MC investment tracker: Top smallcap stocks that LIC bought in Q2

Life Insurance Corp’s equity investments are worth well above Rs 10 lakh crore and are keenly tracked. The insurance giant’s investments range from marquee names, PSU stocks to smallcaps. Here’s a look at LIC’s smallcap shopping in Q2. We have used AMFI categorisation as the criterion to determine smallcap stocks. As of June, those below the market cap of Rs 17,400 crore are classified as smallcap stocks

1/7

Life Insurance Corporations (LIC) of India is the largest domestic institutional investor, often taking strategic positions in stocks. Its actions are actively tracked to see where the smart money is following. This is especially true when it comes to smallcap stocks. In the second quarter, LIC bought additional stakes in several companies. Prominent (where shares bought were more than 1,000) among them are:

2/7

Mahanagar Gas Ltd is engaged in the business of city gas distribution (CGD), presently supplying natural gas in Mumbai and adjoining areas including Raigad in Maharashtra. LIC already held about 8.3 percent stake in the company and added further to take the stake to 9.48 percent, showing its confidence in the company.

3/7

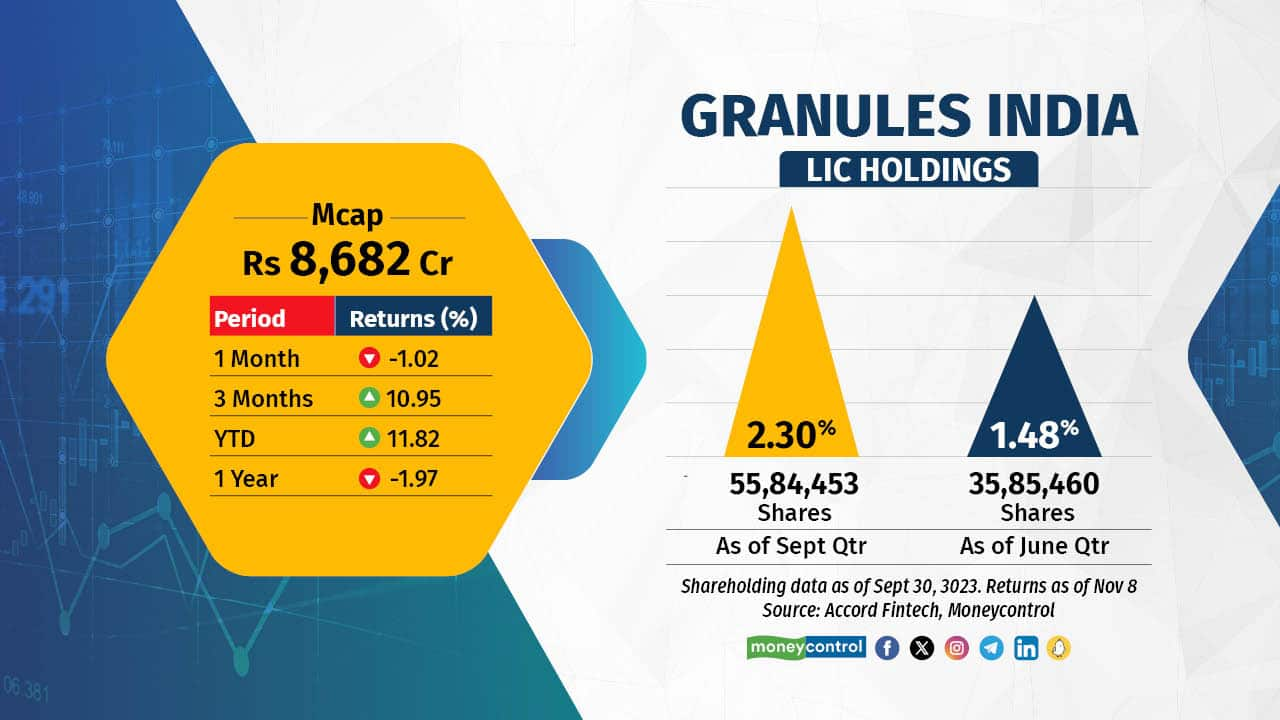

Granules India manufactures and sells Active Pharma Ingredients (APIs), Pharmaceutical Formulation Intermediates (PFIs) and finished dosages, serving a multitude of pharma majors in India and abroad. The company is a big beneficiary of improving outlook for pharma companies. The stock, thus, has done well so far this year.

4/7

DCM Shriram is engaged in the business of manufacturing fertilisers, Chloro Vinyl & Cement. Though the stock has performed poorly in the near term owing to turmoil in the chemical space, it offer LIC an opportunity to add more to its already significant stake as a public investor.

5/7

This asset manager is one company that LIC has been raising its stake in. The insurance giant purchased 1.3 lakh shares of Aditya Birla Sun Life AMC during the quarter. The outlook for most players in the mutual fund industry is positive, as analysts believe they will benefit from ever-rising SIP investment. With low penetration of mutual funds in the country, companies like ABSL AMC have a long growth path.

6/7

LIC bought about 4 lakh shares of the electricity marketplace during the quarter, shareholding disclosure made by the company shows. The stock though has not performed well in the near term. The company has been seeing a surge in trading volume, with October volume rising 18 percent.

7/7

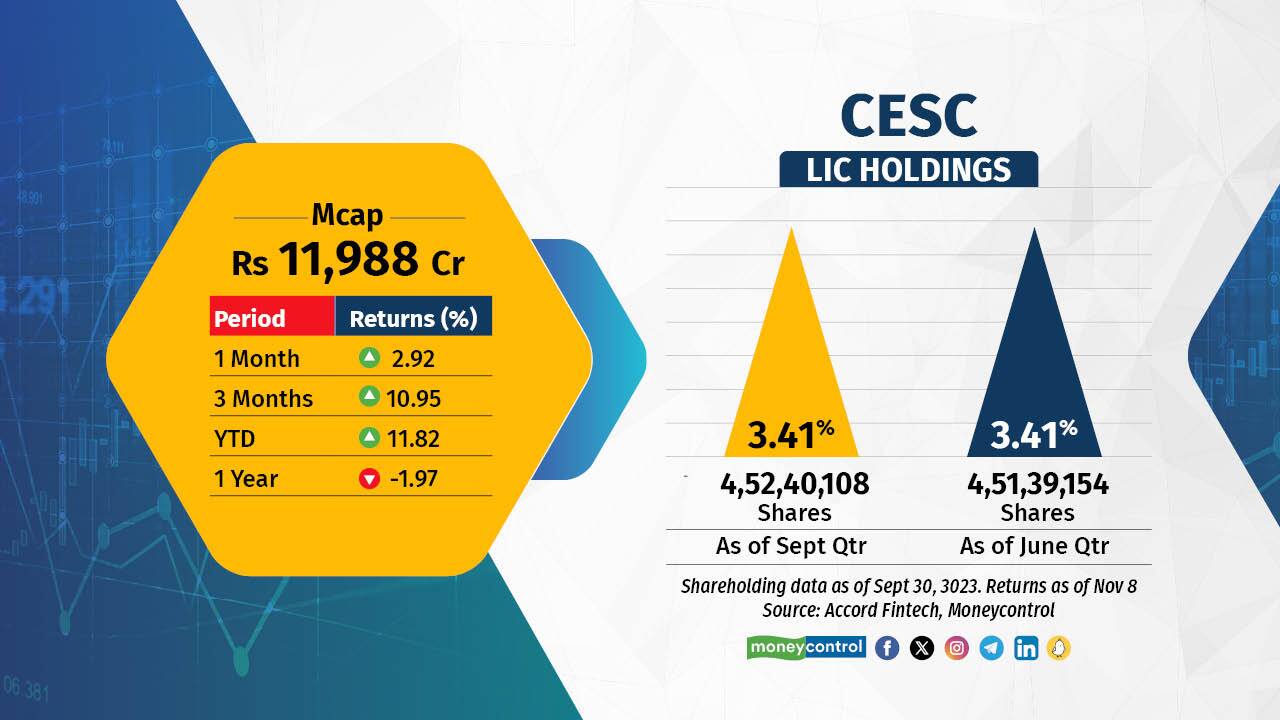

The Kolkata-based electricity supplier is another utility company in which LIC increased its stake, though not by a significant margin. LIC bought about 1 lakh shares of the RP-Sanjiv Goenka Group company during the July-September period. The company’s low valuations (P/B at around 1.1 and P/E at about 13) make it an attractive bet for long-term growth as India’s electricity consultation rises further.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!