BUSINESS

Markets flooded with IPOs – Why caution is warranted

Potential investors need to exercise more caution on the recent IPOs as many of these listing pops would turn out to be short-lived

BUSINESS

Dalmia Bharat -- Ambitious growth plan gets premium valuation match

The management of Dalmia Bharat has executed its growth strategy well and is ambitiously aiming to grow at a 15-20 per cent CAGR over the long term

BUSINESS

Dixon Technologies: Multiple catalysts to drive up growth

From an earnings perspective, FY22 could be another strong year for Dixon, owing to the commencement of the new manufacturing capacities and the addition of new clientele

BUSINESS

Ambuja Cements Q2 CY21: Strong margins a welcome surprise

The commencement of new capacity augurs well over the medium term for Ambuja Cements

BUSINESS

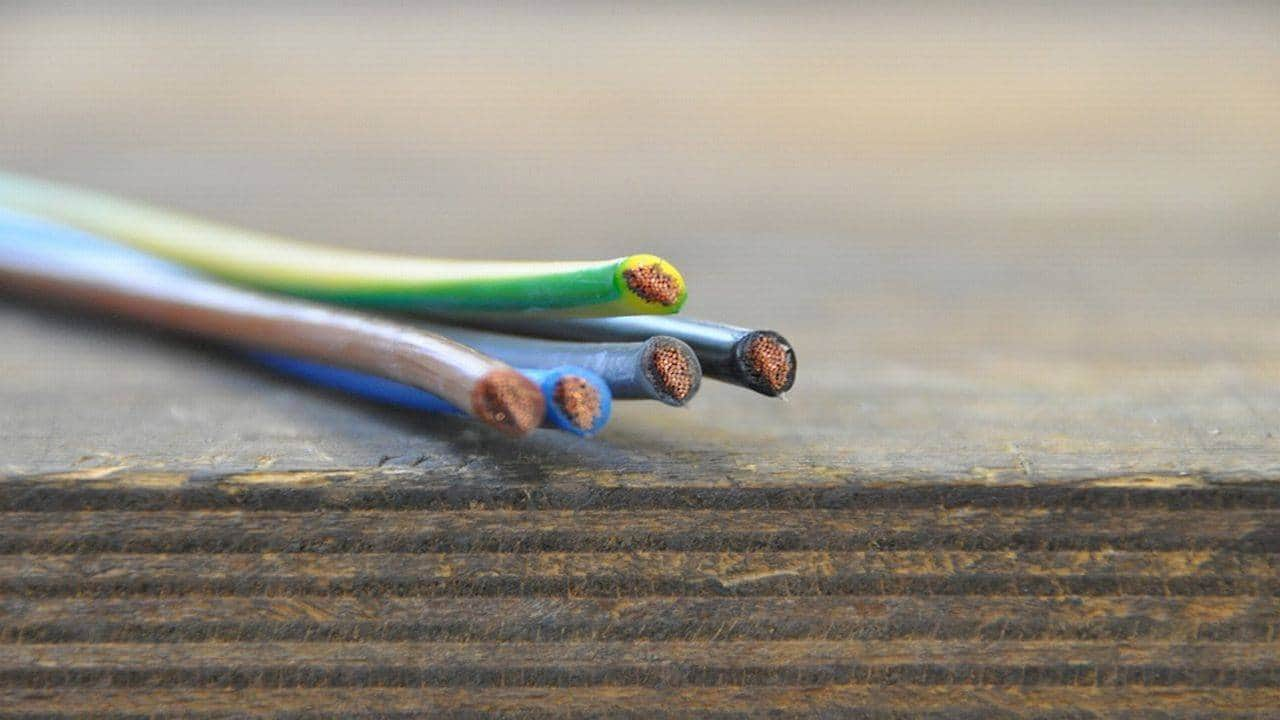

Havells or Polycab: Which one to choose?

Demand conditions for the electrical and the consumer durable sectors continue to remain challenging owing to Covid disruptions.

BUSINESS

UltraTech – A market leader that continues to deliver

UltraTech has been consistently generating free cash flow, which has helped it improve its leverage profile

BUSINESS

Asian Paints: A sector superstar, but $40-billion valuation raises eyebrows

Asian Paints is gradually expanding its product range from paints to other categories with an aim to beautify, preserve and transform all spaces and objects in homes

BUSINESS

ACC: Strong quarter despite COVID disruptions

Our long-term thesis on ACC remains intact because of its market leadership position, operating efficiencies and robust balance sheet

BUSINESS

Emmbi Industries: Growth outlook bullish

Emmbi's management is optimistic on the medium-term outlook as the rebound in manufacturing confidence aligns with better global trade activity and rising consumer confidence

BUSINESS

Finolex Industries: Long-term prospects look solid

While its long-term prospects appear solid, the company will most likely face some demand and margin headwinds in the near term.

BUSINESS

Hawkins Cookers – Long-term promise outweighs near-term concerns

From a competitive standpoint, Hawkins is the second largest player in pressure cookers with a market share of over 30 per cent

BUSINESS

Will earnings set off the next party for the bull market?

There is little doubt that markets are exuberant on many fronts, but domestic businesses have clearly been lacking the elusive 20-25 per cent earnings growth that the investor and analyst community has been waiting for a very long time

BUSINESS

Bajaj Healthcare: Making solid progress on its growth path

For FY22, Bajaj Healthcare does not have any major capex planned and will primarily be focusing on driving growth through new product launches and ramp-up of acquired manufacturing units

BUSINESS

Allcargo Logistics: Macroeconomic tailwinds to fuel growth

With a vast footprint and a long operating history, Allcargo is well positioned to continue the expansion of its Indian business while gaining incremental share in international trade

EARNINGS

Associated Alcohols: A decent mix of growth and value

Lower per-capita consumption of liquor in India compared to western countries offers huge opportunities for growth for Associated Alcohols

BUSINESS

Transport Corporation of India: Value play in an overheated market

TCI has cemented itself as the dominant player in the logistics industry over the past few years

TRENDS

Midcap cement duo that deserve attention

The near-term trajectory for the cement companies once again appears uncertain, but government spending in infrastructure development and policy reforms are expected to boost volumes post the easing of restrictions

BUSINESS

Earnings cheer keeps Radico Khaitan in high spirits. Should investors join in?

The Radico Khaitan stock has started the process of re-rating as the management continues to perform well and the long-term outlook appears promising

BUSINESS

Are you ready for a recap of the Harshad Mehta Bull Run?

There exists a chance the Nifty might even touch 22,000 or even 24,000 in the next 6 months

BUSINESS

Nazara Technologies plugs into growth circuit big time

Valuations of Nazara Tech are undeniably expensive, but investors should view the business in the context of its addressable market size and long-term structural industry tailwinds

BUSINESS

AC makers feel the heat, but are winds of change blowing?

The low penetration levels coupled with rising temperatures make a compelling case for long-term investment in the AC sector

TRENDS

Dixon Technologies: Seizing the market opportunity

The company is eyeing exponential growth in the mobile segment and has recently entered into contractual agreements with Motorola and Nokia for the manufacturing of mobiles under the PLI scheme

TRENDS

Concor – One step closer to divestment

Concor is well positioned to benefit from global recovery over the next 2-3 quarters

BUSINESS

Crompton Consumer — Q4 performance marred by uncertain outlook

Crompton Greaves has also benefited from the investing trend of flight to quality and the stock has been a big winner in recent months