BUSINESS

Copper futures remain flat at Rs 597.75 per kg on muted global cues

In the futures market, copper for February delivery touched an intraday high of Rs 600.90 and a low of Rs 594.55 per kg on the MCX.

BUSINESS

Gold prices drop for 4th day to Rs 47,452/10 gm on rising bond yield, silver slips by Rs 481 per kg

The dollar hit its highest in over two months whereas benchmark 10-year Treasury yield rose to its highest in over three weeks, putting pressure on bullion.

BUSINESS

Crude oil futures rise 0.71% to Rs 4,099 on improved demand, WTI trades above $56 a barrel

In the futures market, crude oil for February delivery touched an intraday high of Rs 4,106 and an intraday low of Rs 4,083 per barrel on MCX.

BUSINESS

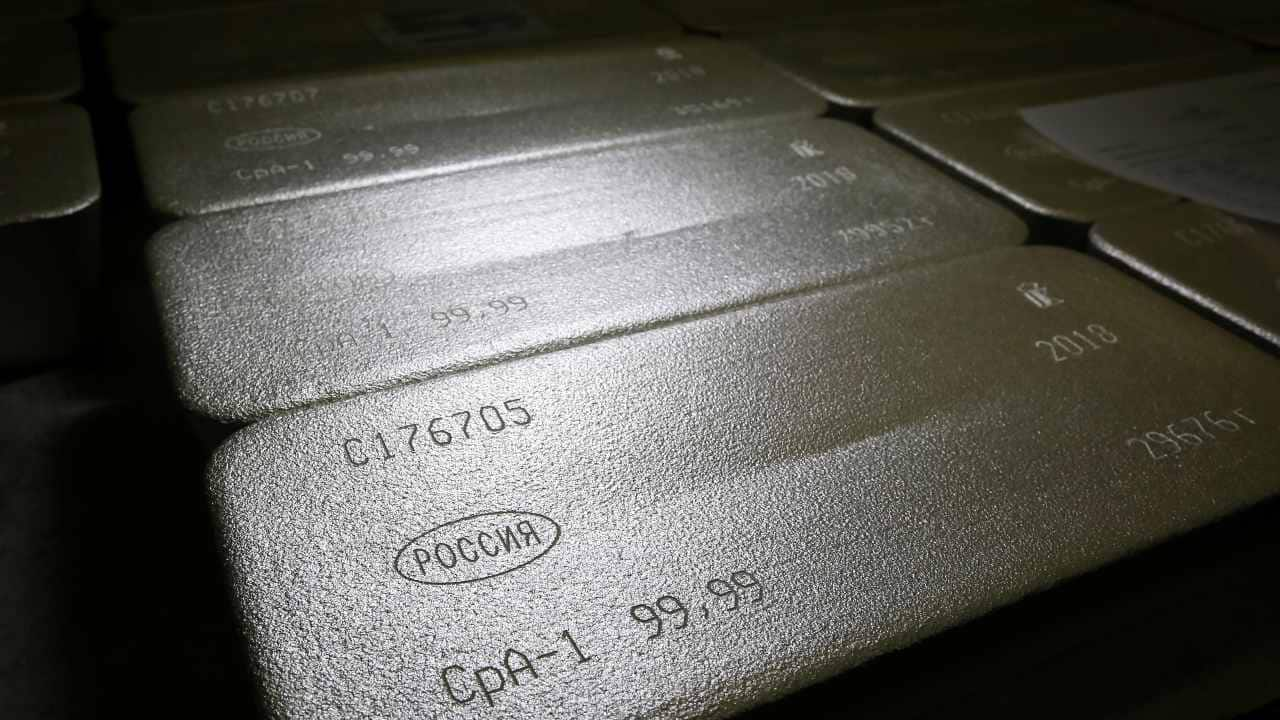

Silver futures slump 1.23% to Rs 67,724 per kg on firm dollar

Technically, MCX Silver March holds the support of 21-Daily Moving Average at Rs 67,300 levels. The range for the rest of the session will be between Rs 67,000-69,800 levels, said Iyer.

BUSINESS

Natural gas falls 1.32% ahead of inventory report, Choice Broking says trend bullish for coming weeks

In the futures market, natural gas for February delivery touched an intraday high of Rs 203.80 and an intraday low of Rs 199.70 per mmBtu on MCX.

BUSINESS

Copper futures rise 0.54% to Rs 594.05 per kg on lower inventory

In the futures market, copper for February delivery touched an intraday high of Rs 596.50 and a low of Rs 587.75 per kg on the MCX.

BUSINESS

Gold prices continue downtrend on firm dollar to Rs 47,976/10 gm, silver drops Rs 2,806 a kg

The broader range on COMEX could be between $1,820-1,860 and on the domestic front, prices could hover in the range of Rs 47,700- 48,300, said Navneet Damani, Vice President, Motilal Oswal.

BUSINESS

Crude oil futures up 0.55% to Rs 4,027 on inventory drawdown, Brent inches near $58/bbl

Crude oil was supported by severe cold weather in US Northeast boosting demand for heating fuels.

BUSINESS

Silver price recovers to Rs 68,096 per kg after sharp fall in previous session

In the futures market, silver for March delivery touched an intraday high of Rs 69,147 and a low of Rs 68,048 per kg on the MCX.

BUSINESS

Steel price spike due to unanticipated rise in demand: S&P Global Platts

Keith Tan said the customs duty exemption announced in Budget 2021 could give India’s national scrap policy a boost by exposing buyers to greater volumes and varieties of scrap from various origins, which would compete with and spur the domestic scrap collection and processing industry.

BUSINESS

Natural gas futures down 1.74% after a sharp rally in last few days

In the futures market, natural gas for February delivery touched an intraday high of Rs 211.60 and an intraday low of Rs 205.20 per mmBtu on the MCX.

BUSINESS

MCX Copper futures flat at Rs 593.60 per kg; bearish momentum likely to continue

In the futures market, copper for February delivery touched an intra-day high of Rs 596.45 and a low of Rs 588.15 per kg on the MCX.

BUSINESS

Gold prices down for second day in a row, silver tanks Rs 2,741 per kg

The broader range on COMEX could be between $1,835- $1,865 and on the domestic front prices could hover in the range of Rs 47,800 - Rs 48,450, said Damani.

BUSINESS

Crude oil futures rise 2.15% to Rs 3,989; Brent trades above $57 a barrel

In the futures market, crude oil for February delivery touched an intraday high of Rs 3,992 and an intraday low of Rs 3,944 per barrel on MCX.

BUSINESS

Silver prices drop nearly Rs 3,000 a kg on long unwinding, increased margins and weak global cues

The spot gold/silver ratio currently stands at 66.73 to 1 indicating that gold has outperformed silver.

BUSINESS

Natural gas futures jump 3.26% to Rs 215.10 per mmBtu on demand uptick

In the futures market, natural gas for February delivery touched an intraday high of Rs 216.50 and an intraday low of Rs 205.60 per mmBtu on MCX.

BUSINESS

Natural gas futures climb 6.21% to Rs 203.40 per mmBtu on positive global cues

In the futures market, natural gas for February delivery touched an intraday high of Rs 202.90 and an intraday low of Rs 191.80 per mmBtu on the MCX.

BUSINESS

Gold prices down Rs 450 at Rs 48,745/10 gm, silver surges above Rs 73,043 a kg

The gold/silver ratio currently stands at 66.73 to 1, which means the number of silver ounces required to buy one ounce of gold.

BUSINESS

Market experts and jewellery industry welcome duty cut in gold; price falls nearly 2%

India is the world’s second-largest gold consumer after China. India is slashing the rate for the first time in eight years to curb smuggling of the yellow metal into the country.

BUSINESS

Crude oil futures jump nearly 1% to Rs 3,858 per barrel on vaccine optimism

In the futures market, crude oil for February delivery touched an intraday high of Rs 3,858 and an intraday low of Rs 3,825 per barrel on the MCX.

BUSINESS

Union Budget 2021: FM Nirmala Sitharaman slashes custom duty to 7.5% on gold; MCX Gold prices slide 2.49%

The gold and diamond jewelry trade contribute 7.5 percent of the country's GDP and 14 percent of the country's total exports. As many as 60 lakh people are employed in this sector.

BUSINESS

Silver futures soar to Rs 73,645 per kg on strong demand; up nearly 15% since January 28

In the futures market, silver for March delivery touched an intra-day high of Rs 73,888 and a low of Rs 71,650 per kg on the MCX.

BUSINESS

Gold, silver weekly outlook | Tips for investors and key events to watch out for

Technically, LBMA Gold Spot gave a sharp correction from $1,875 where it ended near 200-DMA, indicating a bearish momentum in the coming week.

BUSINESS

Gold prices steady this week, silver soars 4.69% on retail frenzy

Gold holdings in SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, fell by 4.66 tonnes to 1,160.13 tonnes.