcap stocks that have bled investor wealth

Stocks such as Union Bank of India, Indian Bank, REC, all of them PSUs, have delivered more than 100 percent returns in one-year period but there are some that have left investors poorer

BUSINESS

Buzzing Stocks: L&T, Tata Motors, SJVN, Relaxo Footwears, Bajaj Auto & others in news today

Stocks to Watch: Check out the companies making headlines before the opening bell today.

BUSINESS

F&O Manual: As Nifty inches closer to 19,500, time to hedge your longs

On the option front, put writers were dominant for the day.

BUSINESS

F&O Manual: All eyes on all time highs as massive short covering lifts mood

Analysts said the shift in expiry from Thursday to Wednesday may have triggered short covering in the Index today leading to rapid movement in it, post the announcement.

BUSINESS

F&O Manual: Inconclusive data warrants credit strategies, say analysts

The Nifty index is neither selling off, nor it is able to break the all-time high mark

BUSINESS

F&O Manual: Employ collar strategy to play rapidly changing market conditions

Call writers were a dominant force today as they pushed the index lower, a stark difference from last week.

BUSINESS

Buzzing Stocks: IKIO Lighting, BHEL, TVS Motor, Pitti Engg, Natco Pharma & others in focus

Stocks to Watch: Check out the companies making headlines before the opening bell today.

BUSINESS

F&O Manual: Selling pressure in Bank Nifty can put Put writers in a spot, say analysts

The Nifty experienced a bearish engulfing pattern, indicating a potential reversal of its previous bullish trend.

BUSINESS

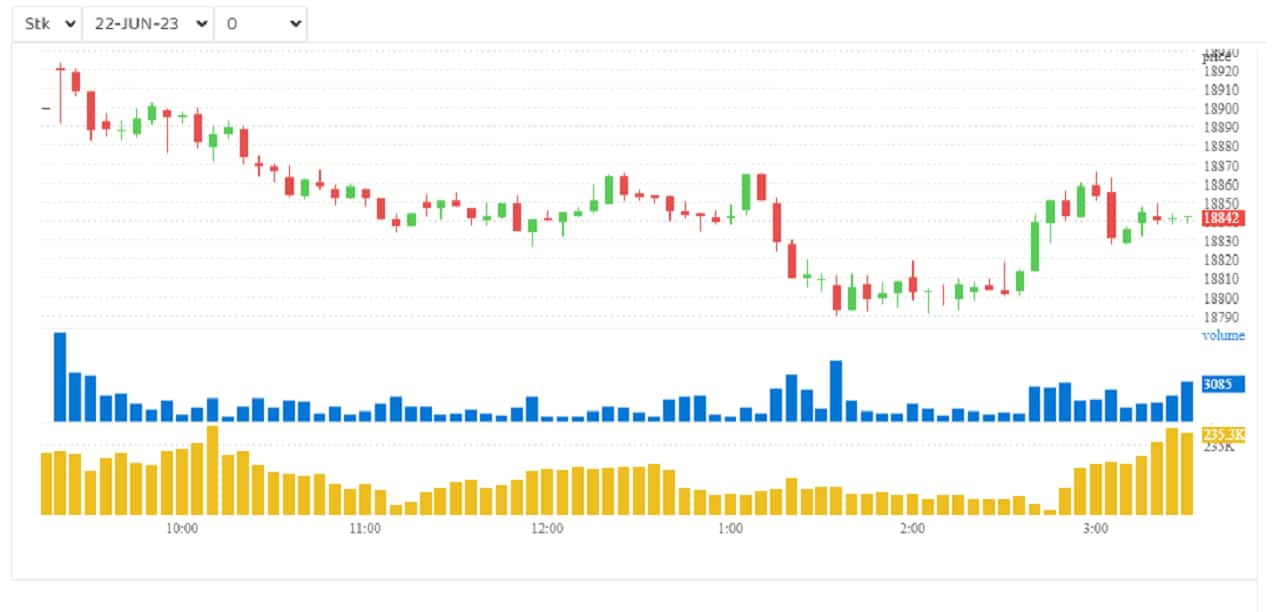

F&O Manual: Initiate bull call spreads for next week's expiry to play upside in Nifty

The Bank Nifty index continues to see open call writing positions for tomorrow's expiry as well as the June monthly expiry. Even if there is a short covering rally in this Index, the 44,500 and 45,000 calls for the June monthly expiry still have significant call writing present, underlined an analyst.

BUSINESS

F&O Manual: 43,700 crucial for Bank Nifty; analysts advise to be cautious

The Bank Nifty index has been trading in a sideways consolidation phase, indicating a lack of clear directional bias.

BUSINESS

F&O Manual: Breach below 43,700 on Bank Nifty may bring more bears to index

Following the RBI policy, the Bank Nifty index experienced persistent selling pressure around the 44,500 level.

BUSINESS

F&O Manual: Outlook bullish, near term bottom for Nifty shifts to 18,400

The Nifty index today saw huge put writing at the 18600 and the 18700 level for this week's expiry along with put writing even at the 18800 put leg for the June monthly expiry.

BUSINESS

F&O Manual: 18,700 likely to be tested in early hours on June 7

On the daily chart, a clear range between 18,450 and 18,700 is visible.

BUSINESS

F&O Manual: Expect consolidation in the next session as data gives mixed signals

The 18,700 level becomes an In-the-Money option signalling bullishness for the week, said analysts.