F&O Manual: Breach below 43,700 on Bank Nifty may bring more bears to index

Following the RBI policy, the Bank Nifty index experienced persistent selling pressure around the 44,500 level.

1/5

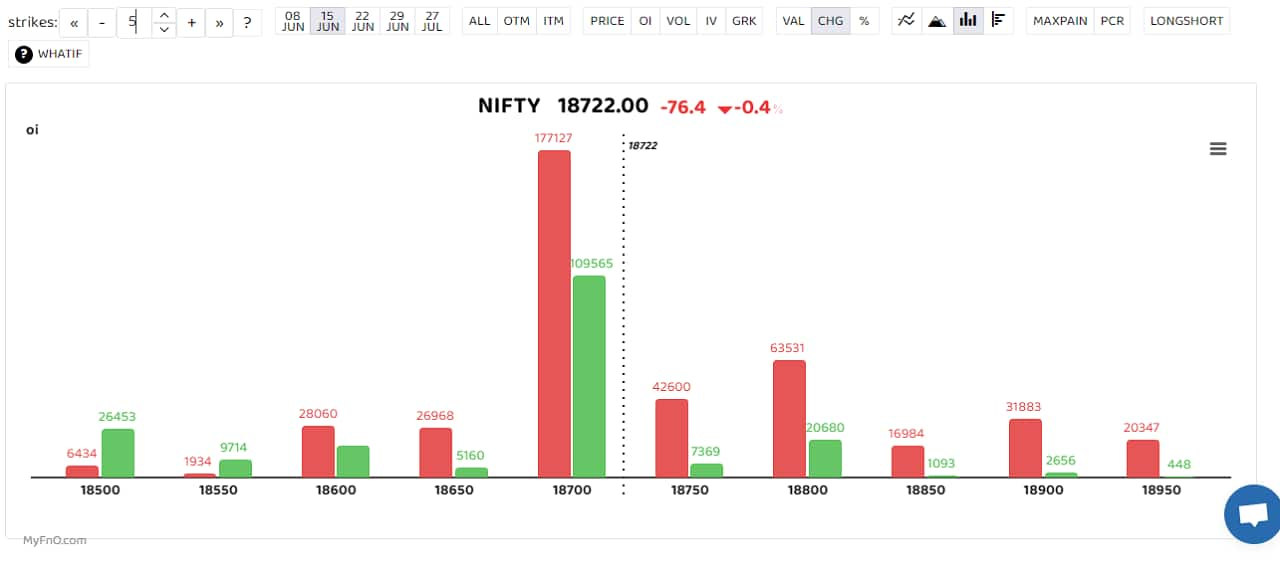

Markets traded volatile on the weekly expiry day that coincided with the RBI policy meet outcome. The beginning was upbeat but profit taking in heavyweights across sectors pared all the gains and pushed the index into the red. The Nifty closed down 91.85 points or 0.49 percent at 18,634.55. (Blue bars show volume and golden bars open interest (OI).)

2/5

For June 15 expiry, the fight is on for gaining supremacy around 18,700 level that has seen heavy call writing along with considerable put writing, signalling a plethora off Straddle trades at this level. Though hurdles are present at subsequent strikes of 18,750 and 18,800. “Markets have been gradually inching higher but mixed global cues combined with continued underperformance from the banking pack capping the momentum. Amid all, we suggest keeping a positive tone while maintaining focus on trade management,” said Ajit Mishra, SVP - Technical Research, Religare Broking. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

3/5

Following the RBI policy, the Bank Nifty index experienced persistent selling pressure around the 44,500 level. “In terms of support levels, the index has a support level positioned at 43,700. This level is crucial as a breach below it could intensify the selling pressure in the market. A breach below this support level might indicate a further downside potential and could attract additional selling interest from traders and investors. The index is stuck in a range and a break on either side will have directional move,” said Rupak De, Senior Technical Analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

4/5

Astral saw a long buildup with open interest rising 17 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Dixon Technologies, NTPC and JSW Steel were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

5/5

Tata Communication was among those that saw short buildup with open interest jumping 28 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!