As cement industry sees surge in demand, which stock can deliver maximum returns?

As the monsoon recedes and the general election nears, cement companies have started hiking prices expecting a surge in demand. This is likely to improve the financial performance of cement companies. Investors have also started taking note of this fact. So, if you want to capitalise on this trend, where should you invest?

1/11

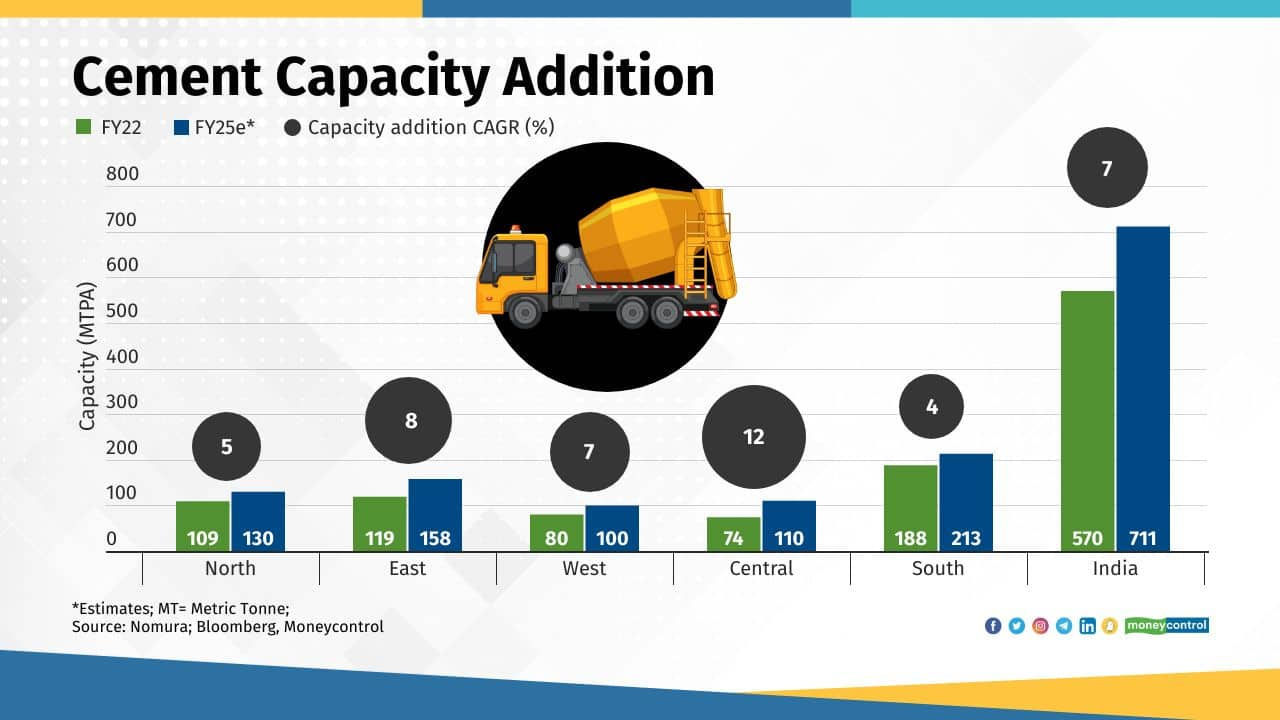

Expansion plans

According to an analysis by UBS Securities, the top 28 cement companies cumulatively want to add about 110 MTPA (million tonne per annum) of capacity over the next 2.5 years, while the incremental demand is likely to be about 70 MTPA. The expansions are planned across regions -- meaning that companies expect growth in demand from all regions of India.

According to an analysis by UBS Securities, the top 28 cement companies cumulatively want to add about 110 MTPA (million tonne per annum) of capacity over the next 2.5 years, while the incremental demand is likely to be about 70 MTPA. The expansions are planned across regions -- meaning that companies expect growth in demand from all regions of India.

2/11

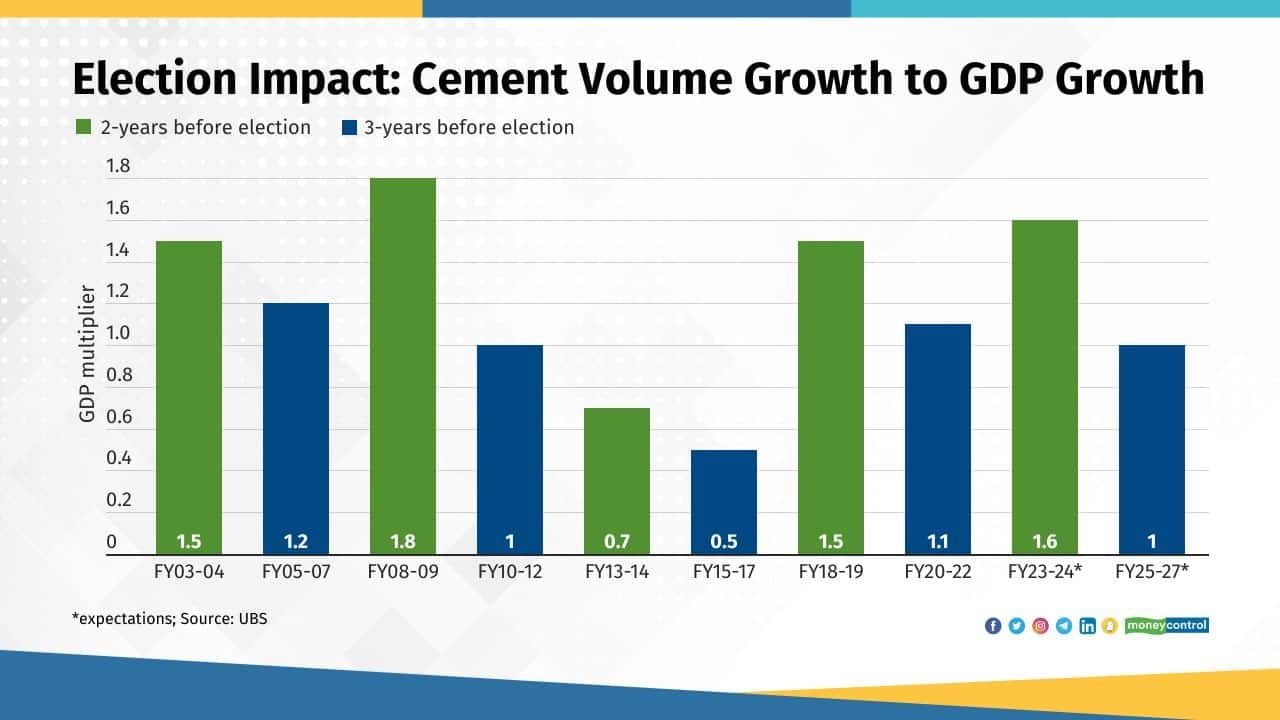

Election impact

Usually general elections bring good news for the industry, as it leads to higher government spending on public projects, and thus, higher demand. But, the growth simmers down after the elections. UBS expects cement volumes to grow 10% YoY in FY24 driven by the government's infrastructure push and robust real estate demand, but sees it moderating to 6% in FY25 -- closer to the real GDP growth rate. Chart shows cement demand in terms of GDP growth 2 years before, and 3 years after general elections.

Usually general elections bring good news for the industry, as it leads to higher government spending on public projects, and thus, higher demand. But, the growth simmers down after the elections. UBS expects cement volumes to grow 10% YoY in FY24 driven by the government's infrastructure push and robust real estate demand, but sees it moderating to 6% in FY25 -- closer to the real GDP growth rate. Chart shows cement demand in terms of GDP growth 2 years before, and 3 years after general elections.

3/11

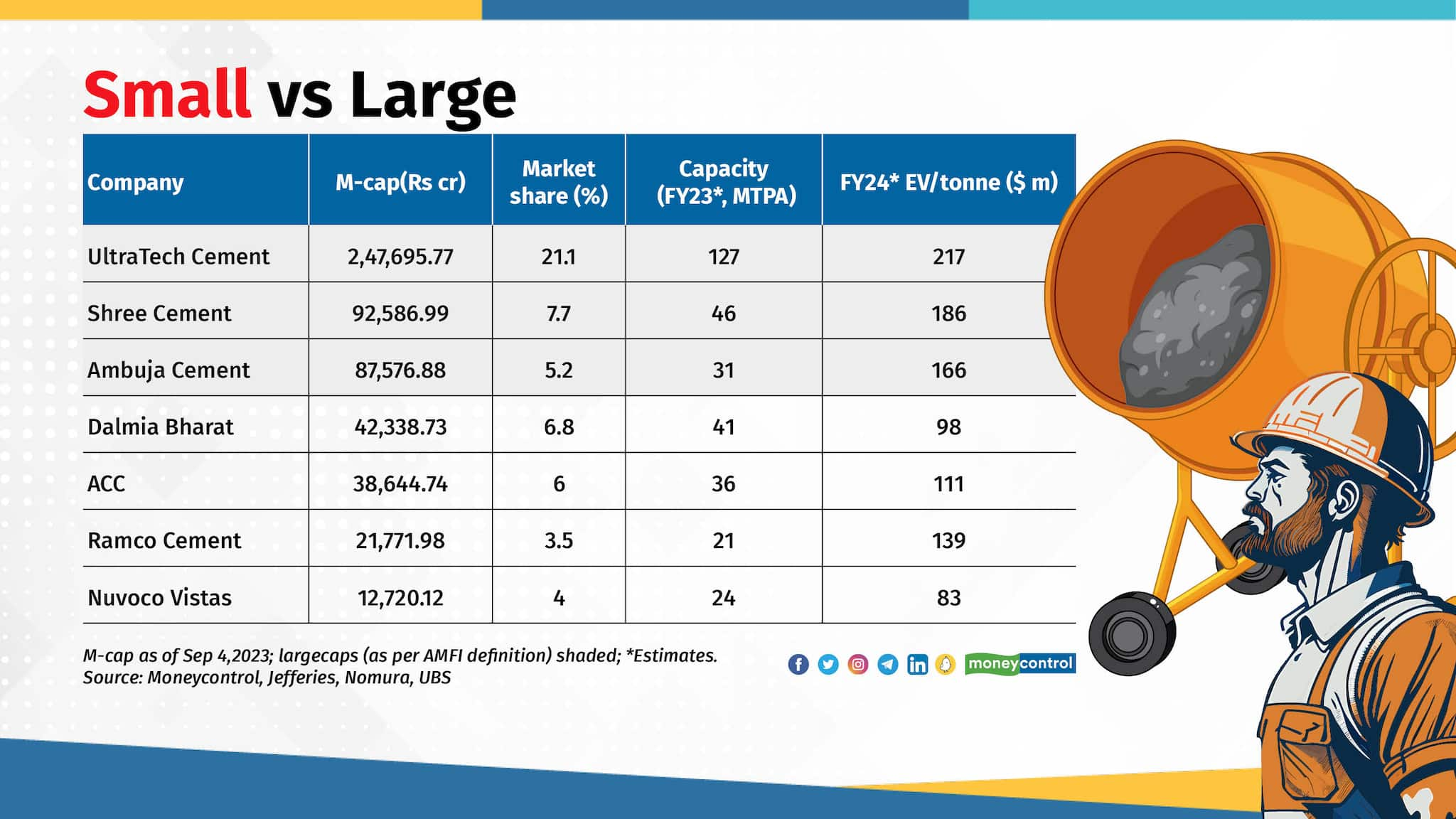

Valuation gap

The entire Indian cement sector is trading 1 standard deviation above its past 10-year average on EV/ tonne basis – at $140 million per tonne. Intense competition in the sector has failed to bring down the valuations. What is interesting is that almost all largecap cement companies are trading at expensive valuations compared to mid and smallcap counterparts -- well above replacement costs. Replacement cost refers to how much one has to spend to set up a 1 MTPA cement unit. Currently, it is around $100-120 million in India. Thus, a company trading below this could be a good value buy for investors (as well as competitors who would prefer to buy an already functioning plant than set one up as it will be cheaper). Replacement cost is also expressed as EV/tonne.

The entire Indian cement sector is trading 1 standard deviation above its past 10-year average on EV/ tonne basis – at $140 million per tonne. Intense competition in the sector has failed to bring down the valuations. What is interesting is that almost all largecap cement companies are trading at expensive valuations compared to mid and smallcap counterparts -- well above replacement costs. Replacement cost refers to how much one has to spend to set up a 1 MTPA cement unit. Currently, it is around $100-120 million in India. Thus, a company trading below this could be a good value buy for investors (as well as competitors who would prefer to buy an already functioning plant than set one up as it will be cheaper). Replacement cost is also expressed as EV/tonne.

4/11

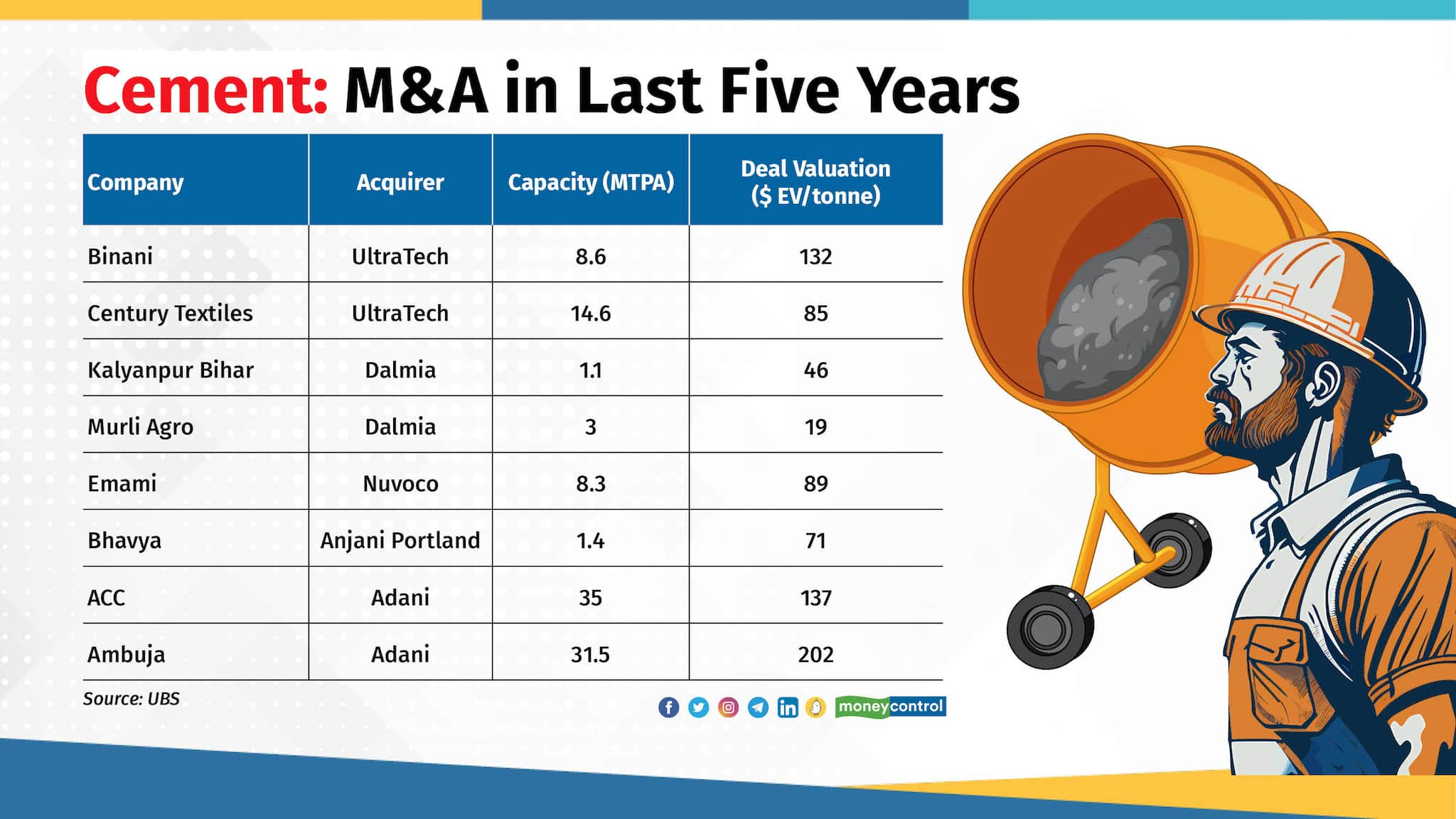

Likely M&A

When valuations are cheaper, and balance sheets are in shambles – companies become acquisition targets. The market, which is assigning hefty valuations to largecap players, believes a consolidation is likely wherein these players will acquire smaller, weaker players. The fact is that industry finances remain strong, and any potential material M&A could happen only at an expensive valuation. Not many of the well performing companies are up for grabs, leading to large players seeking greenfield expansion. In the past one decade, acquisitions have happened at an average price of $129 per million tonne.

When valuations are cheaper, and balance sheets are in shambles – companies become acquisition targets. The market, which is assigning hefty valuations to largecap players, believes a consolidation is likely wherein these players will acquire smaller, weaker players. The fact is that industry finances remain strong, and any potential material M&A could happen only at an expensive valuation. Not many of the well performing companies are up for grabs, leading to large players seeking greenfield expansion. In the past one decade, acquisitions have happened at an average price of $129 per million tonne.

5/11

UltraTech Cement

UltraTech Cement is the largest player and the most expensive one as well. However, there is no dearth of buyers given the company is among the most capital efficient cement firms with a strong balance sheet. Analysts believe the company will remain one of the biggest beneficiaries of the incremental demand, and with capacity addition in coming years will be ready to deal with any competition. However, they have reduced their expectations and see about 5 percent upside from current levels.

UltraTech Cement is the largest player and the most expensive one as well. However, there is no dearth of buyers given the company is among the most capital efficient cement firms with a strong balance sheet. Analysts believe the company will remain one of the biggest beneficiaries of the incremental demand, and with capacity addition in coming years will be ready to deal with any competition. However, they have reduced their expectations and see about 5 percent upside from current levels.

6/11

Shree Cement

Shree Cement is the stock where analysts are among the most pessimistic. Out of 44 analysts tracking the company, just 12 have a BUY rating. The consensus target price is 7 percent lower than the current prices. However investors have shrugged off the pessimism in the last couple of sessions, and the stock has seen heavy buying, especially after taking price hikes.

Shree Cement is the stock where analysts are among the most pessimistic. Out of 44 analysts tracking the company, just 12 have a BUY rating. The consensus target price is 7 percent lower than the current prices. However investors have shrugged off the pessimism in the last couple of sessions, and the stock has seen heavy buying, especially after taking price hikes.

7/11

Ambuja Cements

Ambuja Cements is one of the strongest cement players in the country both in terms of competitiveness and strength in the books with hardly any debt. It is also second most capital efficient. The Adani-owned stock is favoured by analysts, as 27 of them have a BUY call on Ambuja Cement while 10 have ‘hold’ rating.

Ambuja Cements is one of the strongest cement players in the country both in terms of competitiveness and strength in the books with hardly any debt. It is also second most capital efficient. The Adani-owned stock is favoured by analysts, as 27 of them have a BUY call on Ambuja Cement while 10 have ‘hold’ rating.

8/11

ACC

ACC is the second stock in the list owned by Adani Group, and also well liked by investors. Despite the company’s capital efficiency falling in the recent quarters, analysts are upbeat on its growth chart, which will likely come from capacity addition. The consensus sees about 5 percent upside from current levels.

ACC is the second stock in the list owned by Adani Group, and also well liked by investors. Despite the company’s capital efficiency falling in the recent quarters, analysts are upbeat on its growth chart, which will likely come from capacity addition. The consensus sees about 5 percent upside from current levels.

9/11

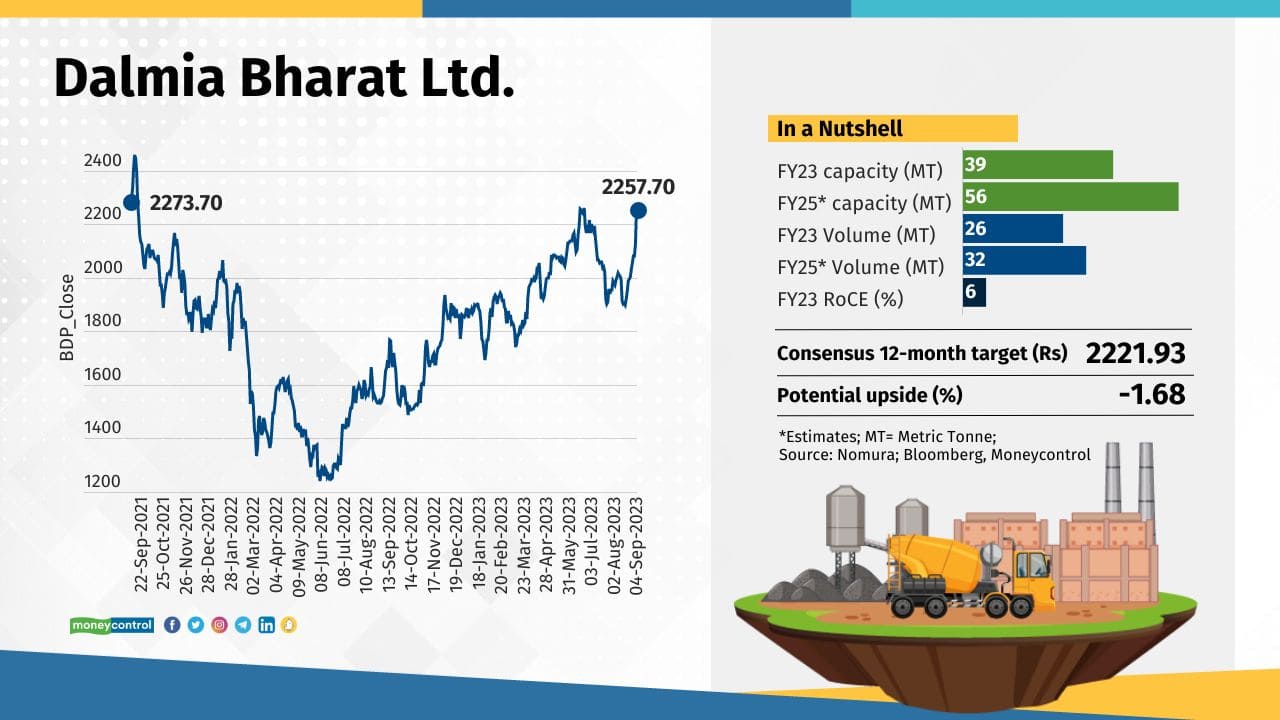

Dalmia Bharat

Dalmia Bharat, which is largely active in central India, has the most aggressive expansion plan among mid and smallcap cement companies. Analysts are also convinced by the narrative around the company with the overwhelming majority of them having BUY calls on the stock. The consensus upside seems to be limited though.

Dalmia Bharat, which is largely active in central India, has the most aggressive expansion plan among mid and smallcap cement companies. Analysts are also convinced by the narrative around the company with the overwhelming majority of them having BUY calls on the stock. The consensus upside seems to be limited though.

10/11

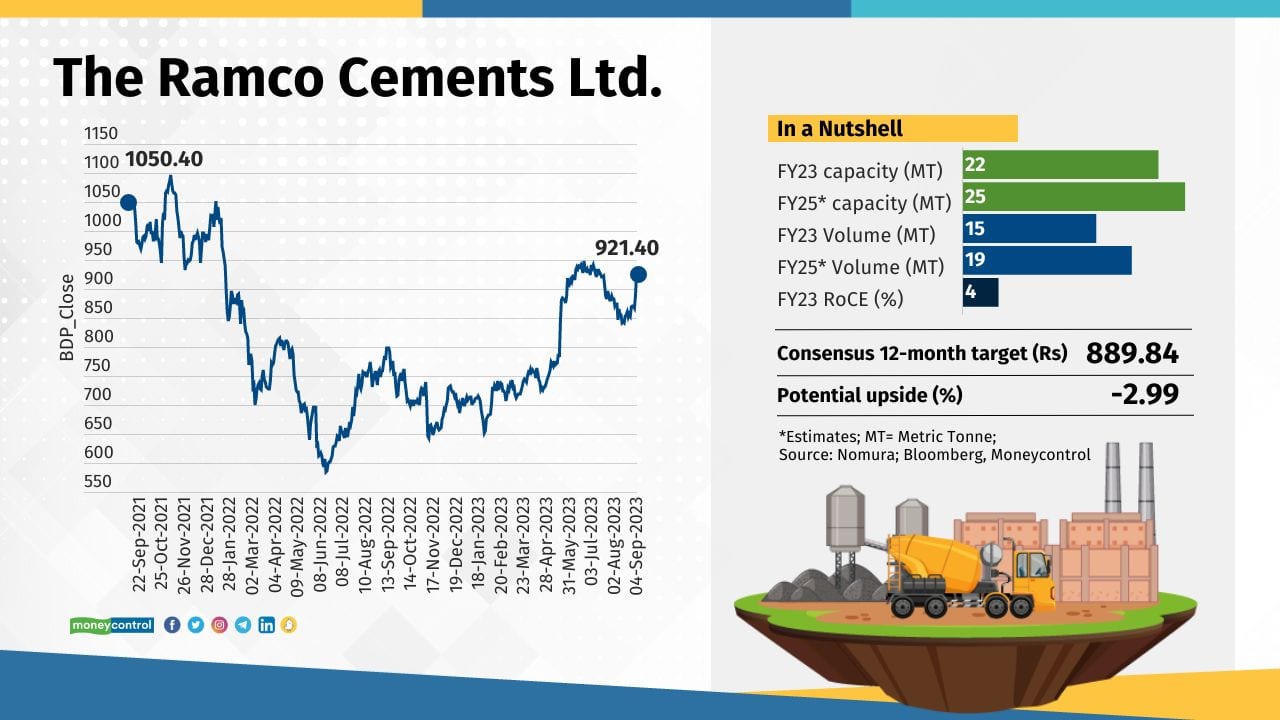

The Ramco Cements

The company’s profits fell last year, so did its capital efficiency. The company’s debt has also risen in recent years -- a matter of concern. But a slight relief is that it has not reached unsustainable levels. Analysts are rather mixed on the stock with bulls and bears equally divided.

The company’s profits fell last year, so did its capital efficiency. The company’s debt has also risen in recent years -- a matter of concern. But a slight relief is that it has not reached unsustainable levels. Analysts are rather mixed on the stock with bulls and bears equally divided.

11/11

Novoco Vistas

Novoco Vistas has been cutting down its debt aggressively, while maintaining its growth plans. The company’s free cash flow has also improved significantly. These positives are leading analysts to have a favourable impression of the stock in the long term.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Novoco Vistas has been cutting down its debt aggressively, while maintaining its growth plans. The company’s free cash flow has also improved significantly. These positives are leading analysts to have a favourable impression of the stock in the long term.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!