F&O Manual: Expect consolidation in the next session as data gives mixed signals

The 18,700 level becomes an In-the-Money option signalling bullishness for the week, said analysts.

1/5

Despite international crude oil prices ticking up, Indian equities managed to close with gains thanks to the end to the US debt ceiling uncertainty and expectations of a rate hike pause by the US Fed. Banking, financial & other rate-sensitive stocks may witness sharp movements ahead of the RBI’s credit policy later this week. The Nifty rose 0.32 percent or 59.75 points to 18,593.85. (Blue bars show volume and golden bars open interest (OI).)

2/5

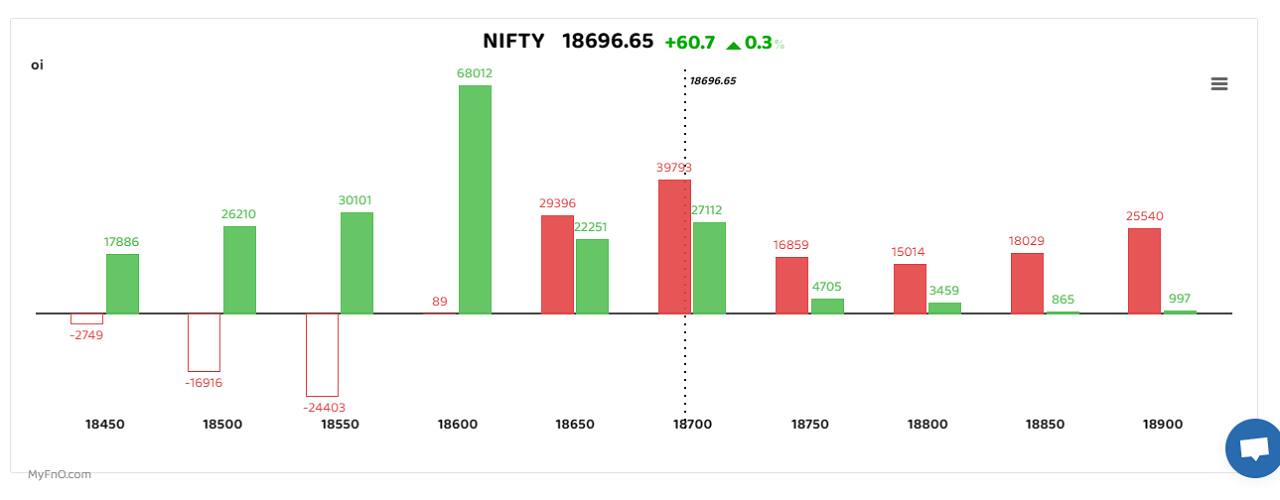

The Nifty Index today saw put writing at the 18,600 and the 18,700 levels. The 18,700 level becomes an In-the-Money option signalling bullishness for the week, said analysts. “The closing candle although today was not a great one. It symbolises a spinning top which is coming on top of a rally. A spinning top formation on top of the rally is usually a sign of a correction which is contrary to what the OI data is suggesting. Both the mixed signals should be read at a possibility of a consolidation phase to continue for this week’s expiry,” said Rahul Ghose, Founder & CEO – Hedged. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

3/5

The Bank Nifty’s move was choppy which suggests that market participants were cautious and waiting for guidance from the central bank. The performance of HDFC twins influenced the overall movement of the index. “Based on the current scenario, the Bank Nifty index is expected to continue to trade within the range of 43,700-44,300. This suggests that the index is likely to move sideways, lacking a clear trend. However, it's important to note that a break on either side of this range can lead to a directional move, potentially indicating a shift in the market sentiment and momentum,” said Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

4/5

India Cement saw a long buildup with open interest rising 20 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. M&M, Hindustan Aeronautics and Zee Entertainment were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

5/5

Manappuram Finance was among those that saw a short buildup with open interest jumping 3 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!