Tracking Q2 Results: 10 BSE 500 companies which saw biggest drop in sales

Real estate companies or chemical players are among the biggest revenue losers of Q2. The real estate sector is seeing rapid growth and the drop is numbers largely stems from how a company recognise revenue. The chemical sector, however, is in for a prolonged slowdown as prices and demand take a hit

1/10

Among BSE 500 companies, Mahindra Lifespaces reported the sharpest decline in revenue in the second quarter of this fiscal at Rs 18 crore but is unlikely to derail the momentum for the stock. The company continues to see high pre-bookings. It achieved a quarterly pre-sale of Rs 455 crore against the previous quarter's Rs 399 crore, giving it revenue visibility.

2/10

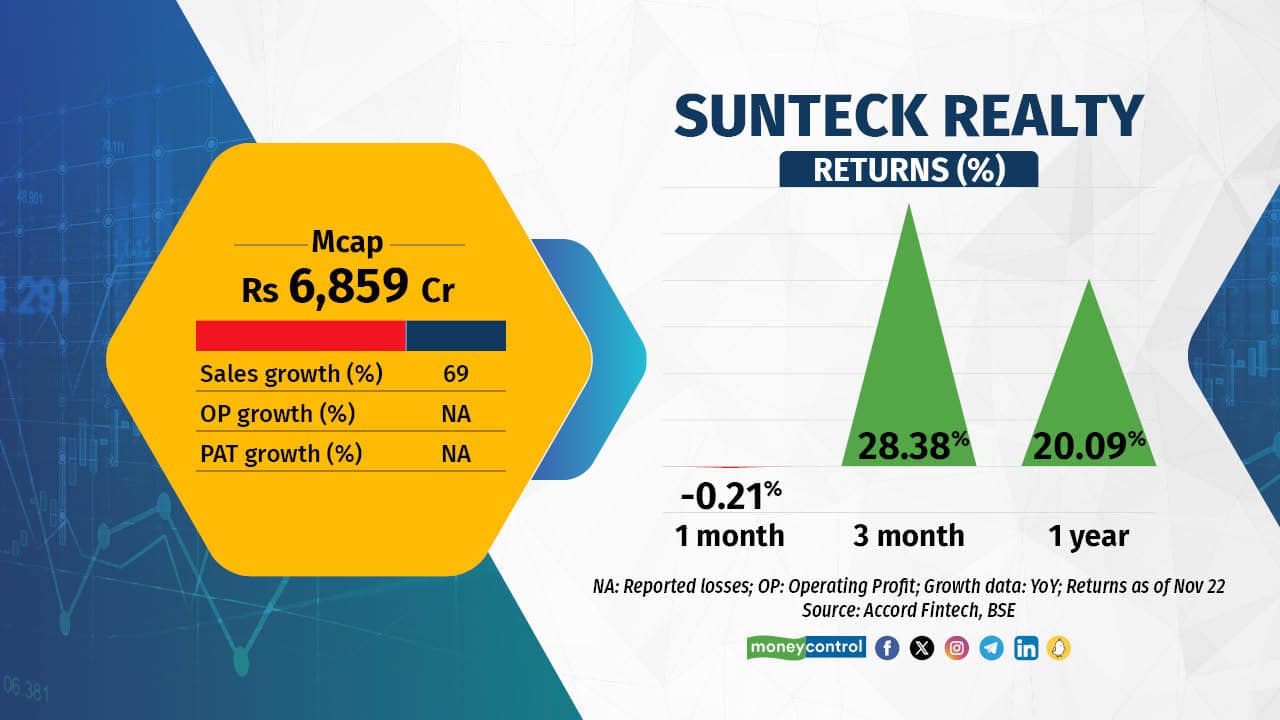

Another real estate company finds itself among the top three to see the biggest drop in sales in the September quarter. Sunteck Realty sales dropped by Rs 25 crore. The company said since it uses the project completion method to "recognise" the revenue, up to Rs 850 crore of it will be added by the end of FY24, thus this drop was likely because of higher recognition in the base quarter. On the side of presales, the company said it continued to see bumper traction.

3/10

Rajesh Exports is one of the largest traders of gold and other precious gems and materials. Although the company has been quiet over the reason for the drop in sales and profit, on the face of it, it seems the company had fewer transactions this quarter. A lean marriage season could be a reason. The company, however, did say it has a strong order book of Rs 46,231.5 crore, meaning revenue, which stood at Rs 38,066 crore, is likely to improve in the current quarter.

4/10

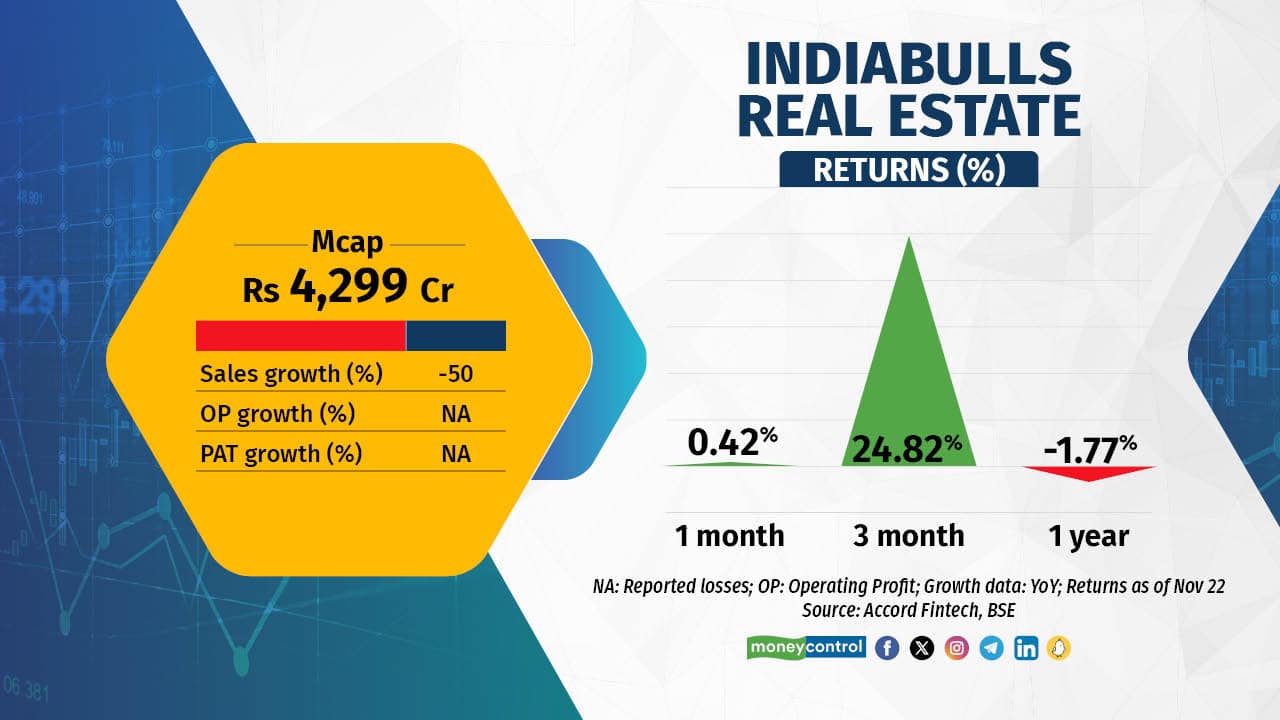

Indiabulls Real Estate is another real estate player on the list. It not only saw a sharp drop in sales at Rs 96 crore but also reported losses at net and operating levels. The company added that its pre-sales have grown, even as new bookings have come down. Investors also seem to have shown confidence, as the stock has delivered decent returns in the near term.

5/10

Aegis Logistics is in the business of importing and distributing liquified petroleum gas and providing storage and terminal facilities for LPG and chemical products. The drop in sales to Rs 1,235 crore largely seems to be impacted by a drop in international prices of gas. This is substantiated by strong growth in profits. Investors, though, have been lukewarm on the company’s prospects.

6/10

Fine Organic is among the worst-performing major chemical companies, seeing more than a 40 percent drop in sales at Rs 540 crore. Its operating profit and profit also tanked over 40 percent in the quarter gone by. It manufactures and markets a wide range of oleochemical-based additives used in foods, plastics, cosmetics, and coatings. Its business is heavily impacted by the fluctuation in vegetable oil prices that it uses as raw material. Moreover, the slowdown in the chemical sector has also hit it hard.

7/10

Adani Enterprises has seen a sharp drop in revenue to Rs 22,517 crore, largely on a decline in coal prices. The company is used as an incubator for all of the new businesses and experiments of the Adani Group. For Q2, its airport business has done relatively better than other segments.

8/10

Balaji Amines is another chemical company hit by the slowdown in the chemical sector. The company faced “a series of unprecedented challenges” which has “impacted (its) revenue streams” with its sales falling to Rs 381 crore. The company said global industry players are destocking and it is a trend that has been observed in this quarter as well. Recovery seems some distance away.

9/10

Chambal Fertiliser, despite a drop in sales to Rs 5,386 crore, has delivered strong profit numbers. The drop in revenue was likely due to a fall in the price of phosphatic fertilisers. The company said sales volumes were higher sequentially. The company has also seen fast payment of subsidy amounts that boosted the numbers.

10/10

Gujarat Fluorochemicals said its performance in all three business segments was hit due to a drop in international prices of chemicals and destocking, which led to sales falling to Rs 947 crore. The company expects a reversal, as it believes prices have hit the bottom. Expected phasing out of destocking, a pickup in demand in the US and the positive impact of the exit of legacy players are likely to be key drivers of recovery, the firm said.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!